Bitcoin Whale Doubles Down on BTC, ETH, SOL Short Positions, $243M at Stake

Highlights

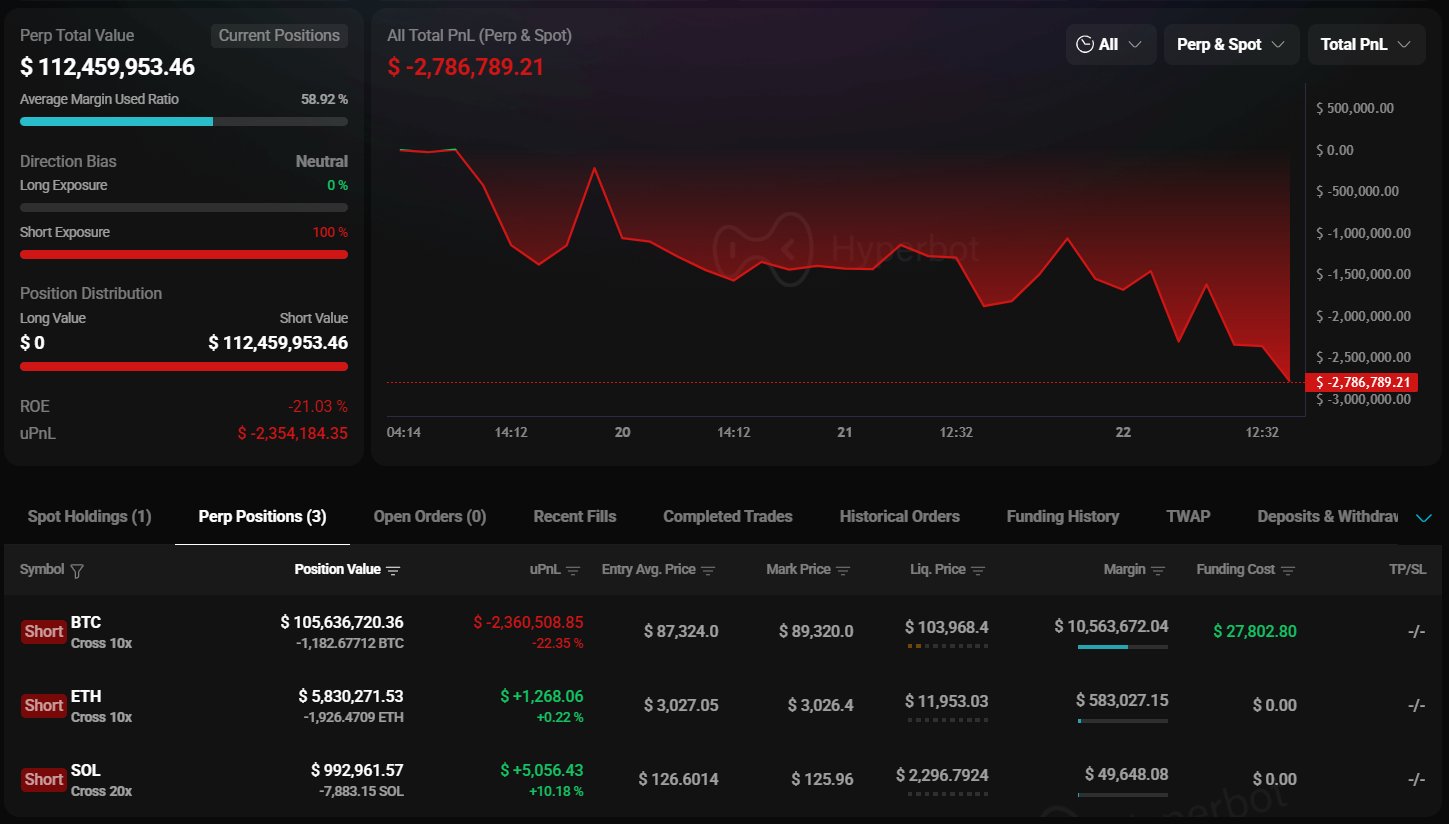

- A Bitcoin whale opened $243M worth of leveraged short positions across BTC, ETH, and SOL.

- Ethereum shorts are currently in unrealized profit, while Bitcoin and Solana trade near critical average entry levels.

- Any upside breakout could trigger significant losses or liquidation risks for the whale’s high-leverage positions.

A Bitcoin whale has made a bold move, betting big on short positions in BTC, ETH, and SOL. The whale sold 255 BTC, increasing their leveraged short positions to 1,899 BTC, 18,527.5298 ETH, and 151,209.08 SOL.

Notably, the Bitcoin investor’s huge move signals a bearish sentiment in the market. However, considering the unpredictable nature of the crypto market, the investor’s bet on a potential downturn puts their $243 million at risk.

Bitcoin Whale’s $243M Bet: Is the Crypto Market Heading for a Downturn?

In an X post earlier today, on-chain analytics platform Onchain Lens shared insights on a Bitcoin whale’s massive bet on BTC, ETH, and SOL short positions. According to on-chain data, the wallet, identified as 0x94d3, has slashed its BTC holdings, replacing them with sizable short positions in BTC, ETH, and SOL.

On Friday, the Bitcoin whale dumped 255 BTC for about $21.77 million at an average price of $85,378. With this move, the crypto investor bolstered bets against the mentioned tokens, indicating that the trader is less confident about the crypto market’s recent rebound from the crash. As per the shared data, the Bitcoin whale currently holds a total of $243 million in these assets- 1,899 Bitcoin ($168M), 18,527.5298 Ether ($56M), and 151,209.08 Solana ($19M).

It is significant to note that the move comes amid the growing investments in Bitcoin and Ethereum, amidst the recent market dip. As CoinGape reported, both individuals and institutions are largely investing in these cryptocurrencies, despite their bearish trends.

Is $243M at Risk?

The Bitcoin whale’s strong bearish conviction could face a significant setback if the cryptocurrencies’ prices move upward from the projected line. While the BTC price, at $87,175, is currently sitting close to the average short entry, upside momentum could bring huge losses for the investor. Experts like Peter Brandt have already projected the potential BTC price crash.

At the same time, Ethereum is currently trading at $2,954, and its average short entry is marked at $3,012. This indicates that the Bitcoin whale’s ETH position is currently at unrealized profits. However, if ETH continues to move higher, breaching the $3.02 mark, then the trader could face losses.

Interestingly, the Solana price is now much closer to the trader’s average short entry. While the whale opened the SOL position at $125.6, the token is currently trading at $124.4. This indicates that the position is in a precarious condition, where a loss or gain is uncertain.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- CLARITY Act: Banks, Crypto Yet To Agree On New Crypto Bill Draft As March 1 Deadline Looms

- Michael Saylor Predicts $50T From Bonds Could Flow Into Bitcoin Ecosystem as Digital Credit Evolves

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale