Bitcoin Whale Addresses At A 3-Year Supply Low, Here’s the Details…

After showing some volatility last week, the world’s largest cryptocurrency Bitcoin has maintained a steady position at around $19,200 levels. The recent BTC price movement has confused investors as to in which direction it will swing next.

On-chain data also shows an interesting exchange of hands between the whales and the smaller addresses. Crypto analytics platform Santiment explains that BTC whales are holding the lowest supply in the last three years. At the same time, the BTC supply with small and mid-sized addresses has touched an all-time high. The Santiment report notes:

Bitcoin’s small to mid-sized addresses (holding 0.1 to 10 $BTC) hold an #AllTimeHigh 15.9% of the coin’s available supply. Meanwhile, whales (holding 100 to 10k $BTC) are at a 3-year low at 45.6% of the supply. #Stablecoin marketcaps are at a 2022 low.

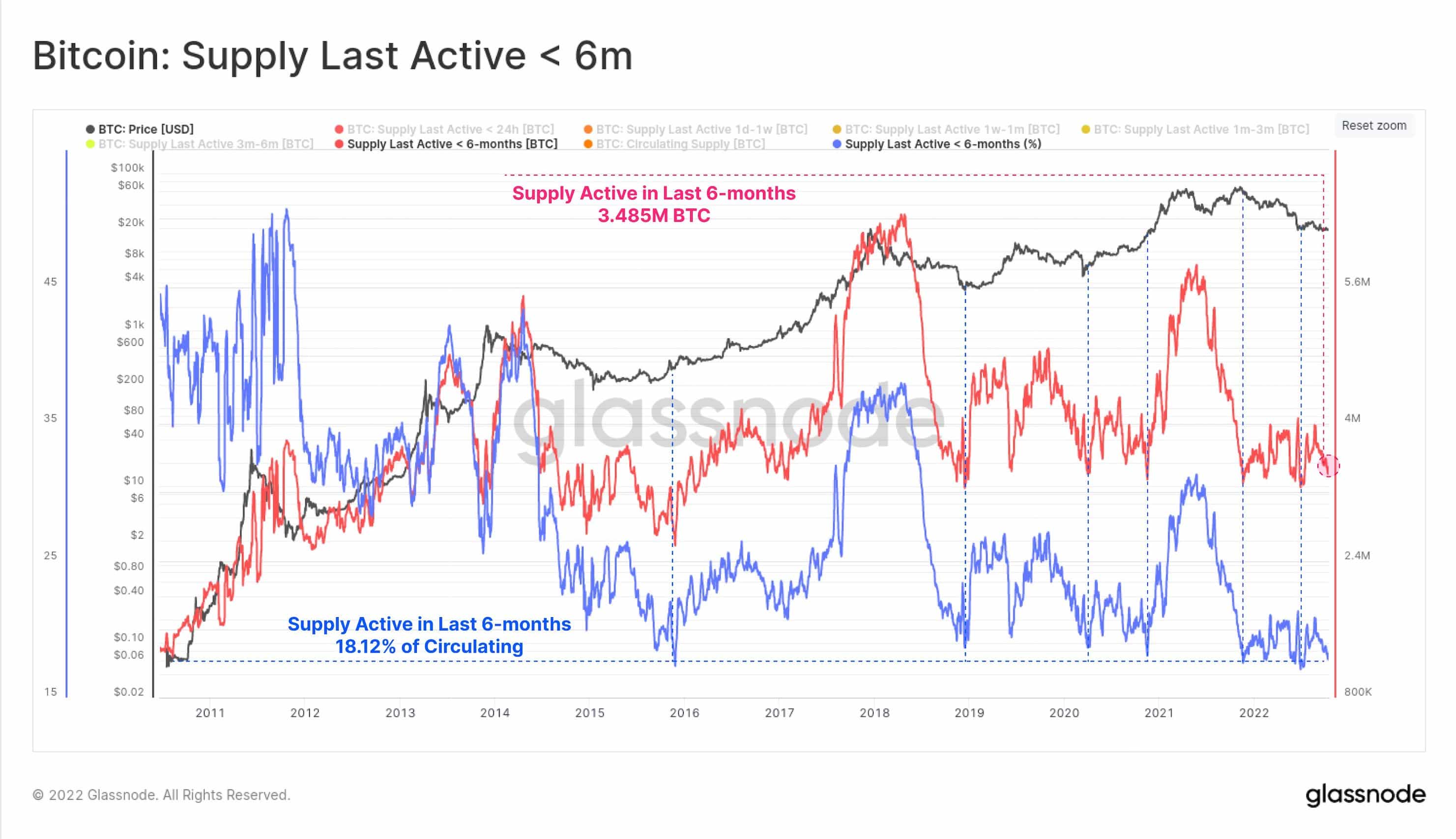

At the same time, the Bitcoin supply on the move over the last six months has reached all-time lows, reports Glassnode. In a six-month period, the active circulating supply for BTC has reached 18.12% or at 3.485 million BTC. As Glassnode explains: “Historically, very low volumes of mobile supply typically occur after prolonged bear markets”.

Where Is Bitcoin Heading Next?

Crypto market analyst Capo notes that Bitcoin could give a bullish move all the way to $21,000 which is its major resistance area. Also, as we reported, the Bitcoin futures market indicates reduced selling pressure. Additionally, data from Coinbase’s professional trading platform Coinbase Pro shows that more than 48,000 BTC moved out of the platform. It looks like institutional players are turning active once again.

JUST-IN: 48k $BTC flowed out from Coinbase today.

Looked at the transactions, and it seems they broke the old piggy bank to deliver #Bitcoin to institutional clients.https://t.co/XSZegaQNoQ https://t.co/4HD05GjOn9 pic.twitter.com/XbONCB1DXt

— Ki Young Ju (@ki_young_ju) October 18, 2022

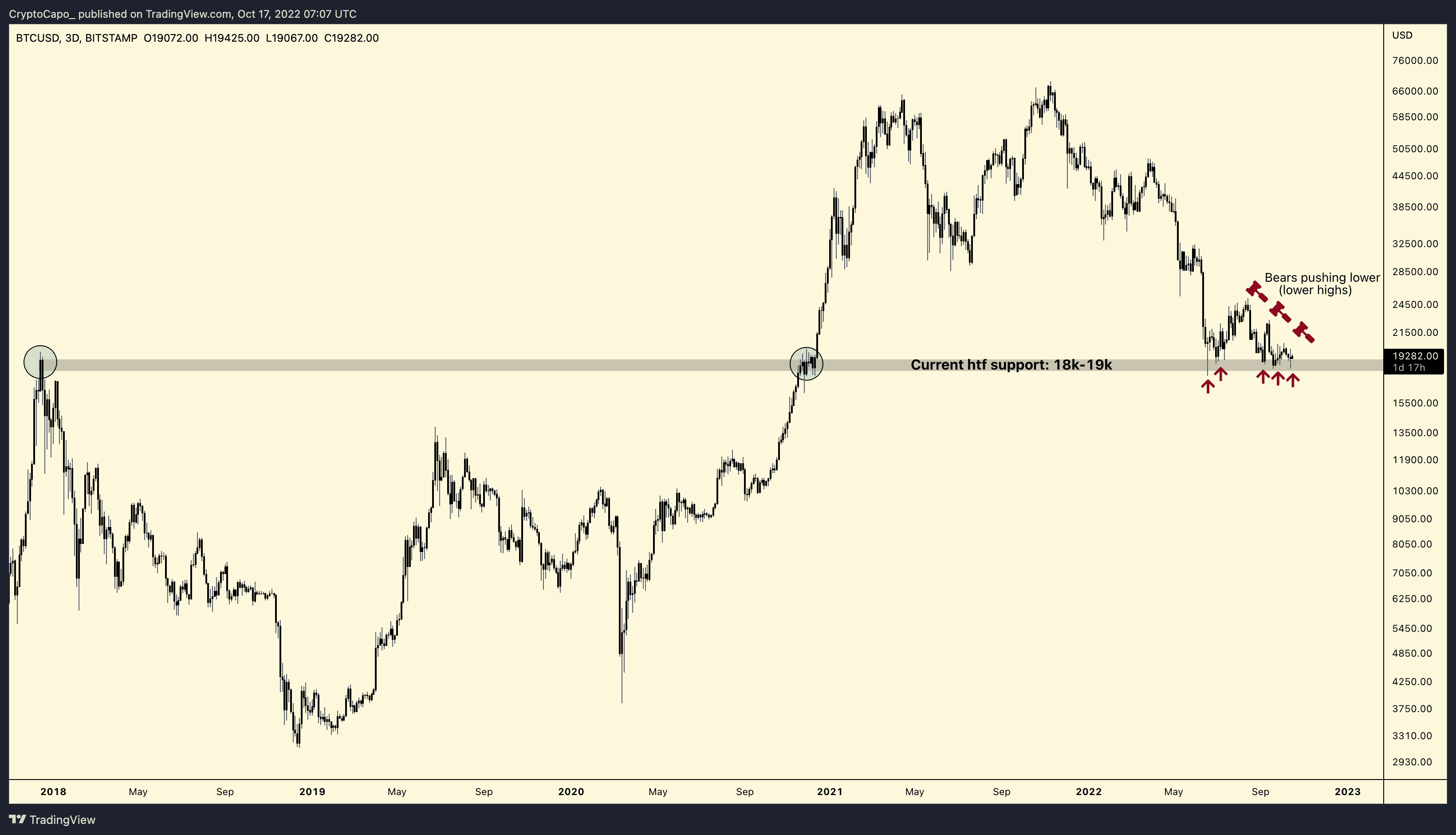

However, Capo adds that the broader trend is bearish. He further noted:

Current support level is 18k-19k. Price has been bouncing from this level several times. However, bounces are getting weak. This shows that the buying power from this level is weaker and that bears are pushing lower everytime. It should eventually break.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs