Bitcoin Price To Hit $337K, Analyst Predicts As BTC Soars Past $72K

Highlights

- A Bitcoin analyst predicted Bitcoin price to reach $337K, citing strong market indicators and institutional inflows.

- Bitcoin's surge to $72K marks another record high amid heightened institutional interest.

- Upcoming Bitcoin Halving events and institutional inflows contribute to Bitcoin's bullish sentiment.

A popular crypto analyst has provided a bullish outlook for Bitcoin price as BTC’s meteoric rise continues smashing through the $72,000 barrier, setting yet another record high. Notably, the analyst predicts a staggering high of $337,000 for the flagship cryptocurrency. With optimism soaring and institutional interest intensifying, Bitcoin’s trajectory has investors on the edge of their seats.

Analyst Predicts Bitcoin Price To Hit $337,000

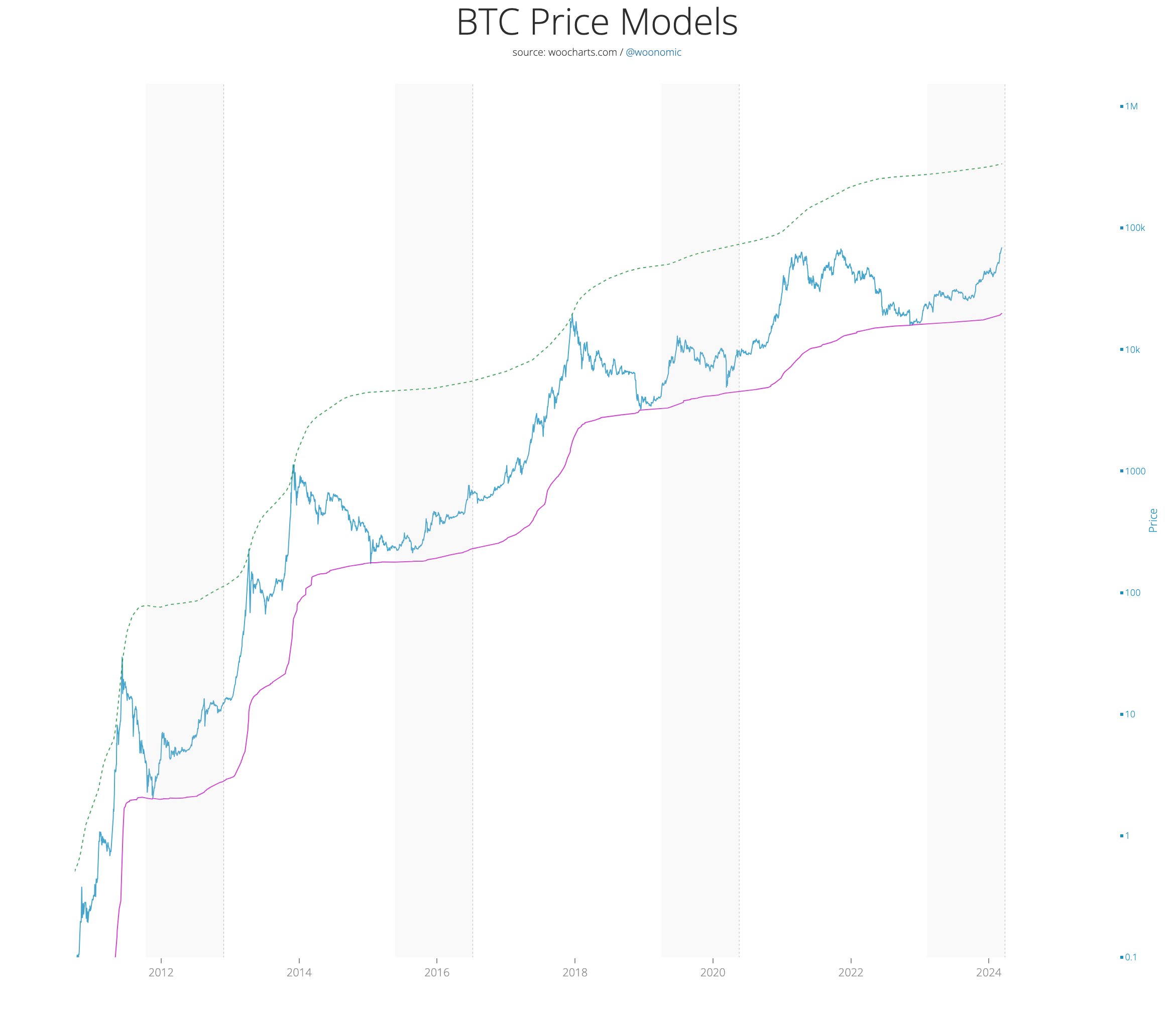

Renowned Bitcoin analyst Willy Woo, managing partner at CMCC Crest, has shared an optimistic outlook for Bitcoin’s price trajectory. Woo’s chart on the X platform illustrates a potential upper-bound model, projecting a remarkable $337,000 peak for Bitcoin.

Notably, he attributes a flurry of factors behind his bullish momentum for Bitcoin. This includes a significant influx of capital into the network as well as the emergence of a full-fledged fundamentals-driven bull market.

However, backing his forecast, Woo emphasizes the Bitcoin Macro Index (BMI), a composite of 17 macro signals, signaling a full-blown bull market. In addition, he highlights the influx of $1.8 billion per day into the network, hinting at strong investor confidence.

However, despite the recent positive momentum, he urged investors to tread cautiously amid the rally. Notably, he warned against potential profit-taking opportunities by the investors, as measured by the Spent Output Profit Ratio (SOPR), suggesting an impending period of consolidation.

Also Read: Mudrex Offers Indian Retail & Institutional Investors Access to US Spot Bitcoin ETFs

Potential Factors Behind The Rally

The bullish sentiment surrounding Bitcoin’s price surge has injected renewed optimism into the market. Investors are buoyed by the anticipation of the upcoming Bitcoin Halving event, historically associated with significant price rallies.

In addition, institutional interest, as evidenced by robust inflows into U.S. Bitcoin Spot ETFs, further underscores confidence in Bitcoin’s long-term potential. With institutional players increasingly entering the crypto space, Bitcoin’s ascent to new highs seems increasingly plausible. Besides, the recent announcement from the London Stock Exchange (LSE) for accepting Bitcoin & Ethereum ETN requests has also fuelled the confidence of investors.

Meanwhile, as of writing, the Bitcoin price was up 3.57% over the last 24 hours and traded at $72,241.90, while its one-day trading volume soared 71.98% to $48.18 billion. Over the last 24 hours, the BTC has touched a high of $72,377.66 and a low of $67,194.89.

On the other hand, the Bitcoin Open Interest (OI) over the last 24 hours rose 5.62% to 495.14K BTC or $35.87 billion, CoinGlass data showed. The CME exchange topped the list with a 3.49% surge to $10.72 billion, followed by Binance’s 6.55% surge to $8.18 billion.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- U.S.–Iran War: Bitcoin Price Extends Decline as Oil Prices Surge To Two-Year High

- Bitcoin Treasury Firm MARA Considers Selling BTC Reserves After Policy Update

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs