Bitcoin Whales Buy The Dips In This Correction, BTC Back Above $40,000

After facing strong selling pressure over the last weekend, Bitcoin is back above the $40,000 level once again. As of press time, Bitcoin is trading 4% up at a price of $40,536 and a market cap of $770 billion.

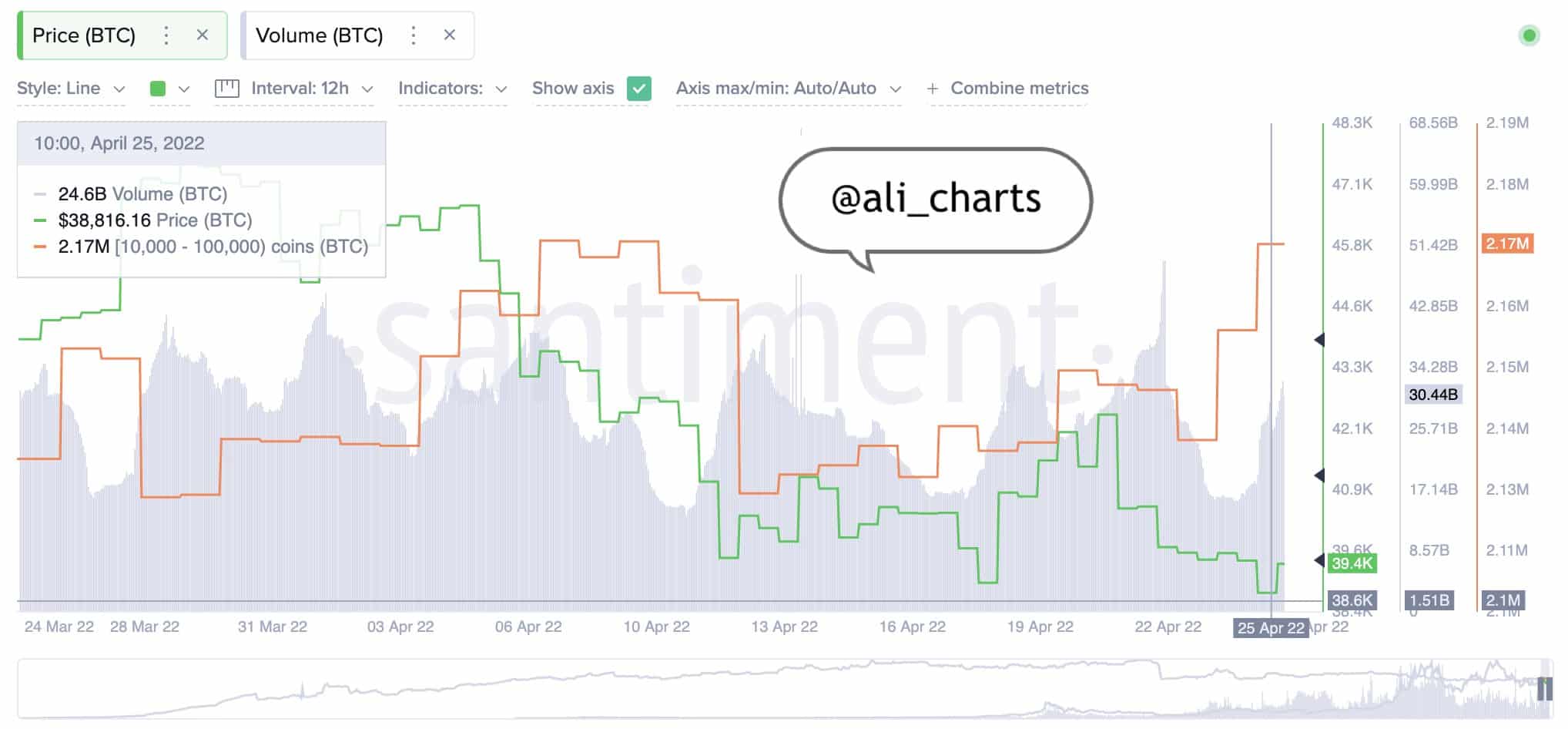

As the BTC price slipped under $39,000 late Sunday, it seems that whales turned active to buy the dips. citing data from on-chain platform Santiment, Ai Martinez reports:

Bitcoin whales took advantage of the recent downswing to buy 40,000 $BTC, worth $1.6 billion! Data from @santimentfeed shows that addresses with 10,000 to 100,000 BTC increased their holdings by nearly 2%, while prices dropped from $39,900 to $38,200.

On the other hand, it seems that the short-term BTC holders have been losing patience during the recent price consolidation. Data from IntoTheBlock shows:

Bitcoin short-term holders continue to decrease their positions. These traders – addresses holding <1 month, tend to follow the price action, and in many cases sell at a loss. The balance held by traders is at the lowest value since Jan 18, as they now hold 1.49m BTC.

What’s Ahead for Bitcoin?

Bitcoin has been showing major price movements in the range of $35,000-$45,000. Thus, this could turn out to be just another price jump and nothing decisively can be said at the moment.

However, we have some interesting developments lined up for Bitcoin investors ahead of this week. Australia is set to get its first spot-Bitcoin ETF this week on April 27 which will be listed on the CBOE equities trading exchange. Further as per market estimates, this could see net inflows of $1 billion and above.

Another positive trigger for Bitcoin could be that the illiquid BTC supply has been growing very fast. Citing data from Glassnode, analysts at Blockforce Capital report that a “massive” number of BTC coins have been moving off exchanges. This supply is going “offline” and into the cold storage. In a note, the analysts wrote:

“We have only seen this level of outflow from exchanges four previous times since the start of 2018. Three of those instances correlated with a sharp upward movement in price not too long after.”

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- CLARITY Act: Stablecoin Yield Debate Heats Up, but March 1 Deadline Not ‘Do or Die’

- Best Institutional Custody Solutions for Tokenized Assets in 2026

- Minnesota Considers Ban on Bitcoin and Crypto ATMs as Scam Reports Rise

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs