Bitcoin Spot Volumes on Decline, Is Bottom Near?

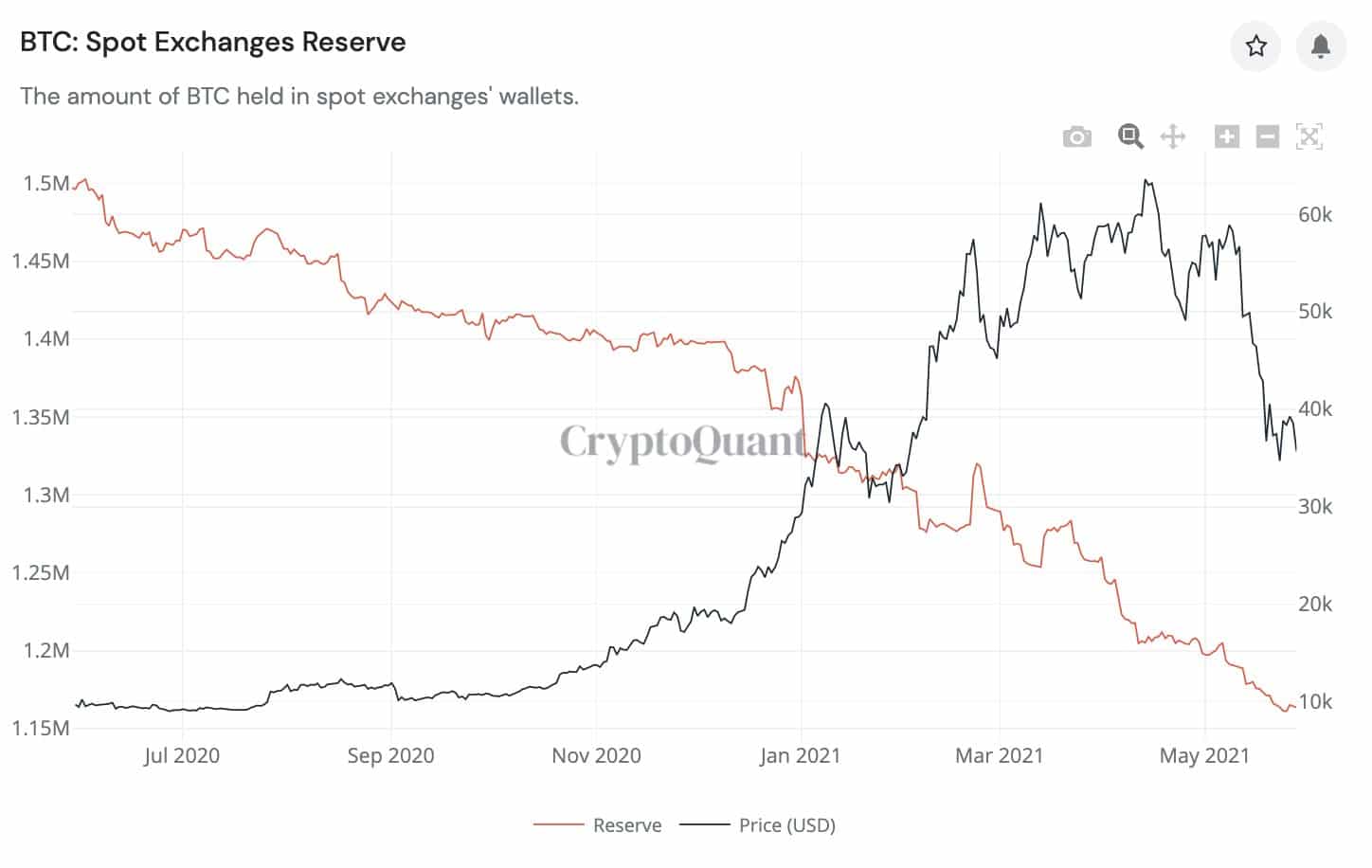

Bitcoin price dipped below $35,000 today currently trading at $34,135 with a 7% price decline over the last year. The price of top cryptocurrency is currently moving between $30k-$40k after the recent market correction, however, on-chain data indicate that Bitcoin price might be nearing its bottom as traders gear up for another bull rally. The spot volume for the top cryptocurrency is on a continuous decline even when the price of BTC has fallen 50% from its ATH.

A declining spot trading volume is often seen as a bullish sign for the Bitcoin market as traders often move their holdings out of the exchanges in anticipation of a price surge. While spot volumes are on a continuous decline the derivative exchange volume is on the rise again which is another sign that traders are confident about trading with leverage.

Before the current market mayhem, Bitcoin was on a record-setting spree and hit a new ATH every month since the start of 2021. The consolidation phase after each ATHs became longer but there was no sign of Bitcoin price reaching a potential top even after the recent 50% drop from the top. Analysts have pointed towards multiple corrections of over 50% during the previous bull cycles.

Is Bitcoin Bottom Round the Corner?

Every bull run comes with a price shakeup to clear the froth created by over-leverage trades to clear weak hands. The recent market correction was one of them after nearly 5-6 months of continuous rise. The on-chain analysis suggests the market sentiment is currently neutral and we may be nearing a bottom before a move up.

The bitcoin dominance also bottomed at 38% and has been on a continuous climb since then currently above 43.5%. With the Biden administration announcing another $6 trillion package to recover the economy, Bitcoin price benefits from the flow of money in the crypto market.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs