Bitcoin Price Risks Of Dropping To $63K If This Crucial Support Breaks

Highlights

- Ali Martinez warns of a downward spiral if key levels aren't maintained.

- Bitcoin's price may slide to $63K if it slips below a critical support level.

- Investors cautiously monitor Bitcoin's movements amid anticipation of a post-Halving rally.

The Bitcoin price saw a small decline on Monday, April 1, drawing the attention of the global market participants. Notably, amid the hopeful outlook for the upcoming Bitcoin Halving event, recent fluctuations in the BTC price have sparked both excitement and worry among stakeholders.

Meanwhile, amid this, a prominent crypto analyst has shared key insights on the Bitcoin price, intensifying discussions about BTC’s future trajectory.

Analyst Provide Key Insights On Bitcoin Price

The recent slump in the Bitcoin price has sparked discussions in the crypto market, especially amid soaring optimism over the Bitcoin Halving scheduled for later this month. Now, with the price declining after touching its all-time high recently, investors are eagerly looking for key insights amid the topsy-turvy scenario in the market.

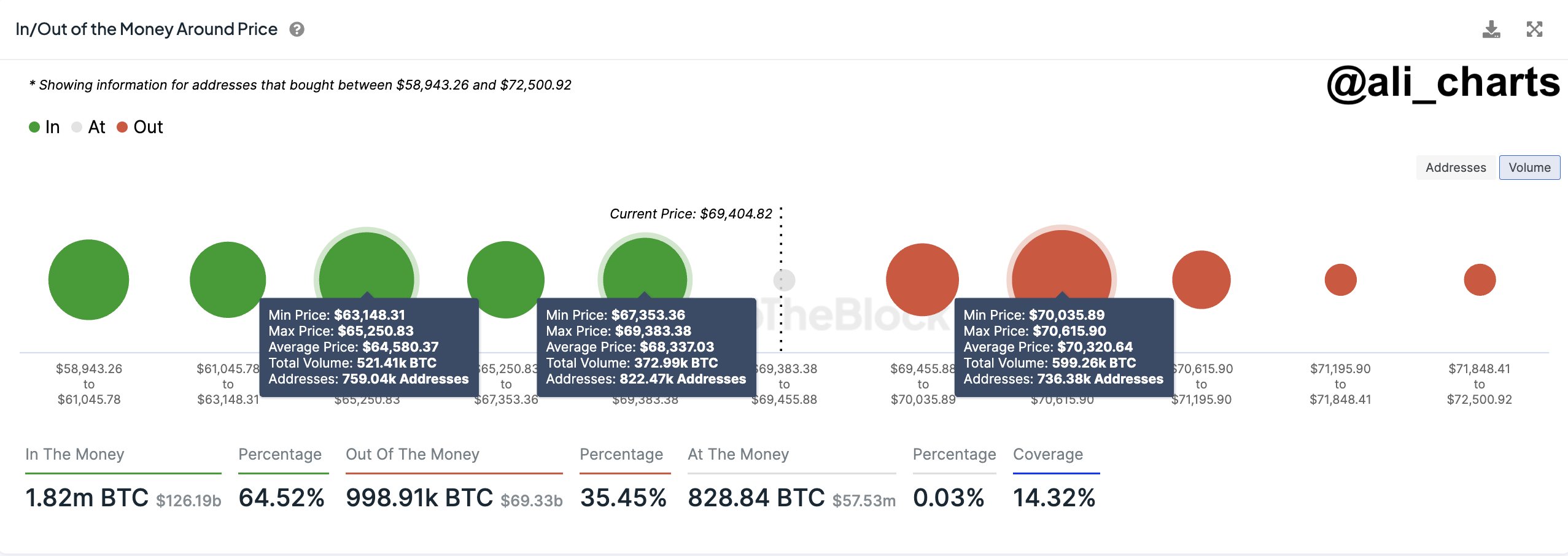

Meanwhile, as Bitcoin teeters on the brink of uncertainty, crypto market analyst Ali Martinez has offered crucial insights into potential price movements. Martinez highlighted a critical support level at $68,300, emphasizing that a breach could trigger a downward spiral toward the $65,250 to $63,150 range. Notably, this range, where 760,000 wallets hold 520,000 BTC, presents a significant psychological threshold for Bitcoin’s trajectory.

In addition, Martinez’s analysis underscores the importance of securing support at $70,320 to propel Bitcoin toward its next upward trend. The discussion sparked by Martinez’s observations reflects the market’s sensitivity to Bitcoin’s current price dynamics, especially amid the backdrop of declining values.

Also Read: Thailand’s Top Crypto Exchange Bitkub Gears Up for IPO

Optimism & Uncertainty Ahead Of Halving

Despite concerns over potential price declines, optimism prevails within the crypto community, fueled by the anticipation of the Halving event. Notably, historical data indicates that Bitcoin typically experiences a rally post-halving, leading many analysts to forecast new highs in the coming months.

Meanwhile, as the market braces for potential volatility, the overarching sentiment remains one of cautious optimism. Investors are closely monitoring Bitcoin’s price movements, weighing the implications of critical support levels and historical trends in anticipation of future developments.

In other words, as Bitcoin navigates through a period of uncertainty, insights from experts like Ali Martinez offer valuable guidance for investors. The delicate balance between support levels and market sentiment will likely dictate Bitcoin’s short-term trajectory, with the forthcoming halving event adding an extra layer of anticipation to the mix.

Meanwhile, the Bitcoin price slipped 1.02% during writing and traded at $69,549.96, while its one-day trading volume soared 47% to $25.57 billion. Notably, the flagship crypto has touched a high of $71,377.78 and a low of $68,986.95 in the last 24 hours.

Also Read: Wall Street Projects 48% Decline In Coinbase Q1 EPS Despite Bull Run

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

Buy $GGs

Buy $GGs