Bitcoin Trading Slows as On-Chain Activity Nears Historic Lows

Highlights

- Bitcoin's on-chain transactions hit multi-year lows amid market uncertainty and fear.

- Long-term Bitcoin holders retain assets, showing strong confidence despite price drop.

- Bitcoin price volatility aligns with historical post-halving corrections, deviating from typical cycles.

Over the last two months, Bitcoin’s on-chain activity has neared historic lows as transaction volumes have reduced noticeably.

This cooling off comes after the all-time high of Bitcoin earlier in the year and is a period headline by crowd fear and indecision rather than being a predictor of further price dips.

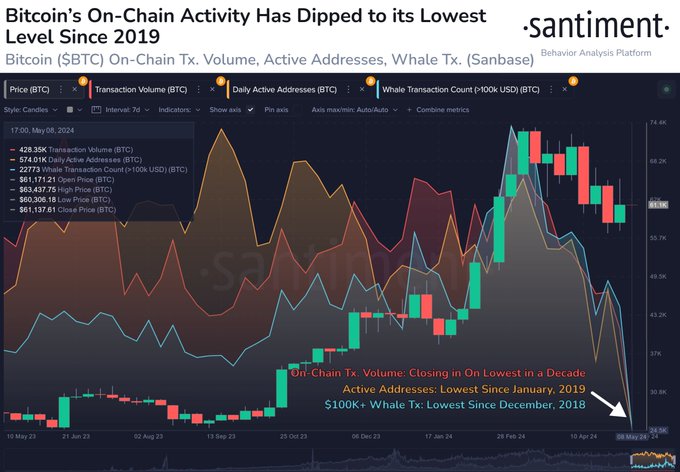

Bitcoin’s On-Chain Activity Declines

According to Santiment data, Bitcoin’s on-chain transaction volume has dropped, hitting figures that were last seen years ago (since 2019). This pattern indicates that traders are reluctant to transfer their positions, possibly because of the market’s volatility.

The sharp decline in activity followed Bitcoin’s all-time high in March 2024, a milestone that was one year ahead of the expected schedule according to historical halving cycles.

Market Reaction and Analysis

The sharp decline in the transaction volume has not escaped the attention of market analysts. As reported by Coingape, Bitcoin tested the $60,000 support on May 10 after a very brief trip up to $63,500.

In addition, on platforms like X (formerly Twitter), traders suggest that institutional players may be manipulating the market to prevent significant breakouts during weekends when the ETF market is closed.

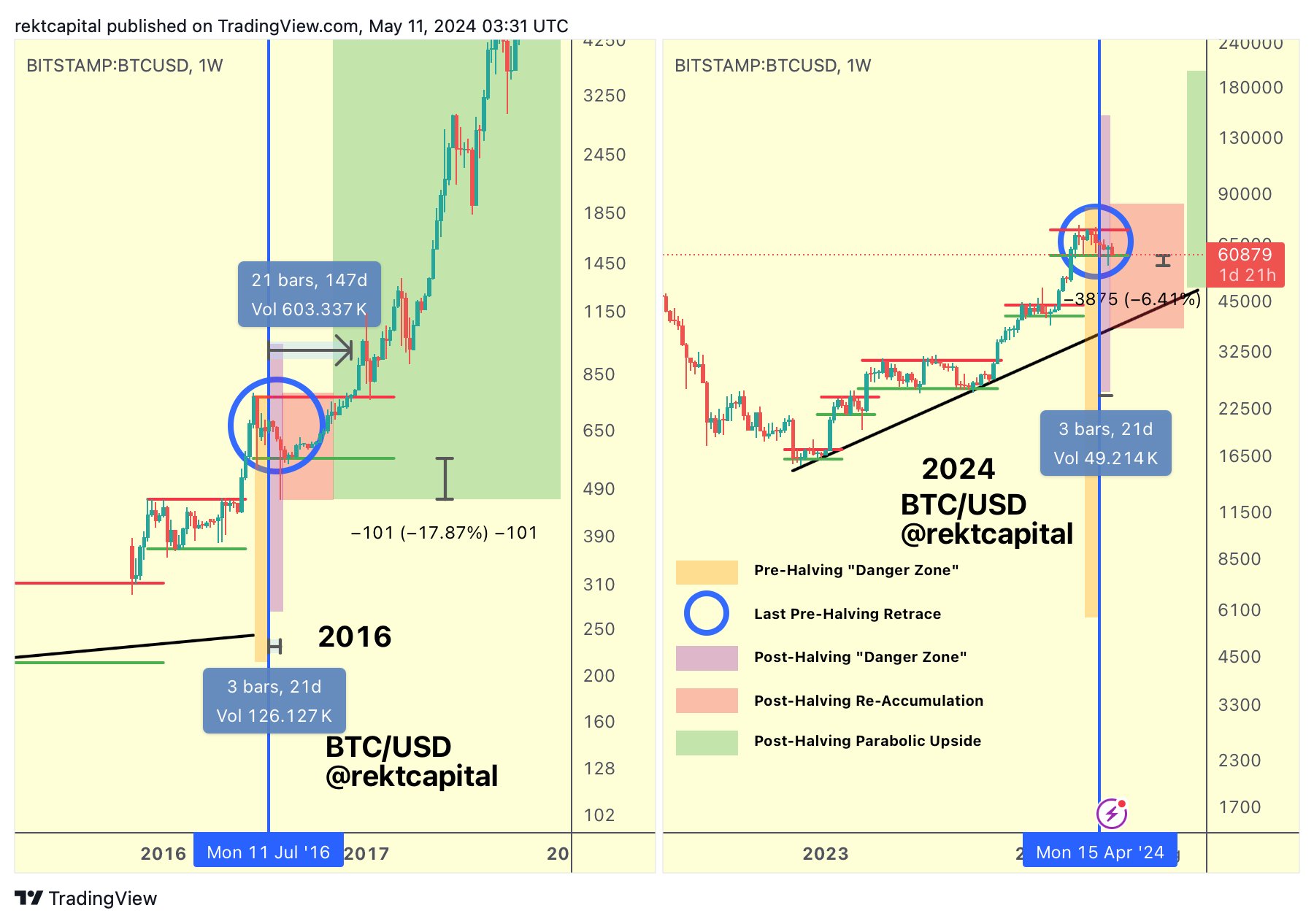

Trader and analyst Rekt Capital highlighted that Bitcoin usually takes a hit weeks after a halving event, an interval he dubs the “danger zone.” ” This phase of price dip, which is coming to an end now, showed a slump in the price of Bitcoin to $56,500. Nevertheless, long-term holders (LTH) are not selling their holdings, which might signify a possible recovery.

Price Performance and Economic Influences

Bitcoin’s price performance has been volatile, as the cryptocurrency has been unable to sustain its motion above $63,000. Bearish indications from stagflationary US economic data and hawkish remarks by Federal Reserve officials have also weakened the bullish sentiment.

Specifically, the University of Michigan Consumer Sentiment Survey revealed a significant drop from 77.2 in April to 67.4 in May, while inflation expectations rose, adding to the market’s concerns.

The price volatility shares the same Bitcoin history pattern where post-halving periods usually see large corrections. But the price trajectory this year in too far from the usual four-year cycle, which implies that the new high can be reached relatively quickly.

Long-Term Holders Maintain Confidence

Although the price of Bitcoin has fallen in recent months, the long-term Bitcoin holders are still positive. According to the data from CryptoQuant, these holders still did not sell their holdings after the top at $73,000. Meanwhile, at press time. Bitcoin(BTC) bulls were still fighting for market control despite a broader market sell-off that dipped the price to an intra-day low of $60,492.63. Trading at $60,908.99, BTC was 0.10% from the intra-day high.

On the contrary, according to Coingape, the long-term holders seem to be waiting for a possible revival. Axel Adler Jr, an on-chain analyst, noted that long-term holders had previously sold 1.3 million BTC at the peak but are currently retaining their assets, anticipating a local bottom.

Such an act shows a strong faith in Bitcoin’s long-term value as opposed to the actions of short-term holders, who have been seen to participate in a number of profit-taking events. Now, the market is looking at major economic data and upcoming events that include PPI and CPI reports, as well as a speech from Fex chair Jerome Powell, which may affect Bitcoin’s trajectory in the following weeks.

Also Read:

- Analysts Urge Bitcoin, Gold & Silver Buy as Elon Musk Critiques FED’s Money Printing

- Cardano Founder Charles Hoskinson Reveals Why Crypto Matters In Choosing Next US President

- Dogecoin and Shiba Inu Await Breakout for Over 100% Rally

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

Buy $GGs

Buy $GGs