BTC and ETH Options Worth $2.6B Set to Expire, Bitcoin Traders Buying Calls for $76K

Highlights

- Options traders actively buying call options for as high as $76K after the FOMC.

- 25K BTC options of notional value $1.7 billion and 252K ETH options of notional value of almost $0.9 billion to expire Friday.

- CME Bitcoin futures OI hits a new all-time high of $11.80 billion.

- Crypto futures and options data indicate massive recovery.

After the Federal Open Market Committee (FOMC) kept interest rates unchanged and Fed Chair Jerome Powell’s dovish outlook on three rate cuts this year, derivatives traders have turned bullish. Traders are actively buying call options in anticipation of Bitcoin price rebound to hit as high as $76K in March.

Derivatives Traders Goes Bullish

GreeksLive market researcher Adam in a post on X revealed that negative market sentiment has significantly eased and large-volume transactions have resumed after the FOMC. Among total options transactions, 30% are large-volume transactions with a majority of them actively buying call options.

The U.S. Federal Reserve left the fed funds rate steady at 5.25%-5.5% for a fifth consecutive meeting on Wednesday, in line with market expectations. Jerome Powell revealed that the Fed still plans to cut interest rates three times this year. Moreover, the dot plot also indicated three cuts in 2025.

Adam further added that the long and short trades are relatively balanced, and the crypto market’s bullish foundation is still there after a rebound of more than 10%. Meanwhile, the RV has been high recently and the IV has remained high and volatile.

Bitcoin and Ethereum $3 Billion Options Expiry

After the FOMC, the investors are bracing for weekly expiry for clear guidance on market direction. The Crypto Greed and Fear Index has dropped to 78, indicating possible buying despite “extreme greed.”

Deribit reported $2.6 billion in Bitcoin and Ethereum set to expire on Friday, March 22 at 8:00 AM UTC. The market could see massive buying during post-expiry, with traders eyeing a new all-time high for BTC price.

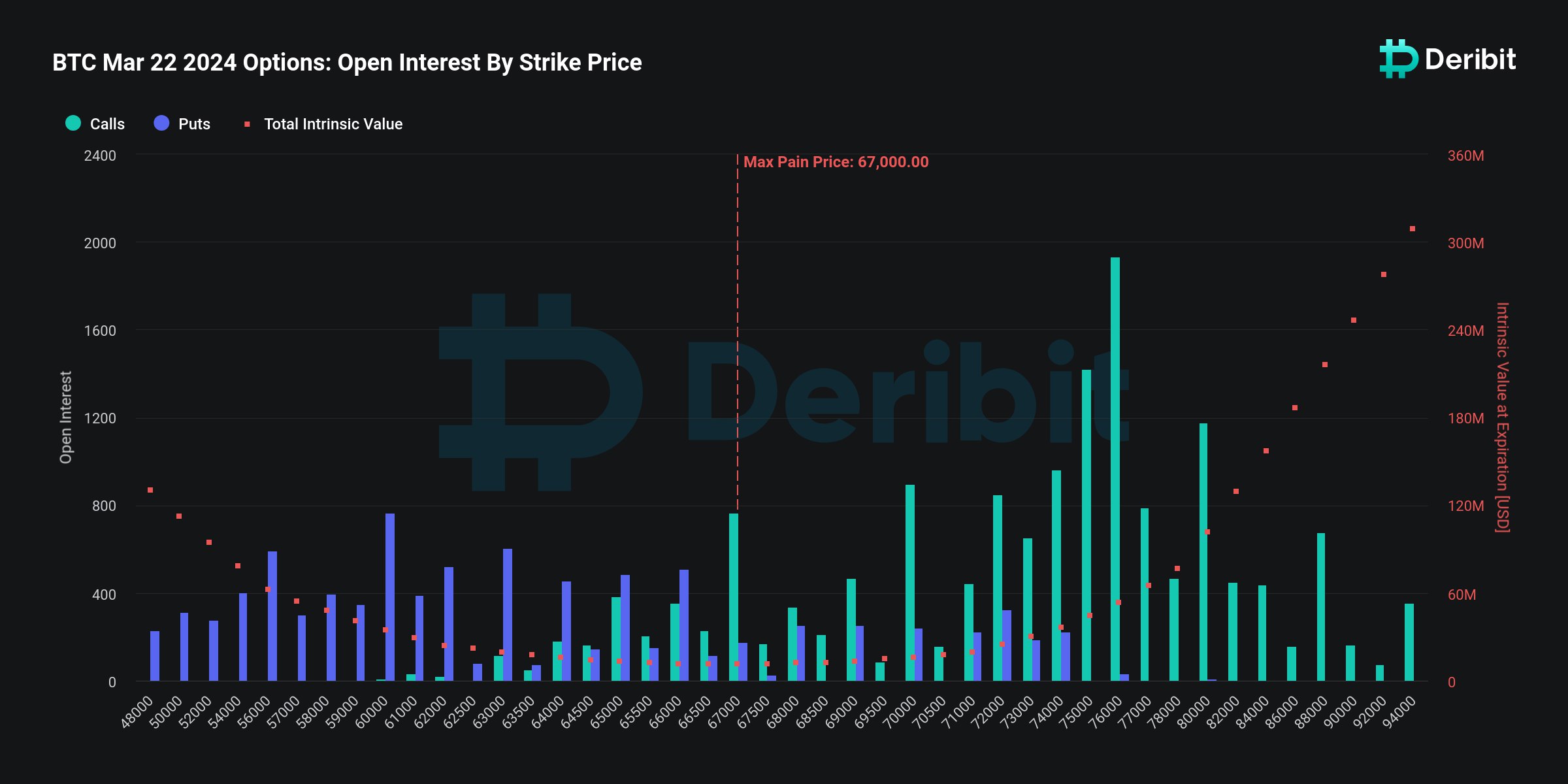

Notably, 25K BTC options of notional value $1.7 billion are set to expire, with a put-call ratio of 0.58. The max pain point is $67,000, indicating that traders are under buying pressure. Volatile price movements are expected amid options expiry, but positive sentiment to drive short-term upward momentum in BTC price.

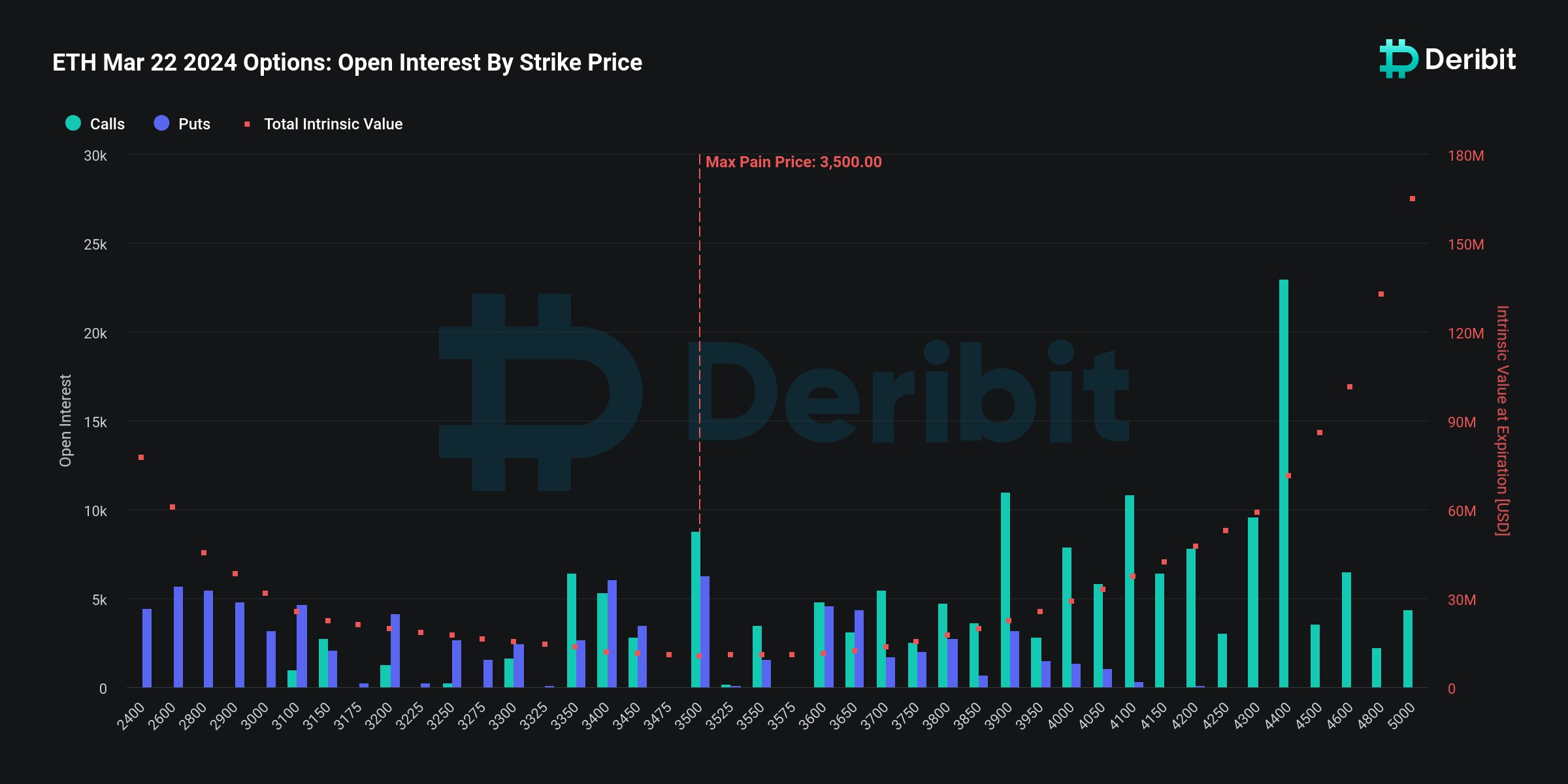

Moreover, 252K ETH options of notional value of almost $0.9 billion are set to expire, with a put call ratio of 0.53. The max pain point is $3,500, which is also higher than the current price of $3,550. Traders must keep an eye on rise in trading volumes for confirmation on recovery towards $4,000, but the scenario could fail due to other pressure such as the SEC probe on Ethereum Foundation.

BTC and ETH Price Action

CoinGlass data indicates traders and investors liquidating BTC and ETH shorts in the last 24 hours. This signals bullish sentiment similar to derivatives traders eye a high of $76K before March end.

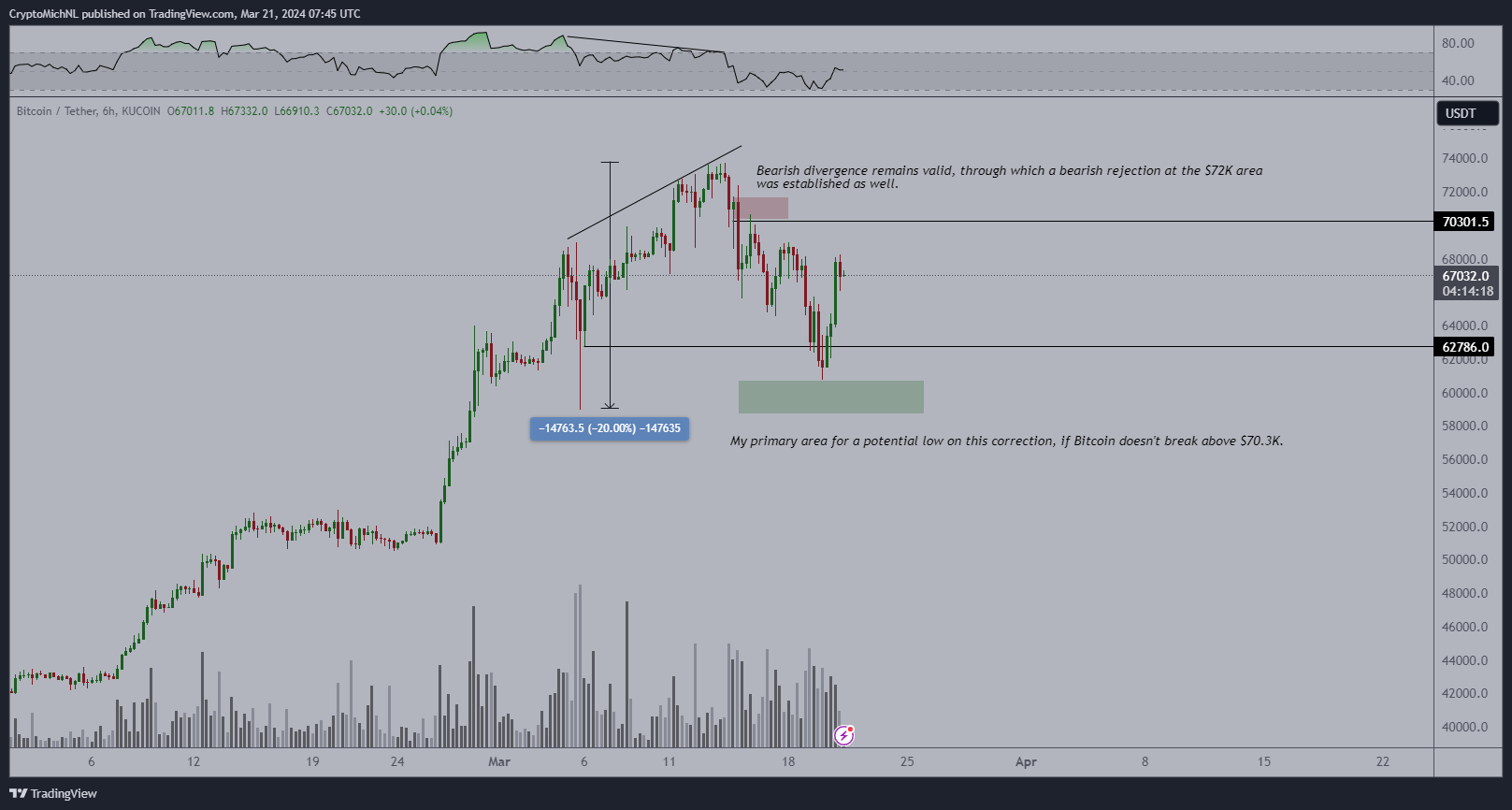

Moreover, analyst Michael van de Poppe predicts a massive bounce on Bitcoin. He thinks a consolidation due to strong bound and then run to new all-time high before Bitcoin halving.

Bitcoin and Ethereum futures OI skyrocketed 7% and 10% on Thursday. In the last 4 hours amid expiry, BTC and ETH OI recorded a 1% jump, indicating buying is still intact in the last few hours. CME Bitcoin futures OI fell 5% after it hit a new all-time high of $11.80 billion, but buying continues on other exchanges. However, there are predictions for BTC price dip below $60K.

Also Read:

- Ripple Vs SEC Update: Judge Torres Considers Extending XRP Lawsuit Fair Enough

- LUNC and USTC Price Rises As Terra Luna Classic Holders Hit Record High

- Ethereum Devs Seek Gas Limit Increase for Lower Transaction Costs

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- White House Proposes Stablecoin Rewards Compromise as CLARITY Act Odds Drop to 44%

- Trump’s Board Of Peace Eyes Dollar-Backed Stablecoin For Gaza Rebuild

- Trump’s World Liberty Financial Flags ‘Coordinated Attack’ as USD1 Stablecoin Briefly Depegs

- Trump Tariffs: U.S. Threatens Higher Tariffs After Supreme Court Ruling, BTC Price Falls

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?