Bitcoin Rises to $90K Even as Trump Defends Tariffs Ahead of Supreme Court Ruling

Highlights

- Bitcoin has surged to a new yearly high of $90,000 as 2026 kicks off.

- The rally comes amid Trump's statement defending his tariffs.

- Crypto traders are betting on the Supreme court ruling against the tariffs.

Bitcoin has surged to a new yearly and intraday high of $90,000 as the new year kicks off, sparking bullish sentiments among market participants. This comes as Trump continues to push for the tariffs ahead of the Supreme Court’s ruling on whether they are legal.

Bitcoin Rises To New Yearly High Of $90,000

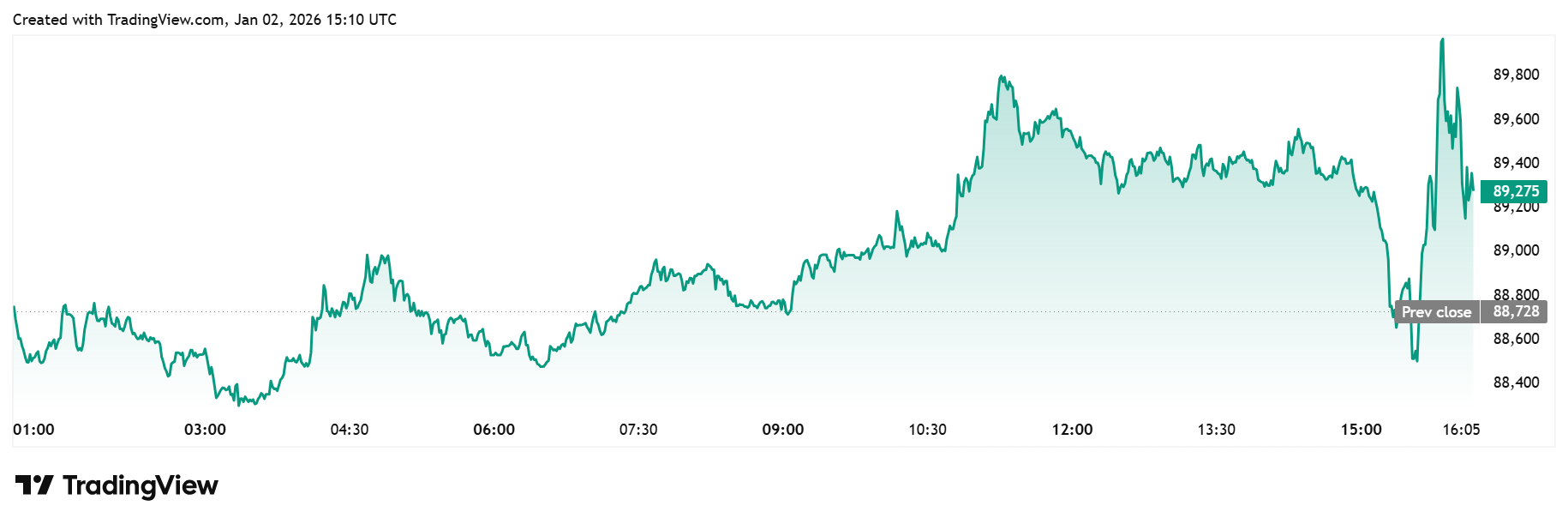

TradingView data shows that the flagship crypto has surged to a new yearly high of $90,000 today, rising from an intraday high of around $88,300. The price surge comes as BTC looks to recover from its downtrend towards the end of last year, which led to a 2025 loss of around 6%.

Bitcoin’s rally to $90,000 today also comes amid the expiry of $2.2 billion crypto options, which has also sparked volatility. Meanwhile, BlackRock had transferred $101 million worth of BTC to Coinbase, likely to offload these coins.

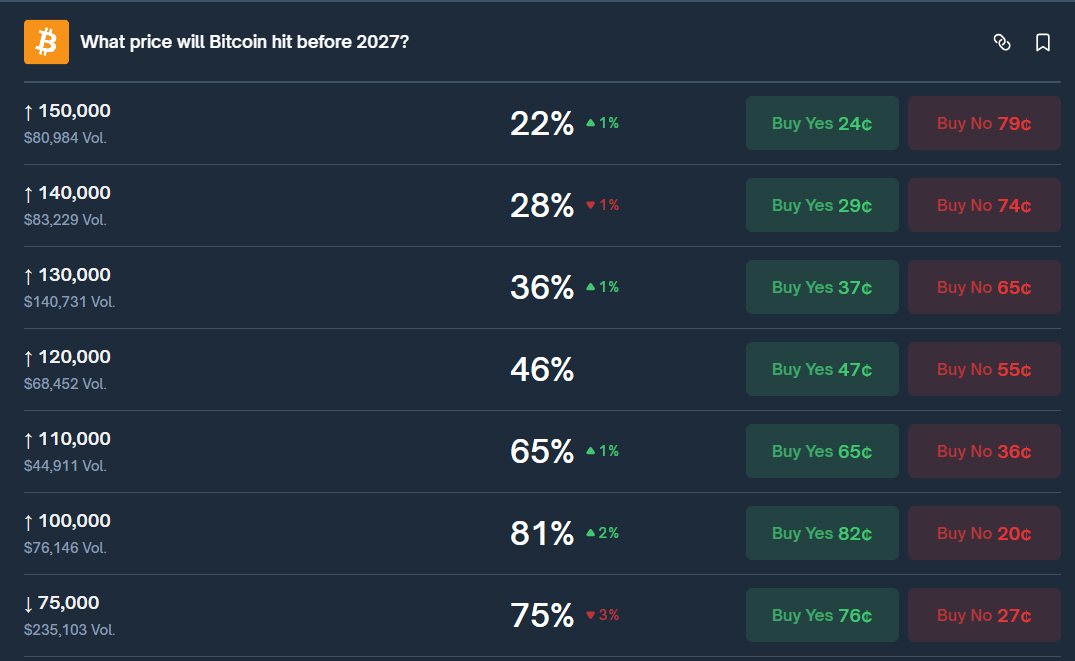

Crypto traders are already betting on what price the flagship crypto can hit this year, with sights on its current all-time high (ATH) around $126,000. Polymarket data shows an 81% chance that BTC will hit $100,000 this year. Furthermore, there is a 36% chance that the crypto asset could rally to 130,000, marking a new ATH.

A CryptoQuant analysis also predicted that Bitcoin could rally to as high as $170,000 this year. However, for that to happen, easing expectations will need to materialize early, and ETF inflows will need to stabilize. The analysis also stated that a drop to the $50,000 range was feasible if persistent ETF outflows end up pushing the flagship crypto below $80,000.

Trump Pushes For Tariffs Ahead Of Supreme Court Ruling

U.S. President Donald Trump has again defended his tariffs ahead of the Supreme Court ruling. In a Truth Social post, he stated that tariffs are an “overwhelming benefit” to the U.S., as they have been incredible for national security and prosperity.

Trump further remarked that losing the ability to impose tariffs on countries that treat the U.S. unfairly would be a terrible blow to the country. His statement comes ahead of the Supreme Court ruling and is significant considering the impact that the Trump tariffs had on the BTC price last year.

Crypto traders are currently betting on the Supreme Court ruling against the Trump tariffs. Polymarket data shows that there is only a 26% chance that the court rules in favor of these tariffs.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs