Bitcoin Retail Accumulation Continues, Why It’s the Right Time to Add BTC?

After a major bloodbath on Satoshi Street earlier on Monday, Bitcoin bears seem to be taking some rest for now. The world’s largest cryptocurrency continues to trade at under $22,000 levels as of now.

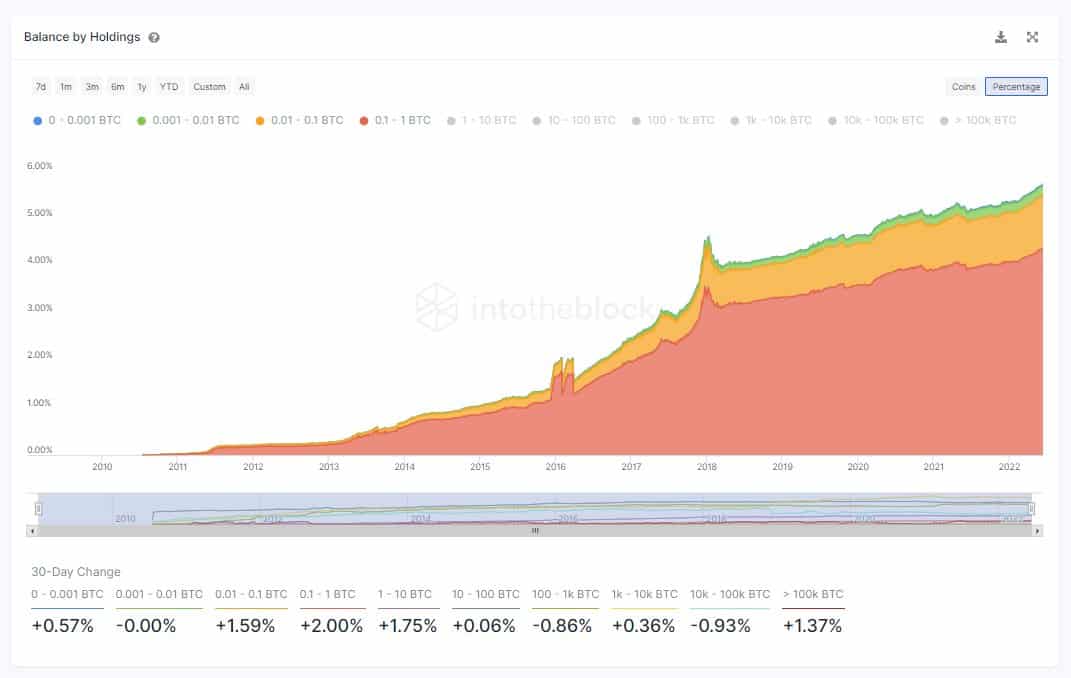

One thing positive about the Bitcoin market is that retailers haven’t given up any hope despite the aggressive correction. On-chain data provider IntoTheBlock explains:

Regardless of the rampant downtrend, retail buyers have been constantly accumulating $BTC since the ATH of November 2021. The group of addresses holding <1 BTC increased their balance by 100,395 BTC since November. This is a 10.11% increase vs the 68% drawdown in price.

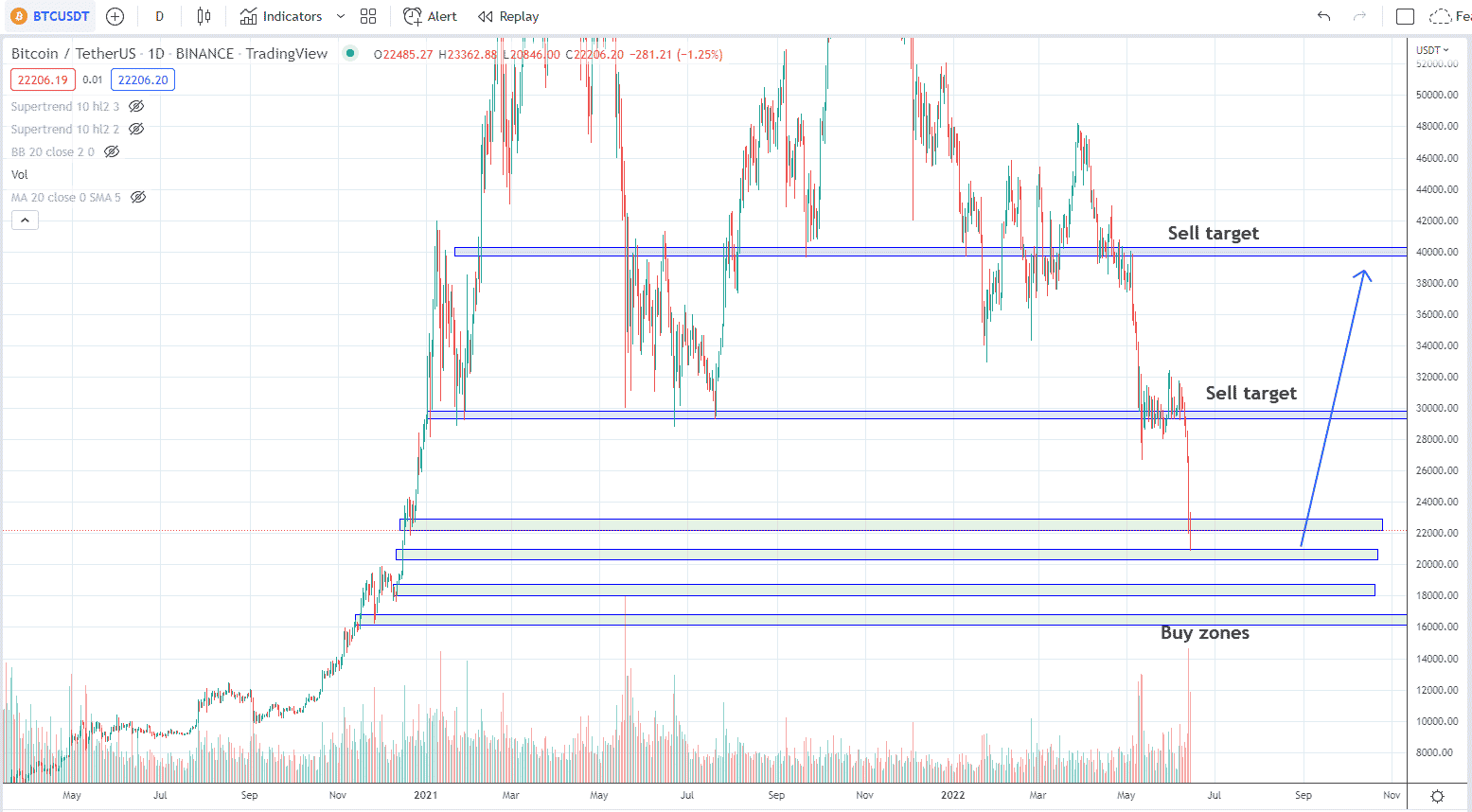

Analysts have been trying to predict the Bitcoin bottom, however, everyone has been clueless for now! Another crypto trader IncomeCharts notes that this could be a good time for spot buying of BTC. The crypto trader writes:

Who cares or knows what the exact bottom will be. Now is the time to be buying like crazy. These are key levels I like for support. I think $20k holds but if I’m wrong I’ll buy lower. Not selling any of this until $34,000 or $40,000 targets.

Peter Schiff Thinks Bitcoin Can Still Go Lower

With Bitcoin crashing more than 25% under its crucial support, Peter Schiff believes that Bitcoin can sell further downside from here. Sharing the below chart, Schiff writes:

How can anyone long Bitcoin look at this chart and not sell? Even if you think Bitcoin will ultimately trade higher, it’s hard to image that it doesn’t test long-term support at the lower line first. I think it will fail that test. Regardless, better to sell now and rebuy lower.

Last weekend, Peter Schiff issued a warning that as inflation continues to soar, the could be a further sell-off in Bitcoins by long-term holders. Last month, Guggenheim Chief Investment Officer Scott Minerd said that Bitcoin can fall further to $8,000. Speaking to CNBC, he said:

“When you break below 30,000 [dollars] consistently, 8,000 [dollars] is the ultimate bottom, so I think we have a lot more room to the downside, especially with the Fed being restrictive”.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- ‘Iran Will Not Surrender’: Crypto Market Falls Again as US–Iran Tensions Rise

- Fed Vice Chair Michelle Bowman Calls for More Rate Cuts as U.S. Labor Data Disappoints

- CLARITY Act Likely to Pass by July, Says Kristin Smith

- Best Cross-Chain Swap Platforms in 2026 – Top 9 Picks Reviewed

- Crypto Traders Predict Oil Prices to Rally Above $100 as Iran War Enters Week 2

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

- Pi Network Price Eyes a 40% Surge as Pi Day Looms on March 14

- Top Reasons Why Circle Stock Price is Surging

- Gold Price Prediction as US-Iran War Hits the Second Week

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

Buy $GGs

Buy $GGs