Bitcoin Price Risk Falling On Options Expiry Before Bitcoin Halving?

Highlights

- Traders brace $2.2 billion in Bitcoin and Ethereum options expiry ahead of this Bitcoin halving.

- Crypto market remains volatile ahead of Bitcoin halving and as tensions escalate between Israel and Iran.

- Short squeeze in the crypto market recovers prices above max paint point as estimated.

Bitcoin price fell below $60,000 today after reports of Israel missile attack on Iran surfaced, which were later confirmed to be Iran’s defense systems taking down drones. Meanwhile, Bitcoin and Ethereum prices rebound due to short squeezes, but traders brace for the last crypto options expiry ahead of this Bitcoin halving as volatility prevails in markets.

Bitcoin and Ethereum Options Worth $2.2 Billion Set To Expire

Crypto market remains volatile ahead of Bitcoin halving and as tensions escalate between Israel and Iran. Stock markets globally saw stock prices plunge as oil price jumps on reports of Middle East conflicts.

Over 21,845 BTC options of notional value $1.35 billion are set to expire, with a put-call ratio of 0.63. The max pain point is $65,000, as per Deribit data. Most traders have put bets at a strike price of $60,000, believing that Bitcoin price remains under selling pressure.

In the last 24 hours, BTC call volume is higher at 16,450 than put volume of 11,429. The put-call ratio is 0.69.

Meanwhile, 297,818 ETH options of notional value of $0.90 billion are set to expire, with a put-call ratio of 0.42. The max pain point is $3,125, which is also higher than the current price of $3,045. This indicates ETH price risks liquidation if price fails to rebound above max pain point where most calls are.

In the last 24 hours, ETH call volume are also higher at 386,859 than put volume of 109,907. The put-call ratio is just 0.28, but traders remain skeptical over a potential drop in ETH price further.

Greeks.live revealed that major term options IVs are falling significantly despite extreme panic selling taking down Bitcoin below the $60,000 mark and ETH below the $3,000 mark. There is a sharp drop in call option prices, with the monthly skew now at a new low in the current bull market. Adam from GreeksLive said puts are priced much higher than calls.

Also Read: Bitcoin (BTC) Price Cracks Under $60,000 As Iran-Israel Conflict Escalates, What’s Next?

Short Squeeze in Crypto Market Recovers Bitcoin Price

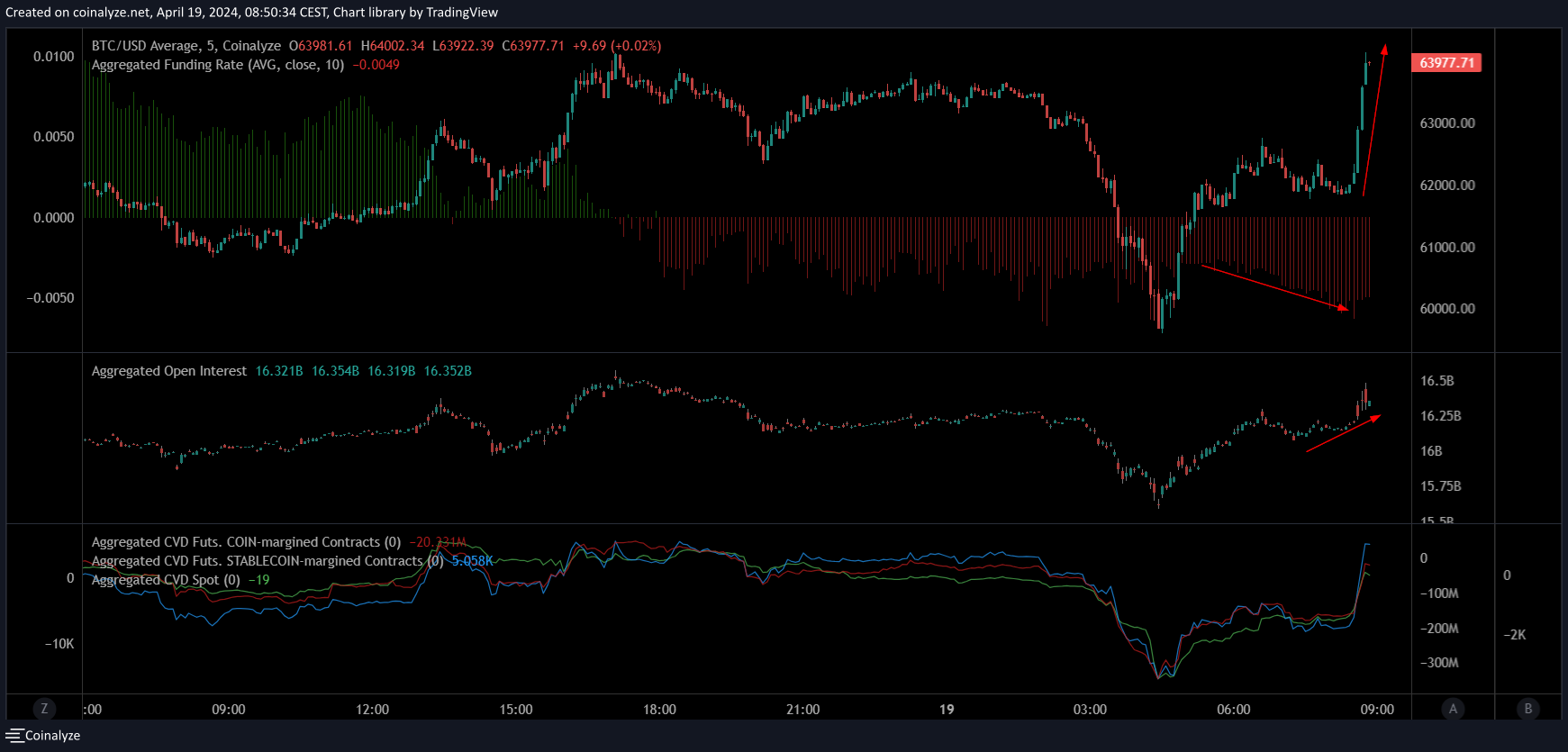

Bitcoin price recovers like always ahead options expiry as negative funding rates led traders to take long positions. On-chain analyst IT Tech reported multiple events of “short squeeze” happening as the Bitcoin price jumped over 4% to hit $65,000.

Popular analyst Skew noted that shorts are getting liquidated and now seeing more interest from longs. He added that “Aggregate CVDs & Delta Spot driven rebound so far for the most part & large deltas / volume in perps due to unwinding of shorts.”

However, traders should wait for trading in the US sessions for further clarity on the market direction. Support levels will be watched out amid volatility.

US dollar index (DXY) fell slightly to 106.11, but still high as compared to earlier weeks. Also, the US 10-year Treasury yield (US10Y) has jumped to a 6-month high of 4.622%, but fell to 4.606% amid wrong reports of attack. As Bitcoin moves opposite to DXY and Treasury yields, a rise in both can cause a downfall in Bitcoin price to $60K.

Also Read: Here’s Why Bitcoin Price and Altcoins Could Crash After Halving?

- Robert Kiyosaki Reveals Why He Bought Bitcoin at $67K?

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?