Bitcoin Price: Top Analyst Predicts BTC Rally To $85K Despite Liquidation Warning

Highlights

- Bitcoin regained its momentum and now looks strong for $85K, as evidenced by the upward momentum in its price.

- Amid the surge in BTC price, a top crypto analyst has warned of massive liquidation near $71K.

- Despite the warning, another crypto market analyst has provided a bullish outlook for Bitcoin.

As the Bitcoin price continues its upward trajectory, anticipation builds within the crypto community. Notably, with key U.S. inflation data and FOMC minutes on the horizon, market sentiment seems to have remained positive to start the week.

However, amid the optimism, a prominent analyst cautioned against potential volatility, particularly when Bitcoin trades at the $71,000 level, but a anticipation towards $85 builds up.

Analyst Warns Massive Liquidation

The regaining momentum in the Bitcoin price has fuelled the market today, with experts anticipating an increasing risk-bet appetite of the investors. However, despite the rally, the recent warning from a popular crypto market analyst has weighed on the sentiment.

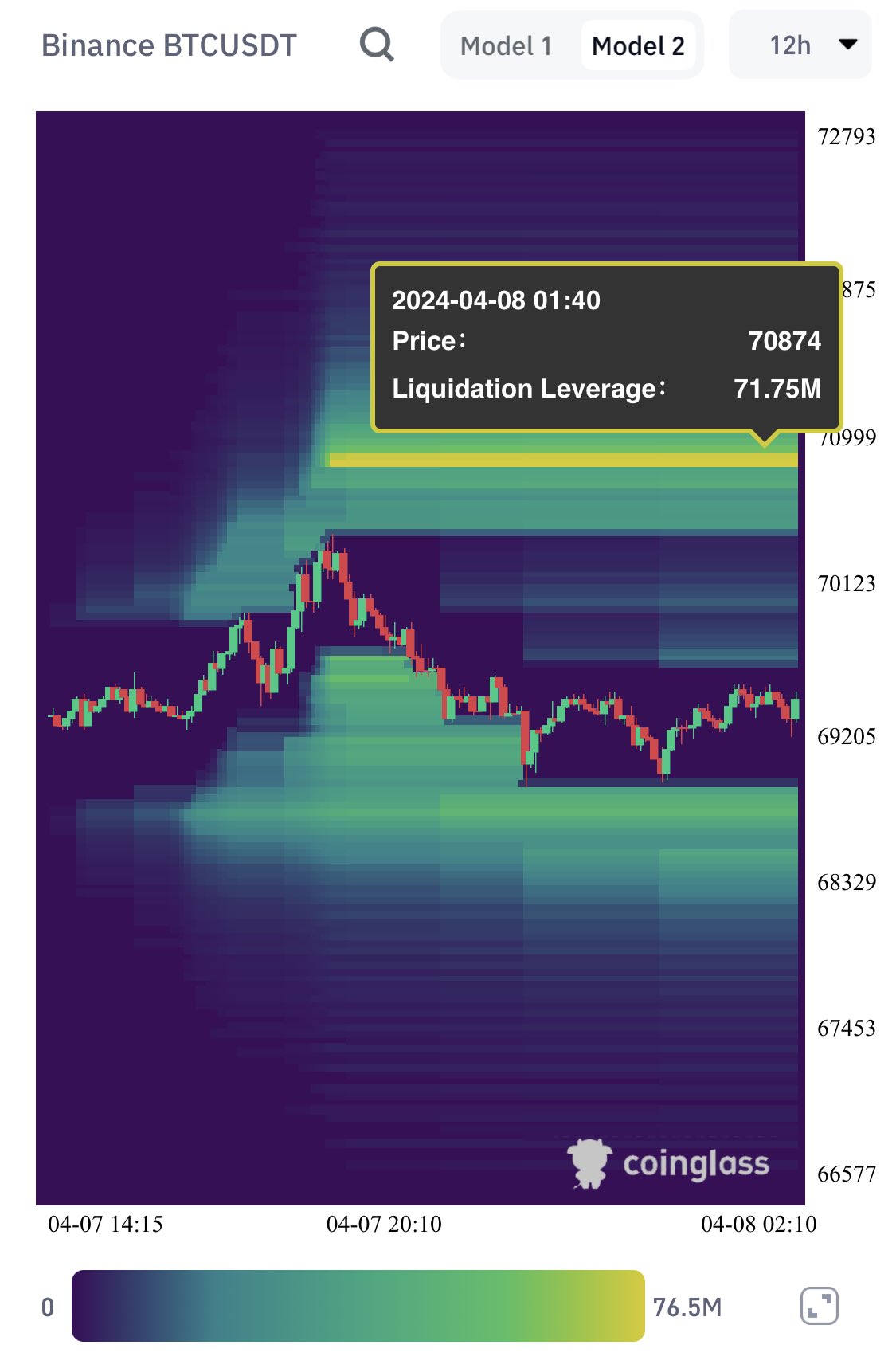

In other words, despite the recent uptick in the Bitcoin price, warnings loom over the potential for significant liquidation if BTC surpasses $71,000, with $72,000 as strong resistance. Notably, prominent crypto market analyst Ali Martinez highlighted the risk, stating that approximately $72 million in liquidation could occur at this price point. This cautionary note underscores the fragility of the market and the need for investors to tread carefully as Bitcoin approaches critical levels.

In a recent X post, Ali Martinez stated:

“A lot of sellers in this recent downswing. Now, nearly $72 million will be liquidated if Bitcoin rebounds to $70,875!”

Meanwhile, this warning serves as a reminder of the potential consequences of rapid price movements in the crypto market, urging traders to remain vigilant.

However, despite this warning, Ali Martinez, in another X post, set $85,000 as the next target for the Bitcoin price. In his post, he said that if Bitcoin can “hold above” $70,800, the next target for the flagship crypto will be $85K. This bullish forecast, despite the warning, has fuelled market sentiment.

Also Read: Hong Kong’s HashKey Exchange Challenges Coinbase With Bermuda License

Bullish Forecast For Bitcoin Price

Despite the warning from Ali Martinez, another market expert has maintained a bullish outlook for Bitcoin price potential. Captain Faibik, a prominent figure in the crypto space, has predicted a new all-time high for Bitcoin.

Meanwhile, pointing to a bullish pennant formation on the daily timeframe chart, Faibik suggests that overcoming the $70,000 resistance level could propel Bitcoin to unprecedented heights. Notably, this optimistic perspective offers a counterbalance to the cautionary tone expressed by Martinez, reflecting the diverse range of opinions within the crypto community.

However, as investors navigate these contrasting perspectives, careful consideration of market dynamics and risk management strategies is essential to navigate the ever-evolving crypto landscape. Notably, the Bitcoin price traded at $69,743.67, up 0.64% over the last 24 hours, while its trading volume rose 3.55% to $20.87 billion.

Over the last seven days, the BTC price has jumped 7% amid high anticipation ahead of Bitcoin halving. Notably, over the last 24 hours, the Bitcoin price has touched a high of $72,715 and a low of $69,654.

Also Read: XRP Price Slips As Whale Offloads 25 Mln Coins, What’s Next?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BTC Price Rises as U.S. Plans to Hold Trump Tariffs on China Steady

- Crypto Market Soars on Rumors of Trump’s 0% Tax Policy for Digital Assets

- Hong Kong Set to Launch Tokenized Bond Platform and Issue First Stablecoin Licenses

- US Senator Launches Probe Into Binance After Fortune Report on Sanctions Violations

- CLARITY Act Odds, Bitcoin Drop as Trump Skips Crypto in State of the Union Speech

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

Buy Presale

Buy Presale