Bitcoin Soars Above $63000, Data Signals Rally Will Sustain For Longer: Matrixport

Highlights

- Bitcoin price hits $63,000 as upside momentum continues following Donald Trump assassination attempt

- Matrixport predicts Bitcoin buying activity will sustain for a longer period

- Coinbase premium gap indicates US whales have turned positive on Bitcoin after weeks of selling BTC

- Bitcoin price predicted to rally above $65,000.

Bitcoin price hits $63,000 as upside momentum continues across crypto and equity markets following Donald Trump assassination attempt. On-chain analyst and capital market expert predict this rally will continue for longer periods as whales, institutional investors, and retail investors have started to buy BTC again. Is a new all-time high on the cards?

Bitcoin Price Rally To Continue

Following Donald Trump assassination attempt, Bitcoin price closed the week above $60,000 to trigger a massive momentum. BTC price has now rallied above $63,000 supported by spot and derivatives buying.

Matrixport predicts BTC buying activity will sustain for a longer period, making it less reliant on macroeconomic events. The forecast came in response to more than $1 billion in inflow into spot Bitcoin ETF in the U.S. in a week. The ETF inflows were closely linked to cooling inflation and slowing labor market in the United States. Analysts at Matriport stated that spot Bitcoin ETF inflows are more likely after last week’s weaker than expected CPI release.

“Notably, the initial institutional buying driven by high arbitrage opportunities has shifted to less stop-loss sensitive retail investors,” the crypto company said on July 15.

On-Chain Data Signals High Buying Sentiment

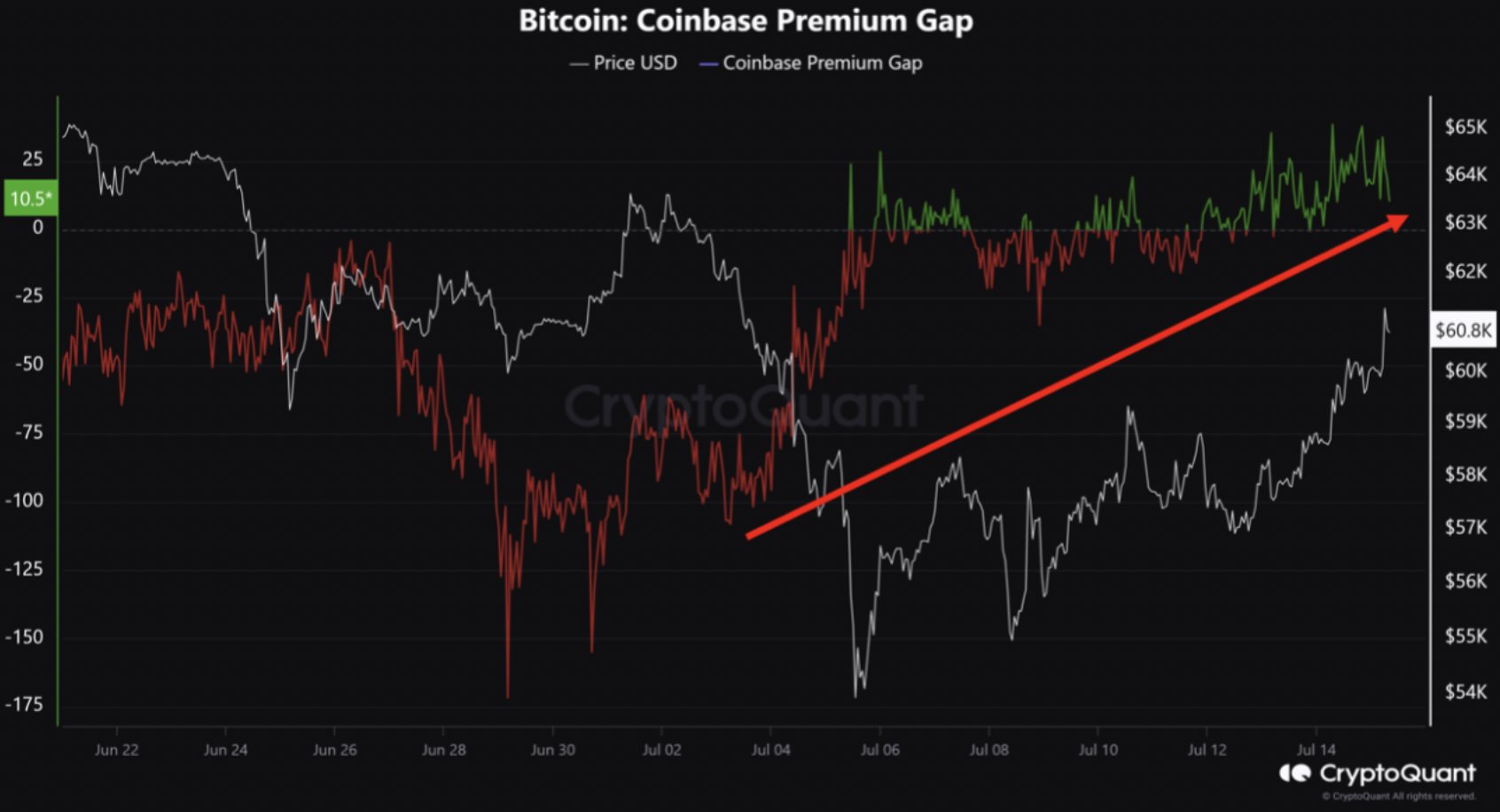

According to Coinbase premium gap data by CryptoQuant, US whales have turned positive on Bitcoin after weeks of selling BTC. With concerns over the German government Bitcoin selloff now over, the rebound has slightly compensated for the decline. Also, the rebound on the weekend indicates that additional funds are expected to flow into the spot Bitcoin ETFs.

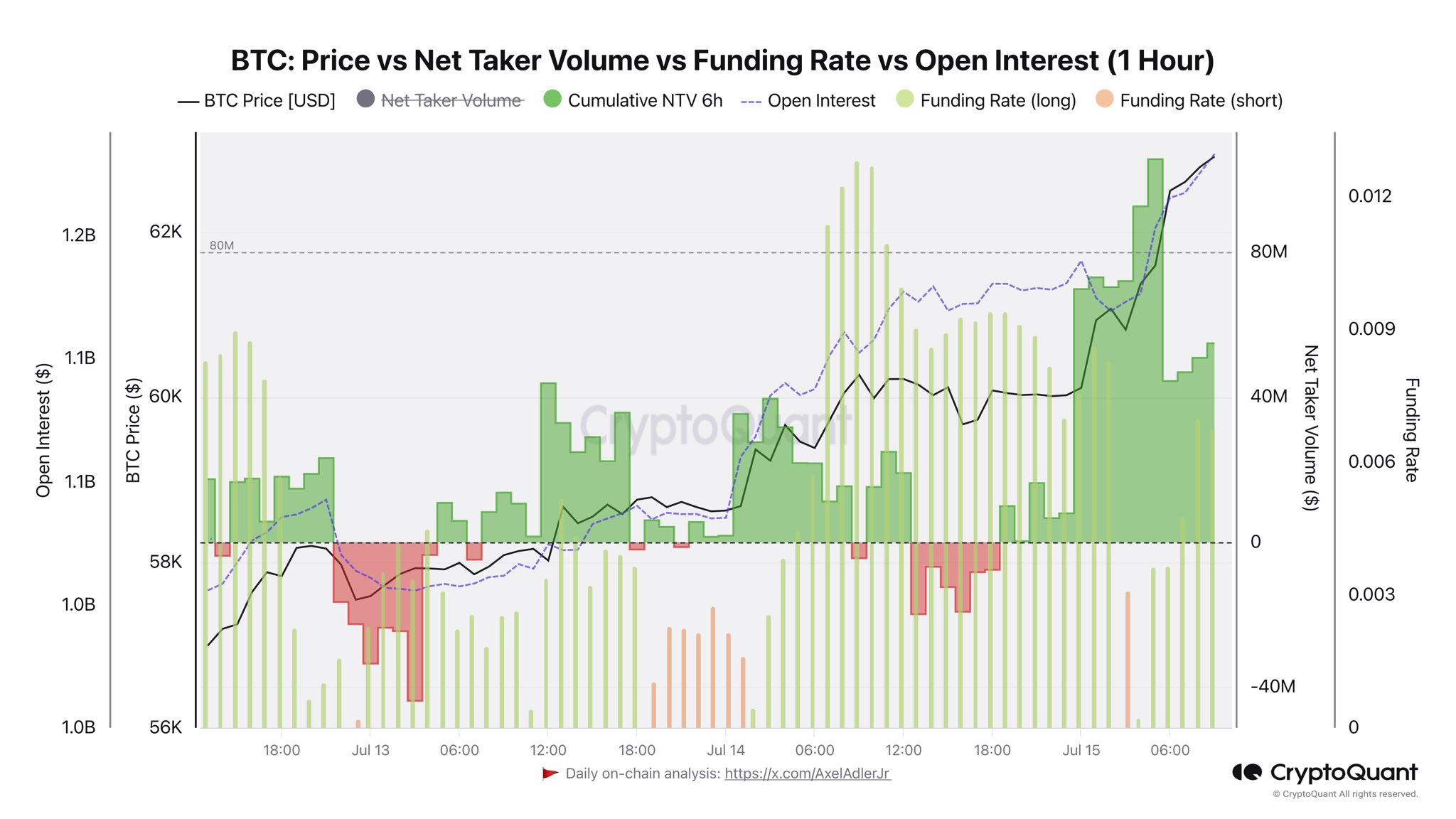

Moreover, BTC derivatives markets’ sentiment towards buying is very positive. The futures market in hourly time frame is showing signs of further crypto market recovery.

Total BTC futures open interest has increased over 4% in the past 24 hours to $32.37 billion. Also, the Futures OI on CME rose over 4%, with OI currently at $9.28 billion.

Also Read: Binance Making Major Changes To Key Spot Pairs Amid Crypto Market Recovery

BTC Price Correction Over

Popular analyst Rekt Capital on July 15 said the bullish divergence has fully played out and Bitcoin has finally broken above its 1.5-month downtrend. He predicts Bitcoin will be ready to start a new cluster of price action above $65,000.

BTC price currently trades at $62,836, up 4% in the last 24 hours. The 24-hour low and high are $59,546 and $63,095, respectively. Furthermore, the trading volume has increased by 26% in the last 24 hours as it closed above $60K, indicating a slight increase in interest among traders.

Also Read: Ex-FTX Exposes Silvergate Bank’s Knowledge Of Suspicious Transactions

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP Prepares for Phase 4 Lift-Off, $21.5 Level in Focus

- Vitalik Buterin Exceeds Planned Ethereum Sales as Total Liquidations Hit $35M

- Circle Stock Price Jumps 35% to $83 on Stablecoin Boom, USDC Supply Soars 72%

- Democrats Convene US Senate Crypto Bill Meeting as a16z Briefs Republicans on CLARITY Act & AI

- After 820% Gains: Privacy Coins Evolve into Payment Rails

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

Buy Presale

Buy Presale