Bitcoin Price Risks Crashing To $48K, Says Analyst Who Predicted Crash to $16K in 2022

Highlights

- Top crypto market expert predicts that Bitcoin price could dip to $48K.

- Peter Brandt unveils crucial levels for Bitcoin price, slipping below which could propel a massive drop in BTC.

- Derivatives data showed that despite the recent drop in Bitcoin price, BTC Futures Open Interest soars.

Bitcoin price recent plunge below $67,000 has sparked discussions among investors, with fears of further declines looming. Notably, renowned analyst and veteran trader Peter Brandt, who accurately forecasted Bitcoin’s drop to $16,000 in 2022, now cautions that the cryptocurrency could plummet to $48,000.

However, he cited the dip could happen if it fails to sustain critical support levels. Meanwhile, amid the bold forecast and significant options expiry, all eyes are on Bitcoin’s next move.

Analyst Predicts Bitcoin Price Dip To $48K

The recent Bitcoin drop has sent ripples through the crypto community. The flagship crypto’s failure to hold above the $67,000 mark has sparked intense speculation about its future trajectory.

Amid this, crypto market expert Peter Brandt, who is also a seasoned trader with a history of accurate predictions, has issued a stark warning. In a recent post on the X platform, he outlined a potential path for Bitcoin’s decline.

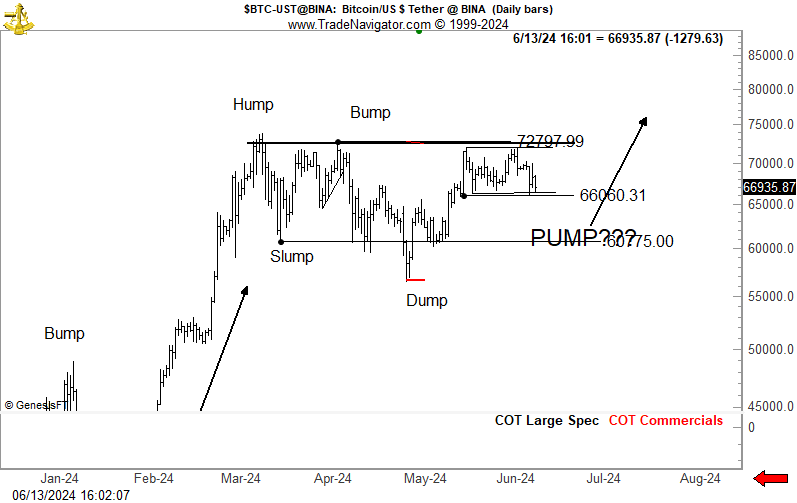

In a recent X post, Peter Brandt shared a price chart of Bitcoin, while noting $65,000 and $60,000 as crucial levels for Bitcoin’s near future. According to Brandt, a drop below $65,000 could pull the price towards $60,000. Conversely, a plunge below the $60,000 level might see Bitcoin fall to $48,000.

However, Brandt says that while these are the most straightforward interpretations, the market can be unpredictable. In this context, he stated:

Sometimes the most obvious interpretations of a chart work out, most of the time the charts morph.

Also Read: Bitcoin ETF Outflows Hit $228 Million Amid BTC Price Dip, What’s Happening?

Macroeconomic Factors & Options Expiry In Focus

The latest inflation data from the U.S. Labor Department has shown signs of cooling. For context, May’s Consumer Price Index (CPI) and Producer Price Index (PPI) reports suggest cooling inflationary pressures in the nation.

Notably, this development could influence the U.S. Federal Reserve’s approach to interest rates. Having said that, if the Fed adopts a more dovish stance, it might offer some relief to the crypto market. A potential policy shift could mitigate further declines in Bitcoin’s price, providing a possible lifeline for investors.

Meanwhile, another critical factor affecting Bitcoin’s price is the recent expiry of 20,000 Bitcoin options on June 14, 2024. Options expiry events often introduce significant volatility as traders adjust their positions. Notably, the maximum pain point for this expiry was set at $68,500, indicating the price level at which most options would expire.

As of writing, Bitcoin price stayed in the red while crossing the brief $67,000 mark. Over the last 24 hours, its price saw a high of $68,337.23 and a low of $66,304.57, reflecting the volatile scenario in the market.

Furthermore, its trading volume also fell 24.55% to $27.17 billion. However, despite a drop in its price, Bitcoin Futures Open Interest rose 0.98% in the last 4 hours to 522.67K BTC or $35.14 billion.

Also Read:

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin Price Falls Below $70K as Iran War Drives US Oil Prices Rise To 2-Year High

- U.S. Jobs Report: Nonfarm Payrolls Fall By 92k, Bitcoin Falls

- Kazakhstan’s Central Bank Diversifies From Gold, Plans to Invest in Crypto by May

- Vancouver Halts Bitcoin Reserve Plan Despite Growing States Adoption

- WhiteBIT Coin ($WBT) Officially Listed on Kraken Exchange, Highlighting Its Growing Recognition

- Top Reasons Why Circle Stock Price is Surging

- Gold Price Prediction as US-Iran War Hits the Second Week

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

Buy $GGs

Buy $GGs