BTC Price Hits $73K As Spot Bitcoin ETF Saw Record $1.05 Billion Net Inflow

Highlights

- Spot Bitcoin ETFs recorded $1.05 billion net inflows in a single day, the highest to date

- Bloomberg analyst said in follows as spot Bitcoin saw the best day with second highest trading volumes

- Bitcoin price hits new all time high above $73K

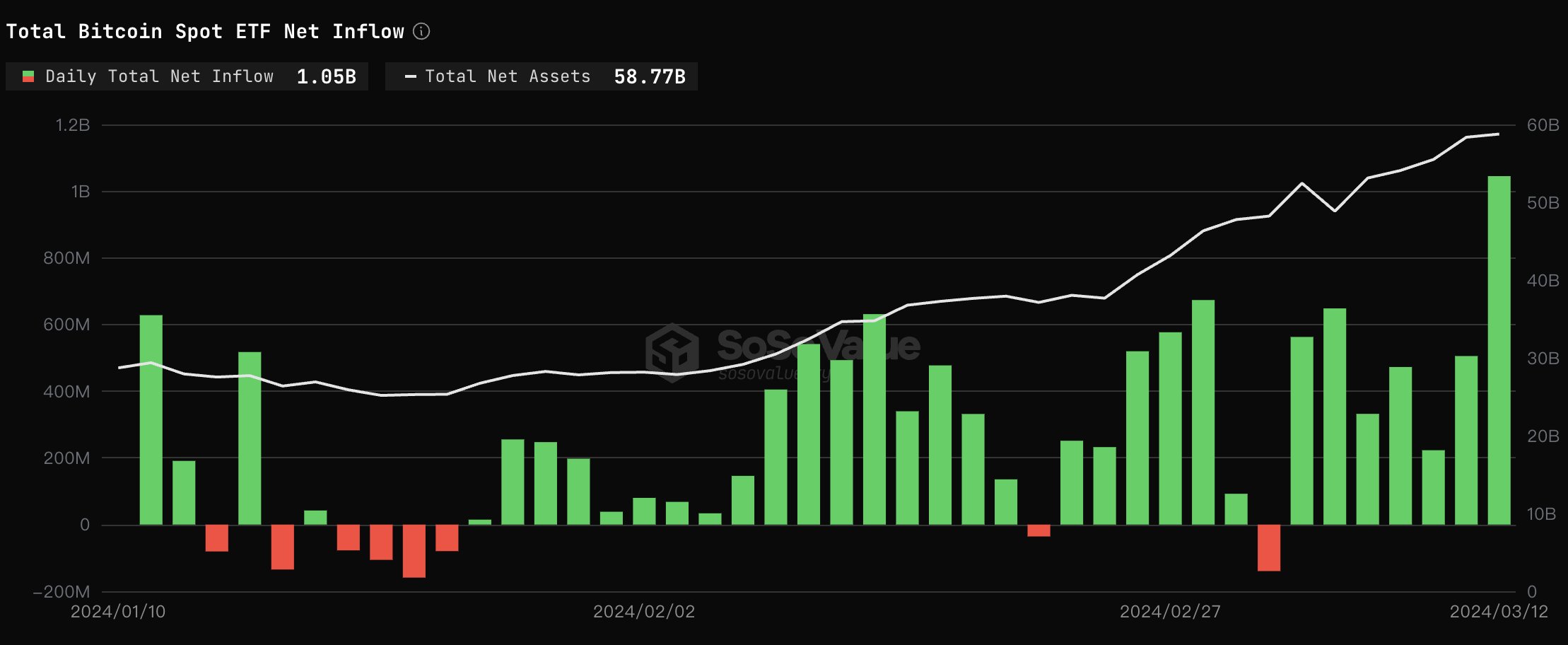

Spot Bitcoin ETFs set another record, witnessing the highest single-day net inflow since the launch of Bitcoin ETF in the United States. The record net inflow of over $1 billion helped Bitcoin rebound from a decline after hotter CPI inflation data and hit a new all-time high of $73K.

Spot Bitcoin ETF Records $1.05 Billion New Inflow

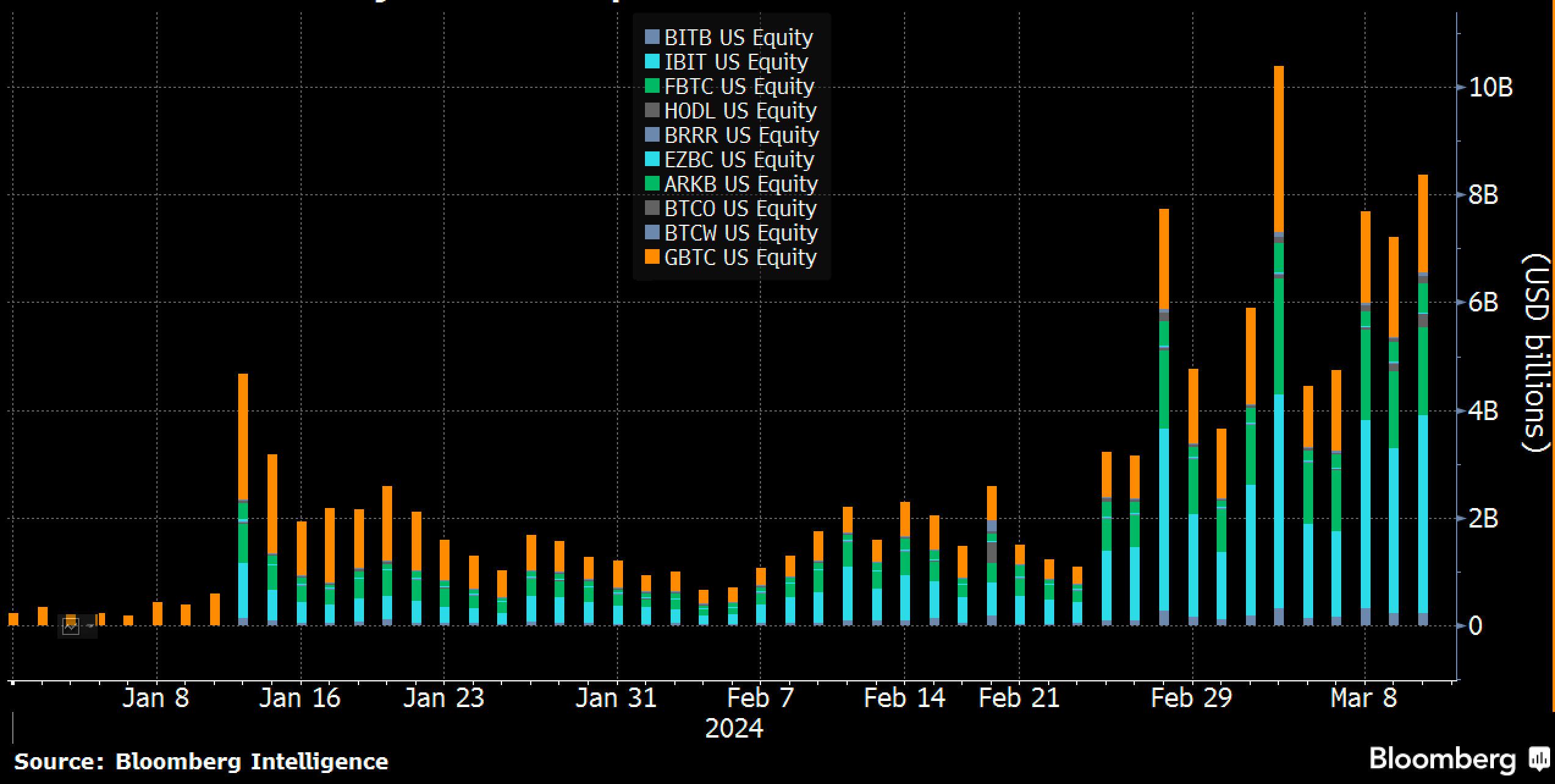

Net inflow into spot Bitcoin exchange-traded funds (ETF) reaches $1.05 billion on March 12, according to data by SoSoValue. The massive inflow came on the back of the second-highest volume day for the 10 Bitcoin ETFs. In fact, it was the best day in the past five weeks, with $8.5 billion.

Bloomberg senior ETF analyst Eric Balchunas said only five stocks have recorded higher trading volumes than $8.5 billion. BlackRock’s iShares Bitcoin ETF (IBIT) nearly $4 billion in volume, VanEck Bitcoin Trust ETF (HODL) and Invesco Galaxy Bitcoin ETF (BTCO) recording $150 million and $250 million volumes indicate huge demand in other ETFs. VanEck recently cut its Bitcoin ETF management fees to 0% for the next twelve months.

BlackRock’s iShares Bitcoin ETF (IBIT) saw $849 million inflow, breaking records of the highest inflow to date. Following the latest inflow, BlackRock’s net inflow hit over $11.44 billion and asset holdings jumped over $14.5 billion.

Fidelity Bitcoin ETF (FBTC) and Ark 21Shares (ARKB) Bitcoin ETF saw $51.6 million and $93 million inflows, respectively. Bitwise (BITB) and other spot Bitcoin ETFs saw marginally low inflows. VanEck Bitcoin ETF (HODL) saw an inflow of $82.9 million due to 0% fees amid higher competition.

In addition, GBTC recorded another outflow of $79 million, a welcomed fall indicative of Genesis’ GBTC selloffs reaching the end. Crypto lender Genesis received bankruptcy court approval to sell 35 million GBTC shares worth $1.3 billion. Notably, GBTC net outflow to date has reached over $11.12 billion.

Also Read: Bitcoin Leveraged Bets Surge Amid Strong Demand for Bitcoin Futures ETFs

Bitcoin Price Hits $73K

BTC price jumped over 2% in the past 24 hours to hit a new all-time high, with the price currently trading at $73,067. The 24-hour low and high are $68,728 and $73,182, respectively. Furthermore, the trading volume has increased slightly in the last 24 hours, indicating a rise in interest among traders.

Bitcoin futures and options open interests (OI) remain at record levels, with total futures OI rising over 3% to $36.97 billion, as per Coinglass data. CME Bitcoin futures OI hits new record high $11.47 billion. Bitcoin price to $100K prediction remains intact despite sentiment towards consolidation due to sky-high funding rates.

Also Read: Ethereum Put Options Demand Surges, ETH Price Correction Soon?

- WLFI Token Sees 19% Spike Ahead of World Liberty’s Mar-a-Lago Forum Today

- Veteran Trader Peter Brandt Predicts Bitcoin Price Rebound, Gold Fall to $4000

- Peter Thiel Exits ETHZilla as Stock Slides 3% Amid Token Launch

- Bitwise, Granitshares Eyes $63B Sector With New Prediction Markets ETF Filing

- Breaking: Grayscale Sui Staking ETF to Start Trading on NYSE Arca Today

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- How Long Will Pi Network Price Rally Continue?

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k