Bitcoin Trading Volume Plummet 90% On Binance, BTC Price Risks Fall

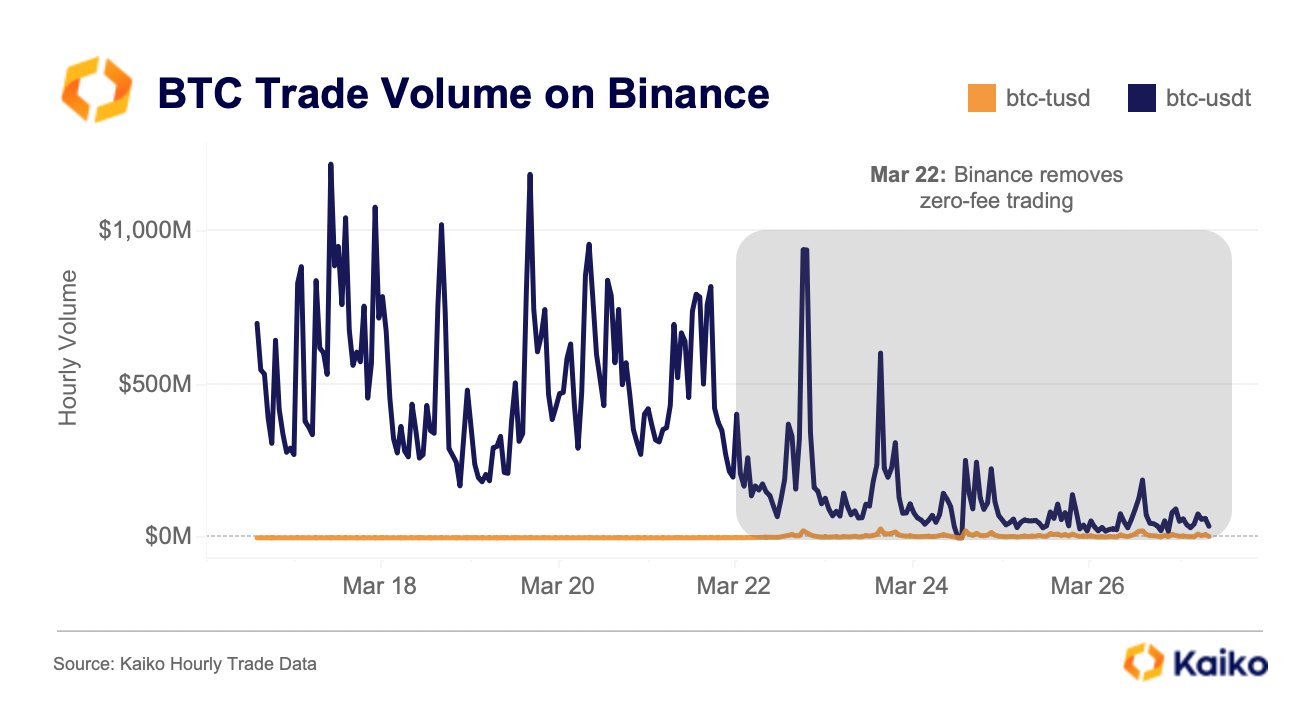

Bitcoin trading volume dropped massively on crypto exchange Binance after it ended the zero-fee Bitcoin trading for all trading pairs except TrueUSD (TUSD), according to Kaiko data. The move is causing selling pressure on Bitcoin price.

Crypto data provider Kaiko on March 27 revealed that Bitcoin trading volume for the BTC-USDT pair fell 90% on crypto exchange Binance after it ended the zero-fee Bitcoin trading for all trading pairs except TrueUSD (TUSD). While the daily trading volume on BTC-TUSD pair has increased to $170 million, it’s still relatively lower.

Binance made major changes to its zero-fee Bitcoin trading program and BUSD zero-maker fee promotion as part of removing Binance USD (BUSD) after the crackdown by U.S. regulators.

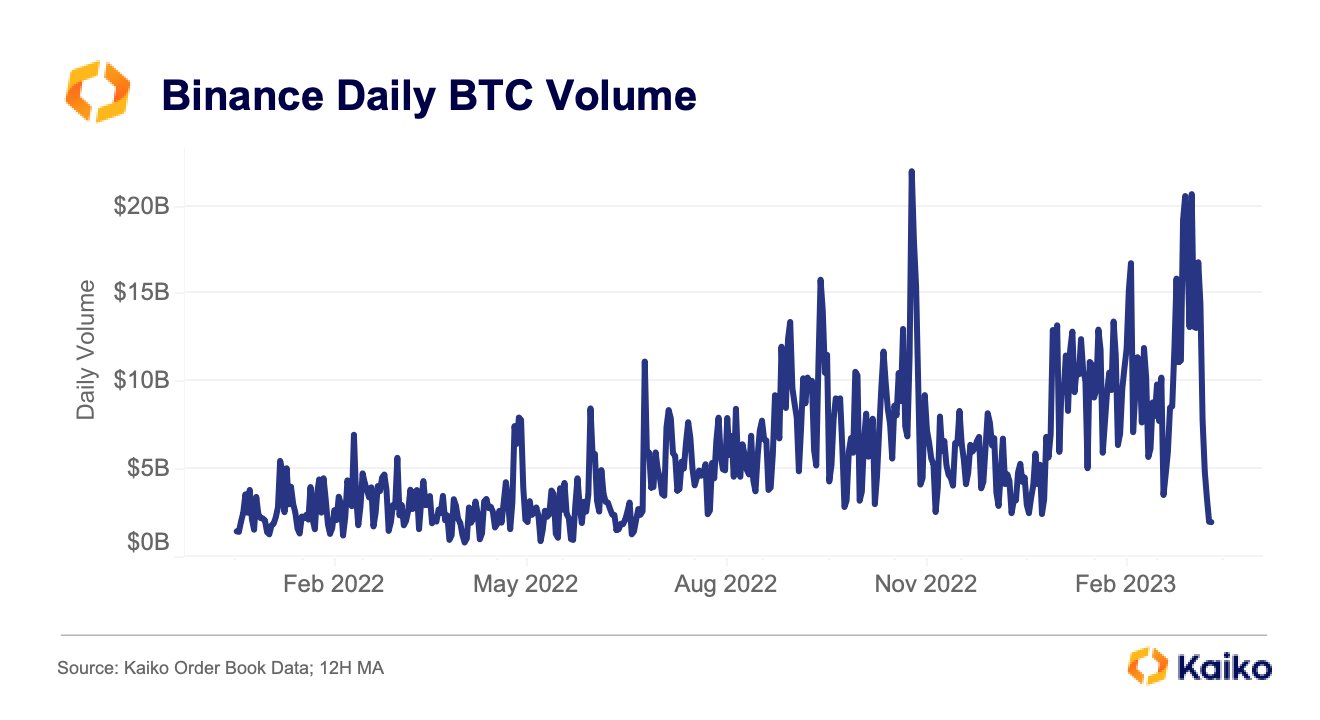

During the weekend, Binance’s Bitcoin (BTC) daily trading volume fell to its lowest level since July 4, 2022. The last time Binance’s volume went this low was two days before it introduced the zero-fee trading program.

Crypto Twitter raised concerns over Binance moving to support TUSD stablecoin after BUSD, which is a comparatively small stablecoin with just a $2 billion market cap. On March 11, Binance switched to multiple stablecoins and discontinued its Binance USD (BUSD) Auto-Conversion policy that was introduced last September.

Bitcoin Faces Selling Pressure

Bitcoin price faces strong resistance between $28.3K-$29K as the BTC price continues to hit $28,000. The BTC price hit a 9-month high of $28,803 amid the banking crisis as the U.S. Federal Reserve balance sheet rises almost $400 billion in the last two weeks. BTC price currently trades at $27,378.

While analysts are confident over Bitcoin price hitting $35,000 in the coming weeks, on-chain data and technical analysis revealed some weakness in Bitcoin price. Moreover, BTC liquidity has dropped to a 10-month low as crypto loses access to banking systems and USD payments. The current banking crisis, inflationary pressure, and uncertain macro environment caused a pause in the current market rally.

Also Read: MicroStrategy Buys 6455 Bitcoin, Binance CEO Reacts

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Why Is Crypto Market Crashing Today (Feb 28)

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs