Bitcoin Price To Hit $125K, Peter Brandt Predicts As BTC Demand Soars

Highlights

- Peter Brandt predicts Bitcoin price to hit $125K, sparking market optimism.

- Bitcoin price has recently touched its ATH as optimism soars towards BTC Strategic Reserve in the US.

- Top experts highlight market trends which indicates growing BTC demand from whales and institutions.

Bitcoin price has continued to make new records every day, indicating a strong market confidence towards the asset. Notably, this rally comes amid soaring institutional interest and whale accumulation, which suggests that the demand for BTC remains strong despite the recent rally. On the other hand, veteran trader and market expert Peter Brandt has shared a bold forecast for BTC amid this, sparking further discussions in the market.

Bitcoin Price To Hit $125K, Peter Brandt Says

Bitcoin price has recorded a robust rally recently, which has caught the eyes of investors. Notably, this is because the institutional interest remained strong and continued to grow after Donald Trump’s election win. Notably, Trump has pledged to make the US a crypto capital while voicing strong support for BTC during his campaigns.

In addition, he has recently said “We’re gonna do something great with crypto,” indicating its competitive focus in the digital assets space. Besides, he also reiterated his focus on making BTC the US strategic reserve.

On the other hand, the institutional interest is also evidenced by the robust US Spot Bitcoin ETF inflow recently. Notably, the overall influx into the investment instrument has continued over the last few weeks, with BlackRock’s IBIT providing the biggest boost. According to Farside Investors data, the overall influx into the US Spot BTC ETF was $636.9 million on December 16.

Meanwhile, this robust inflow suggests that the Wall Street players as well as the investors remained confident in the asset. Besides, the BTC price performance and the recent on-chain data also indicate a strong BTC demand, which could further fuel the rally in the coming days. Amid this, veteran trader Peter Brandt has shared a bullish BTC forecast.

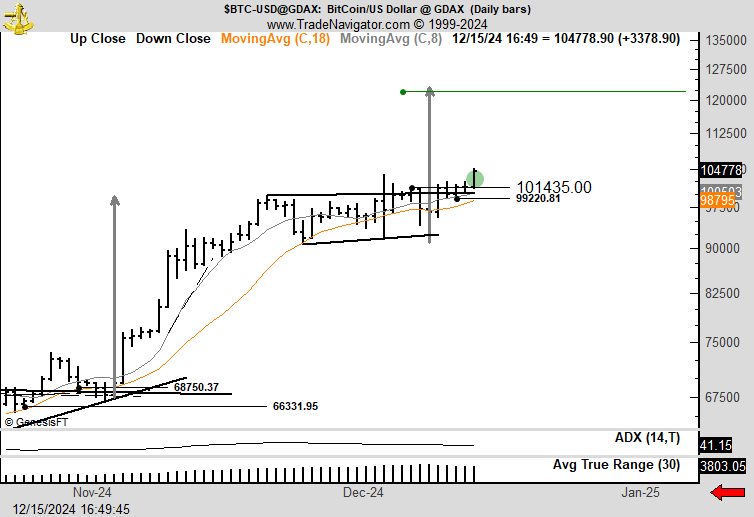

Sharing a price chart for BTC in a recent X post, he has set $125K as the next target for BTC. Besides, he also said that “everything else is a pretender”, reflecting the expert’s strong confidence towards the flagship crypto.

What’s Next For BTC?

With Peter Brandt’s bold forecast and Donald Trump’s recent hint towards making BTC the US strategic reserve, BTC has recorded a robust rally. The latest BTC price showed a spike of 2% from yesterday to $106,729, with its trading volume soaring 25% to $79 billion.

Notably, the crypto has recently touched an ATH of $107,780 in the last 24 hours, while providing a monthly gain of nearly 18%. Furthermore, CoinGlass data showed that BTC Futures Open Interest rose 2%, suggesting a continuing strong momentum ahead. Besides, a Bitcoin price prediction indicates a potential rally for the flagship crypto to $115,208 this month, boosting market sentiments.

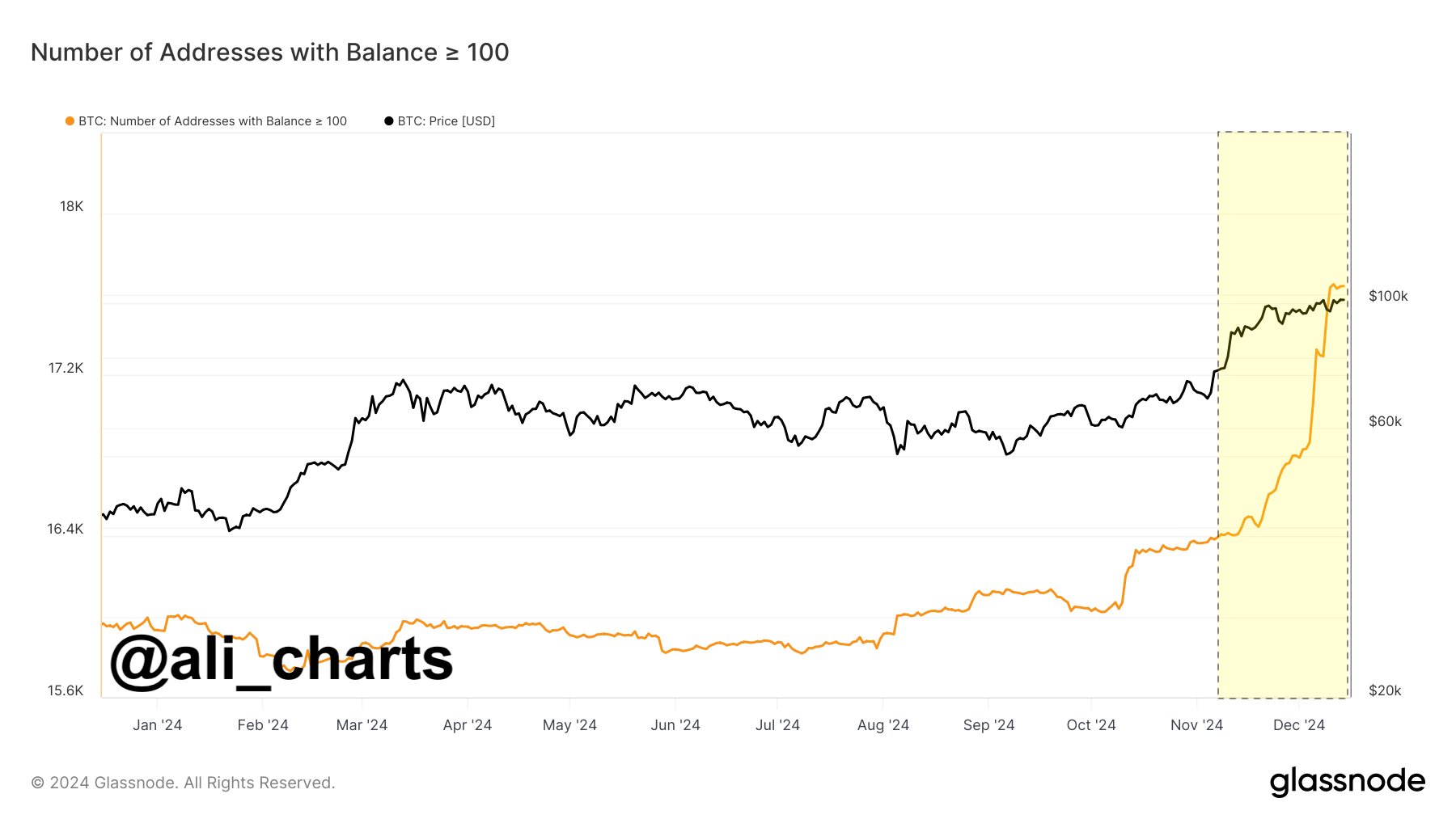

Meanwhile, prominent crypto market analyst Ali Martinez has recently highlighted the BTC whale trend. In a recent X post, he said that the “number of Bitcoin (BTC) whales on the network went parabolic ever since Donald Trump won the US presidential elections!” This showcases the growing whale confidence in the asset, which could trigger further rallies for the asset ahead.

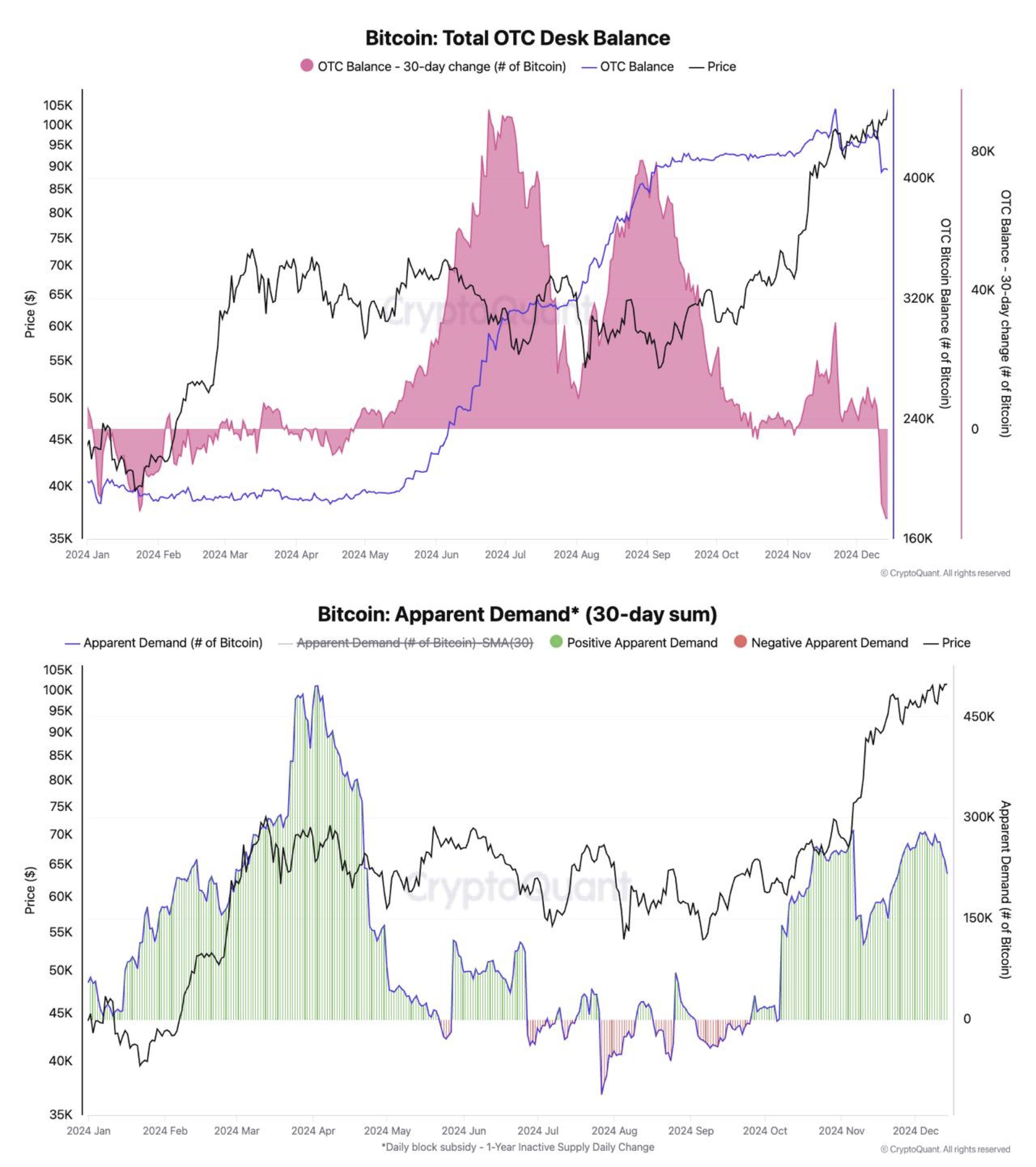

In addition, top on-chain analytics firm CrytoQuant has also highlighted a bullish trend recently. In a recent X post, CryptoQuant said that as Bitcoin price touched its ATH recently, the demand is continuing to outpace supply. The firm’s head of Research Julio Moreno said that BTC OTC Desks are witnessing their highest monthly balance decline so far in 2024 amid soaring BTC demand. Since November 20, the balance has slumped by 40K BTC, indicating a bullish trend ahead.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Vitalik Buterin Maps Out Quantum Risks as Ethereum Foundation Unveils ‘Strawmap’

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs