Bitcoin Slumps Below $108K, Will Crypto Market Crash on Hindenburg Omen Jitters?

Highlights

- Crypto market crash concerns mount as Bitcoin slips below $108K again today.

- Hindenburg Omen technical indicator flashes crash signals two times in October.

- Global markets seek cues from U.S. Supreme Court's decision on Trump tariffs this week.

- 10x Research predicts BTC price fall below $107K support as liquidations by whales and LTH continue.

Crypto investors and experts anticipate a bullish November after Bitcoin ended in the red last month, for the first time in over 6 years. Crypto market crash concerns continue as BTC price falls under $108K due to various reasons, including the US Supreme Court’s decision on Trump tariffs.

Hindenburg Omen Indicator Triggered, Will Crypto Market Crash?

The Hindenburg Omen technical indicator that predicted the 1987 Black Monday and the 2008 Financial Crisis has flashed a warning sign. With the crypto market moving in correlation with the stock market, traders and institutions are considering the high risks for a Bitcoin and a broader crypto market crash further.

The controversial indicator flashed for the second time last month. Expert Tom McClellan claimed it “tends to matter more when we see a cluster of them.” The timing has raised more concerns among investors amid spot Bitcoin and Ethereum ETFs outflow and a slump in prices of tech stocks, including Meta, Oracle, and Microsoft.

Crypto Market Awaits Supreme Court Decision on Trump Tariffs

Global markets await the U.S. Supreme Court proceedings on Trump tariffs on Wednesday. Cases by businesses and a group of states contend that Trump’s trade strategy of raising tariffs is illegal and should be struck down.

The United States could become a third-world country without tariffs, President Donald Trump posted on Truth Social on November 3. The case on tariffs is one of the most important in history, he added.

"What happens to your economic plan if the Supreme court invalidates tariffs?"@POTUS: "I think our country would be immeasurably hurt. I think our economy will go to hell… I think it's the most important subject discussed by the Supreme Court in 100 years." pic.twitter.com/ciBJMxUncF

— Rapid Response 47 (@RapidResponse47) November 3, 2025

Trump signed multiple trade deals during his Asia visit last week, including a landmark trade deal with China. Bitcoin and the broader crypto market rebounded as Trump reduced tariffs on China to 47% and reached a 1-year trade deal on rare earths and critical minerals.

Selloffs by Whales Spark Crypto Market Crash Concerns

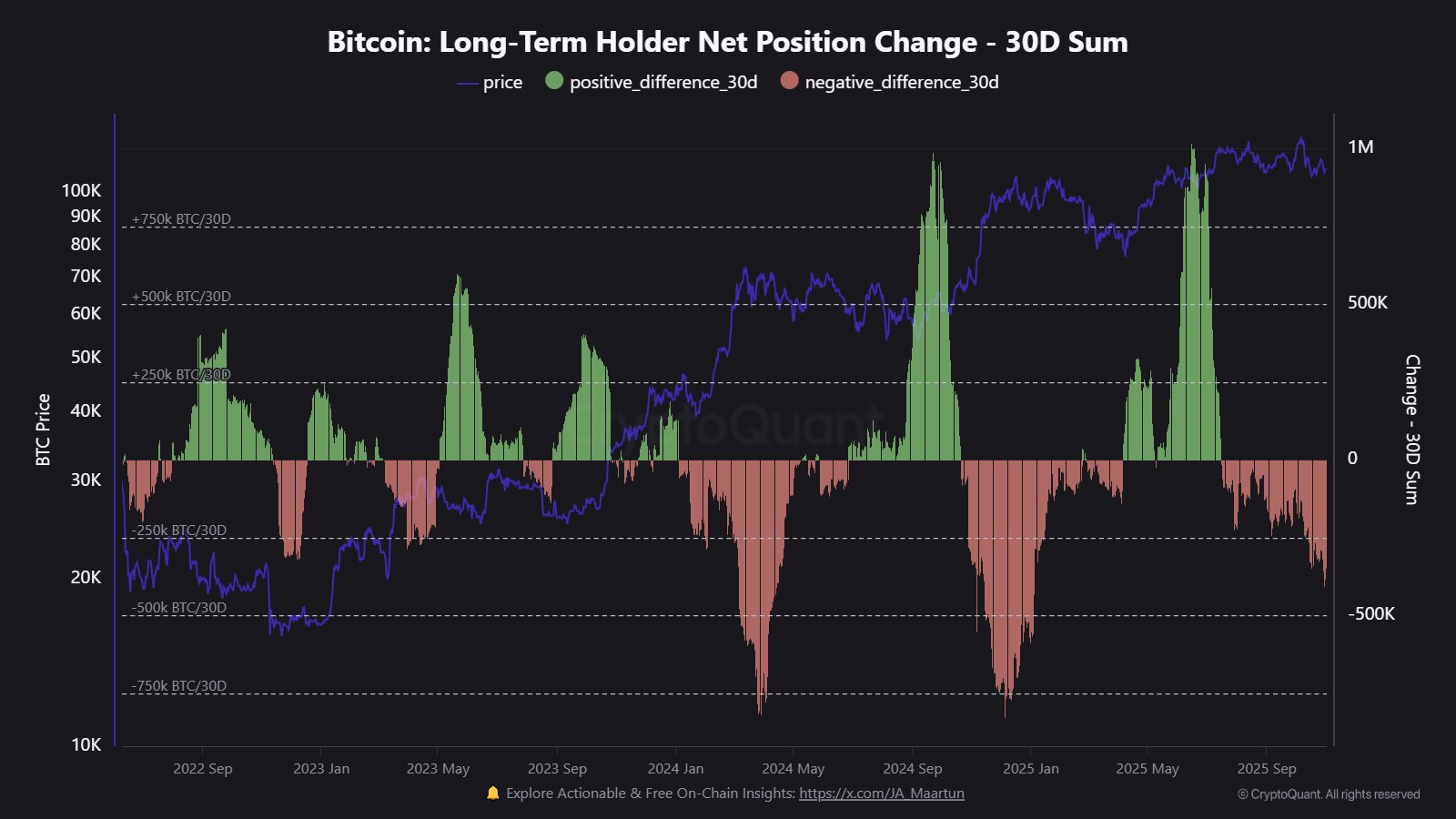

Whales and long-term holders have been selling their crypto holdings. As per on-chain data, long-term holders have offloaded 405,000 BTC in the past 30 days. The crypto market saw nearly $450 million in liquidations in the past 24 hours, with $250 million liquidated in just 4 hours.

Lookonchain pointed out that Bitcoin OGs are dumping BTC in the last few weeks. A whale deposited 13K BTC worth $1.48 billion to Kraken, Binance, Coinbase, and Hyperliquid in October. Also, Owen Gunden has deposited 483.3 BTC worth $53 million today, expanding selloffs to $364.5 million in the last 2 weeks.

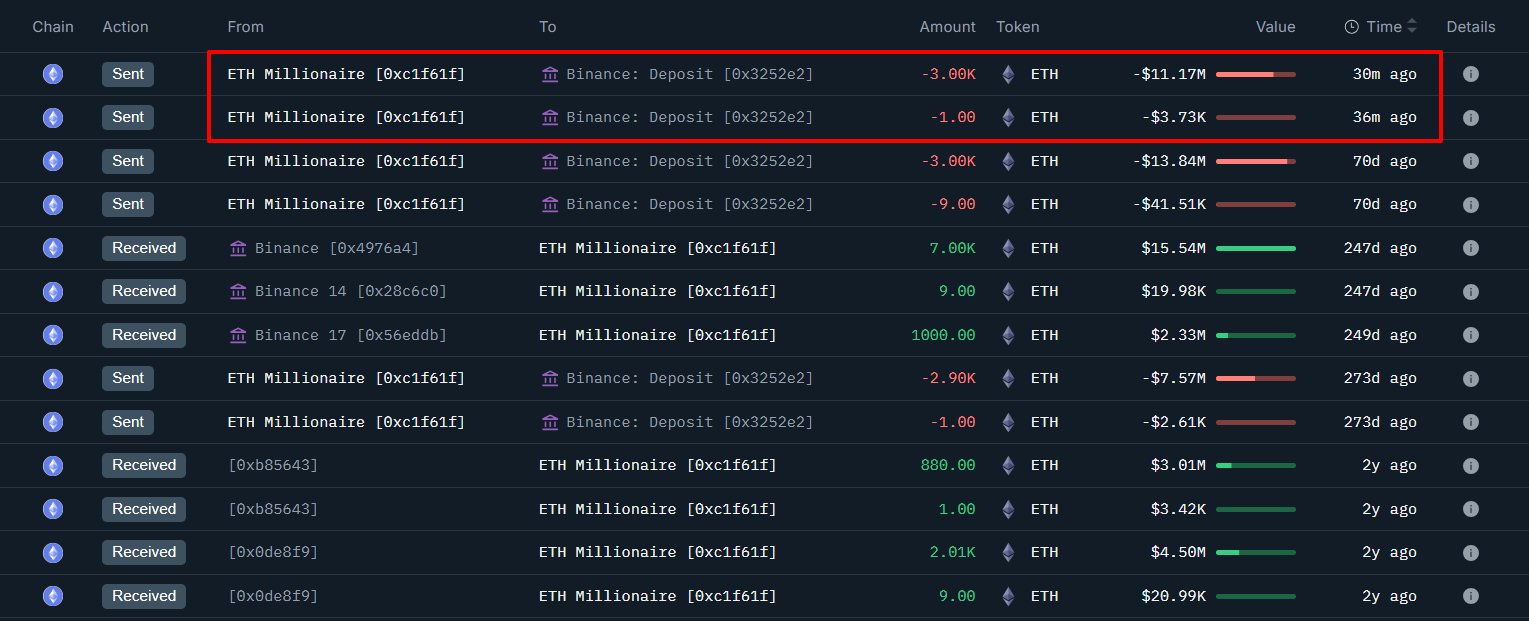

Onchain Lens also reported that a whale deposited 3,000 ETH worth $11.17 million to Binance, making a profit of $14.76 million. The whale still holds 2,000 ETH worth $7.48 million.

10x Research predicts a crypto market crash, with Bitcoin price breaking below the support at $107,000. The firm cited cooling ETF demand, shifting miner economics toward AI, and weakening Ethereum patterns amid a thinning buyer base as key reasons.

The declining value of Bitcoin treasury stocks and steady selling by mega whales have further added selling pressure. While many see it as a healthy correction, a shift in market psychology can not be avoided. “This week’s tape will tell us whether capital steps back in or whether this rotation is only just beginning,” 10x Research noted.

Bitcoin would break this support line at $107,000 pic.twitter.com/ieByNXR8hu

— 10x Research (@10x_Research) November 3, 2025

- CLARITY Act: Banks and Crypto Make Progress Following “Constructive” Dialogue at White House Meeting

- Expert Warns Bitcoin Bear Market Just In ‘Phase 1’ as Glassnode Flags BTC Demand Exhaustion

- SEC Chair Reveals Regulatory Roadmap for Crypto Securities Amid Wait for CLARITY Act

- ProShares Launches First GENIUS Act Focused Money Market ETF, Targeting Ripple, Tether, Circle

- BTC Price Falls as Initial Jobless Claims Come In Below Expectations

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?