Bitcoin and Stock Markets Jump as Coronavirus Curve Begins to Flatten World-wide

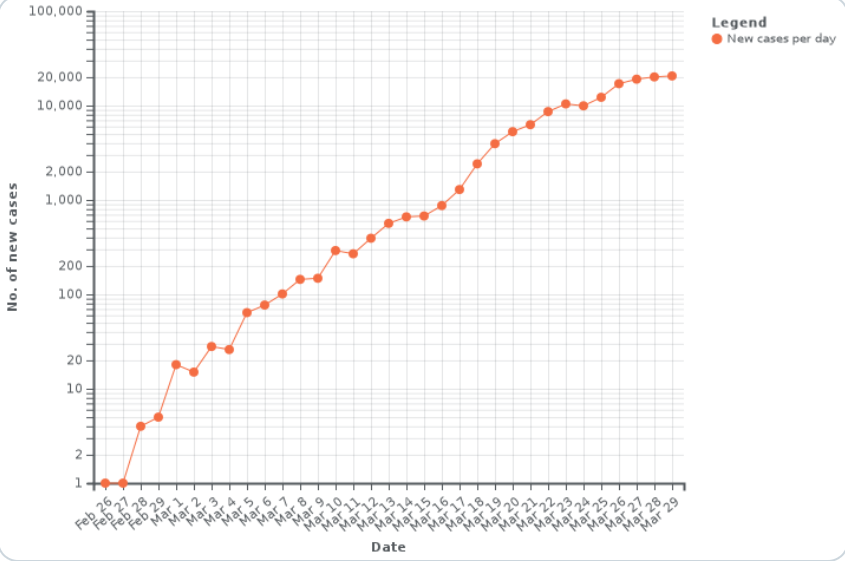

- Social distancing and work from home is helping in flattening the coronavirus curve in the U.S.

- Moreover, the WHO also reports that Europe also seems to be flattening the curve with Italy, the worst hit country there reporting fewer new cases.

- Stock Markets and Bitcoin starts to revive bullish sentiments, with gold taking a step back.

The number of new cases of Coronavirus usually follows a bell curve which first rises exponentially and then reverses it direction with a rounding top. According to Ken Fisher, Billionaire investor and financial expert, the number of new daily cases in the US seems to have reached it’s second state. Fisher tweeted,

U.S. growth rate clearly way past exponential and markedly arithmetic. Follow the data, not the media headlines. Headlines want to be scarier as can be.

The FDA in the U.S. also appears to be approving of a medicine to cure Coronavirus hydroxy-Chloroquine for Covid-19 which is showing positive results in trials.

Too Early for Stock Market Reversal?

The beginning of positive news on the pandemic spread seems to be favoring the stock markets as well. It rose by 3.35% last day with a closing at $2626. Moreover, historically every sell-off of such large magnitudes seems to have bounced on a v-shaped bottom in the short term.

Thomas Lee, a veteran financial expert and partner at Funstrat had noted recently that the stock markets might repeat it’s history of quick short-term reversal. He tweeted,

On time will tell if 3/23/2020 was the final bottom, but we noted, based on 10 precedent examples below, S&P 500 2,800 could happen within 3 weeks (from 3/26/2020)

Will Bitcoin Follow?

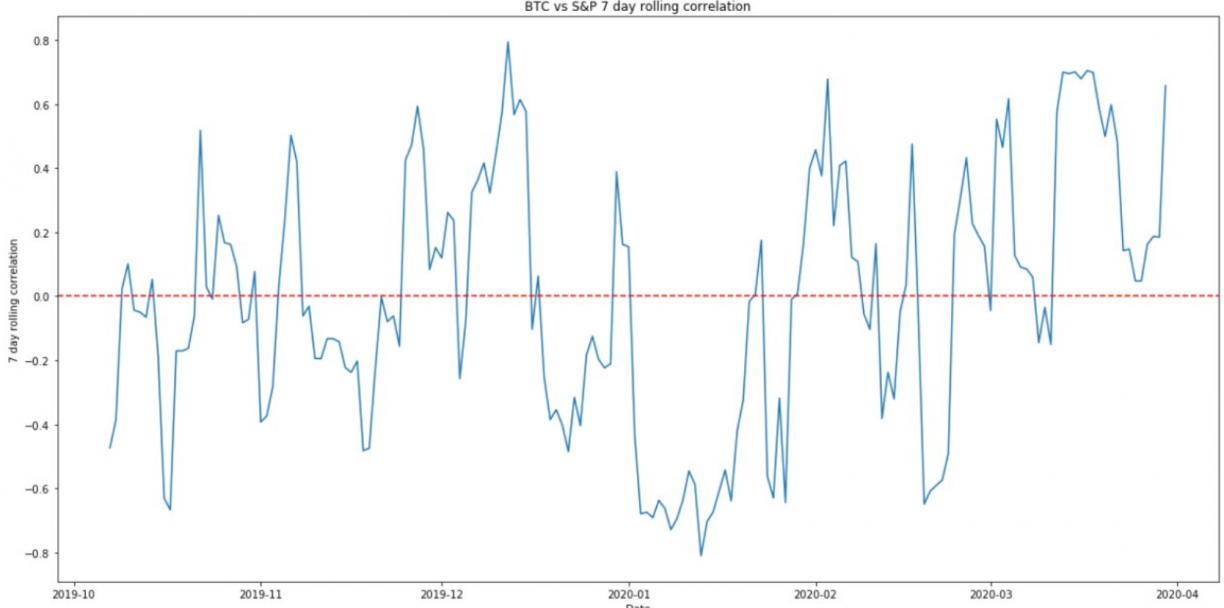

This could potentially be a short-term long signal on the Bitcoin as well. The impending relief from the deadly spread, which caused the panic drop in the first place now looks to reverse its action. The correlation between Bitcoin and stock markets turns positive (around 0.6) which is quite strong.

Yesterday, it recorded a 9% gain from $5800, with a close at $6406. The price of BTC at 5: 00 hours UTC is $6450.

Nevertheless, Tyler D. Coates (alias Sawcruhteez), a derivatives and crypto trader suspects a reversal in the sync of these price movements. He tweets,

Very interesting chart! However my interpretation is that correlation is in a range and nearing resistance. To me this would suggest that #Bitcoin will not be correlated with the #SP500 during the month of April

Furthermore, the drop in Bitcoin was of higher proportions that it was in the stock markets with a strong buy-back without the help of Fed or Government intervention. This has potentially wiped the miner capitulation fears around halving as well. Veteran Traders and Bitcoin investor, UglyOldGoat notes,

All the requirements for BTC to now reach ATH have been met. Expect a slow grinding up move accelerating into the halving.

Currently, the range between $6,800-$7,000 is acting as strong levels for resistance to the price. The conversion of these levels into support will be a strong bullish signal for Bitcoin.

Do you think bulls are back in the crypto-markets? Please share your views with us.

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs