Strategy’s Bitcoin-Backed Securities Reach New High, Can It Beat Gold ETFs?

Highlights

- Strategy’s Bitcoin securities reach $3.3B, showing growing interest.

- STRD leads surge in these BTC-backed products, driving their rising momentum.

- Bitcoin investment products show promise, slowly gaining ground on the more established gold ETFs.

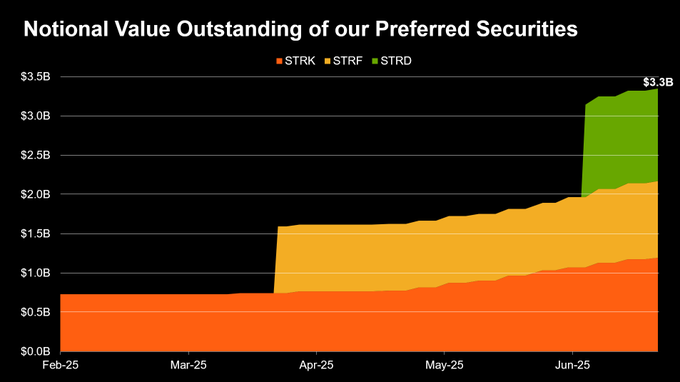

Strategy, a company focused on innovative financial solutions, has shared an exciting update about its $BTC-backed fixed income products. The announcement came via a post on X from the company’s official X handle. It showcases a chart that tracks the notional value of these securities.

Bitcoin-Backed Securities Gains Traction as Market Matures

This uptrend highlights a growing interest in cryptocurrency-based investments, offering a new way for people to earn steady returns using Bitcoin. The chart, spanning from February to June 2025, shows a steady climb in the total value of these securities.

Starting at around $0.5 billion, the value rose to an impressive $3.3 billion by mid-June. The growth is split across three categories: STRK, STRF, and STRD, each represented by different colors. STRD, in green, saw the biggest jump recently, pushing the total value higher as the year progressed. This suggests strong demand for these Bitcoin-backed products.

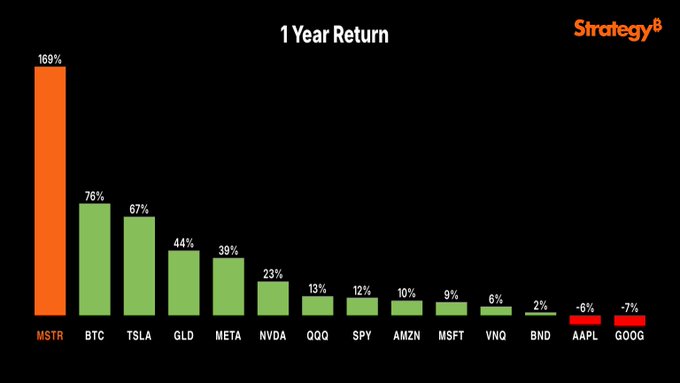

Strategy products’ milestone suggests a maturing space. The company’s work could encourage more firms to enter this field, potentially increasing options for investors. In an X post, Saylor also highlighted the MSTR stock’s performance over the last year, with the stock outperforming other major tech stocks like Apple, Tesla, and Meta. MSTR has also outperformed Gold during this period.

Bitcoin Products Gain Traction Compared to Gold ETFs and Traditional Assets

While the rise is notable, the Bitcoin market still lags behind traditional investment options. For instance, GLD, the top gold exchange-traded fund (ETF), currently manages about $60 billion in assets.

This shows that Bitcoin-based structured products are still a small part of this sector compared to gold. However, their rapid growth indicates a shift where they are starting to challenge the dominance of older, established ones.

Strategy’s efforts are part of a broader trend where investors are exploring digital currencies as a reliable source of income. The company’s focus on building this market could signal a future where Bitcoin plays a bigger role alongside traditional commodities. The chart’s upward trend reflects growing confidence, even if the scale remains modest compared to giants like gold ETFs.

CoinMarketCap data shows that the Bitcoin price is trading around $107,000. The flagship crypto reached an intraday high of $108,300 but is now at risk of losing the psychological $107,000 level.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs