Bitcoin Whales Derivative Accumulation Surges, Here’s Why it Could Send BTC Over $50K

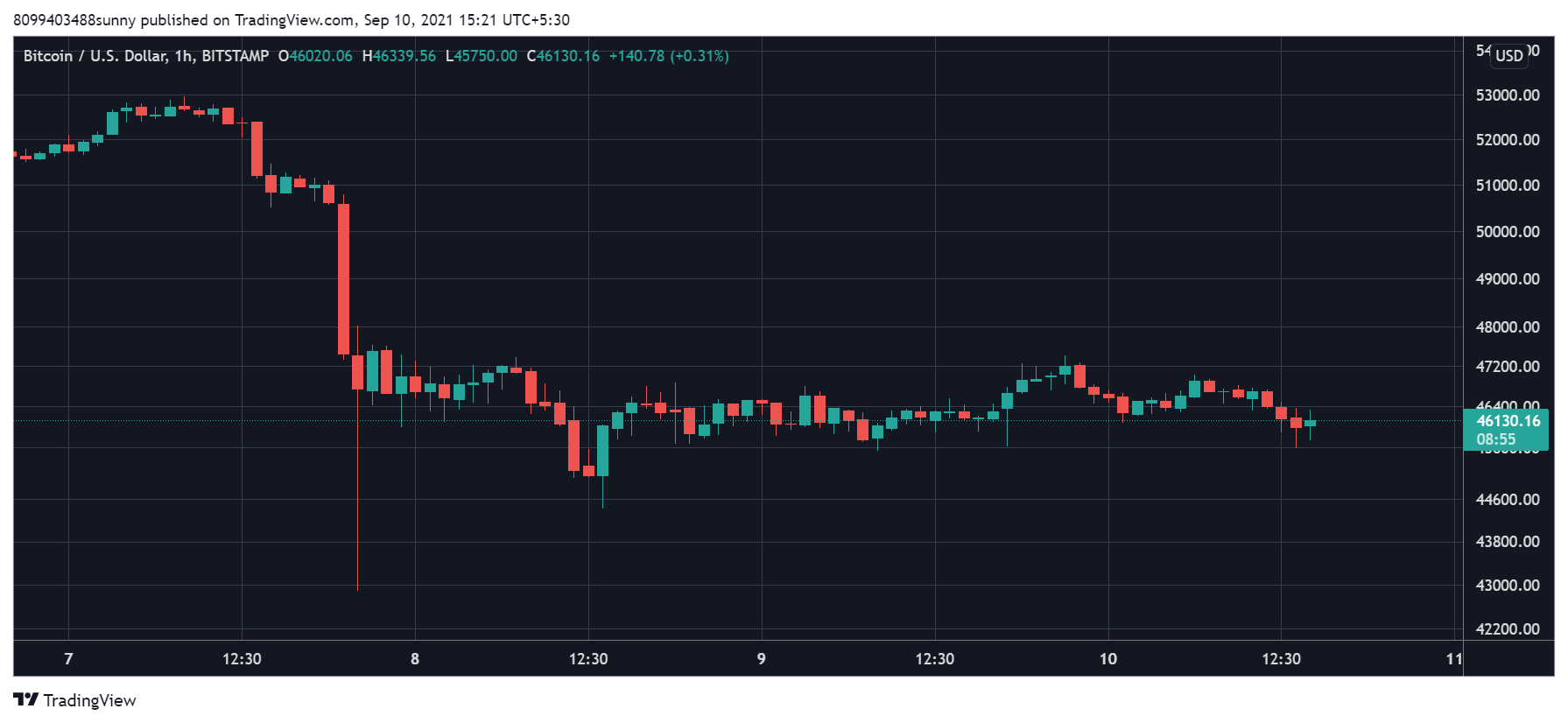

Bitcoin’s (BTC) price has moved sideways since the Tuesday flash crash that saw top cryptocurrency lose over 20% of its market value within an hour. The price fell from near $53K to sub $43K levels before recovering above $45K. The price volatility on Tuesday led to Bitcoin losing a strong on-chain support zone of $45K-$50K. The top cryptocurrency is currently trading at $46,153 and on-chain metrics indicate it might be gearing up for a next move up.

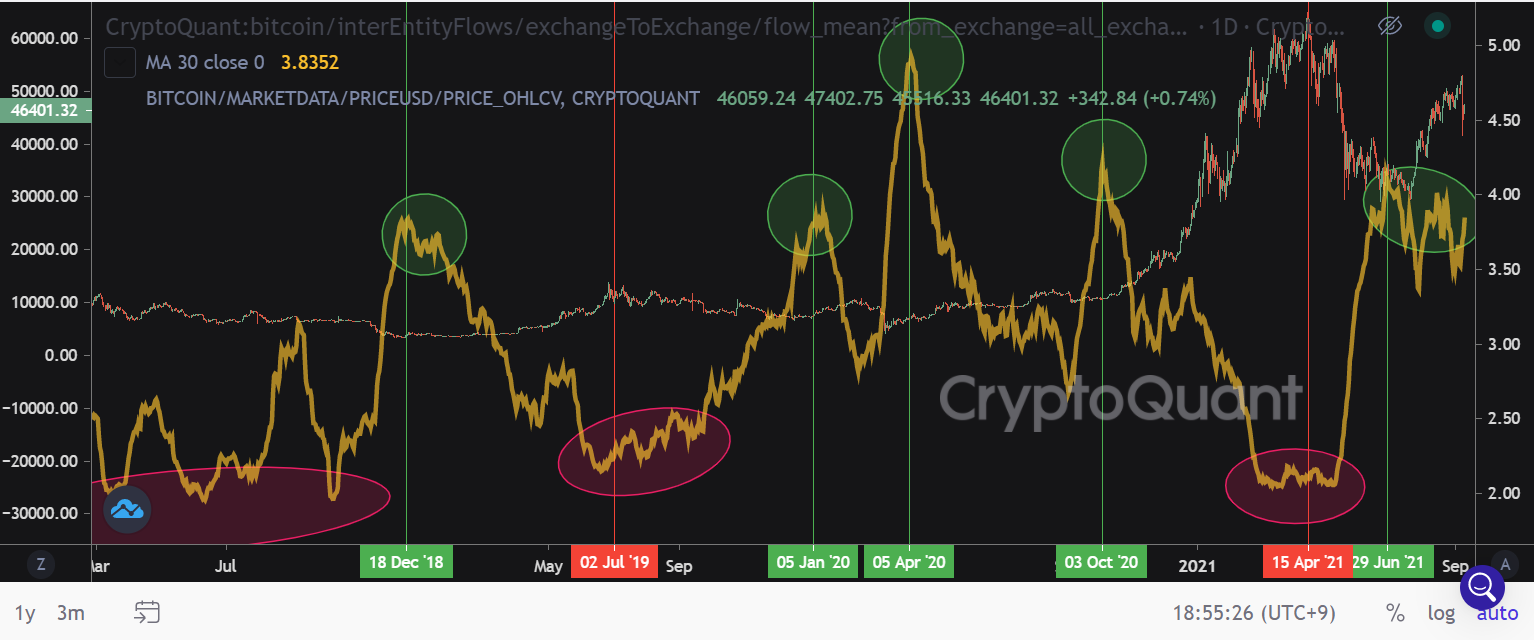

CryptoQuant CEO Ki-Young Ju pointed towards the growing whale activity on derivative platforms as they move their BTC holdings from cold storage and centralized exchanges to derivative exchanges. The move is believed to be for opening a new position or filling up margin gaps. Young pointed out that the majority of the new derivative positions are long which is a bullish sign.

Historical data indicates that the price of the top cryptocurrency goes higher in the wake of derivative accumulation by whales.

Whales are sending $BTC to derivative exchanges from other exchanges to punt new positions or fill up margins.

If you look at the historical data, the price goes up in the long term after their accumulation. Their positions seem to be long positions.https://t.co/O0imZE7DIv

— Ki Young Ju 주기영 (@ki_young_ju) September 10, 2021

Bitcoin Price Could Benefit From Sell-Side Liquidity Crisis

Bitcoin price is looking to regain its position above $50K again and derivative whale accumulation along with declining centralized exchange supply could help it push through the $50K barrier again. Bitcoin supply on exchanges is set to break the previous low creating a sell-side liquidity crisis.

FTX crypto exchange saw a massive 16,190 BTC being away from the platform yesterday, but many believe the large outflow could be a part of an internal transfer. However, irrespective of it being an internal transfer, the BTC supply on centralized exchanges continues to decline.

According to CryptoQuant, 7 hours ago, FTX had a large outflow of Bitcoin, the outflow amount was about 16,190 BTC, and the current Bitcoin balance on the FTX was about 33,200 BTC. (Such a huge outflow may be due to internal wallet sorting) pic.twitter.com/6OVBfYaOXy

— Wu Blockchain (@WuBlockchain) September 10, 2021

Bitcoin was looking set to test $55K resistance before the market experienced a flash crash reminding everyone about the infamous bearish September. The top cryptocurrency solidified its position above $50K in the first week of the month making many believe that this September could reverse the historical trend. However, the flash crash on Tuesday reminded back everyone about the historic trend. The on-chain metrics are building a bullish momentum again for the top cryptocurrency.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs