Bitcoin’s (BTC) Correlation With S&P 500 Turns Negative for the First Time In 2021

Bitcoin (BTC) continues to show volatility while trading in a closed range between $30,000-$35,000. At press time, Bitcoin is down 3.88% trading at $33,142 with a market cap of $620 billion.

As BTC continues to trade under pressure, it has now entered into a negative correlation with the S&P 500 (INDEXSP: .INX) index. As a result, there’s a sharp divergence between the world’s largest cryptocurrency and the largest equity index.

This is for the first time in 2021 that BTC’s correlation has turned negative. For the initial six months of 2021, Bitcoin and the S&P 500 were loosely correlated as both continued their northward journey by hitting new all-time highs for a few weeks, reports Kaiko.

However, BTC has corrected more than 45% in the last two months while the S&P 500 continues to surge. On Monday, the S&P 500 surged further making a record close at 4384 levels. On a year-to-date basis, the S&P 500 has given a solid 18.48% return.

Bitcoin’s correlation with Gold also remains negative, however, it has jumped 20% over the last month.

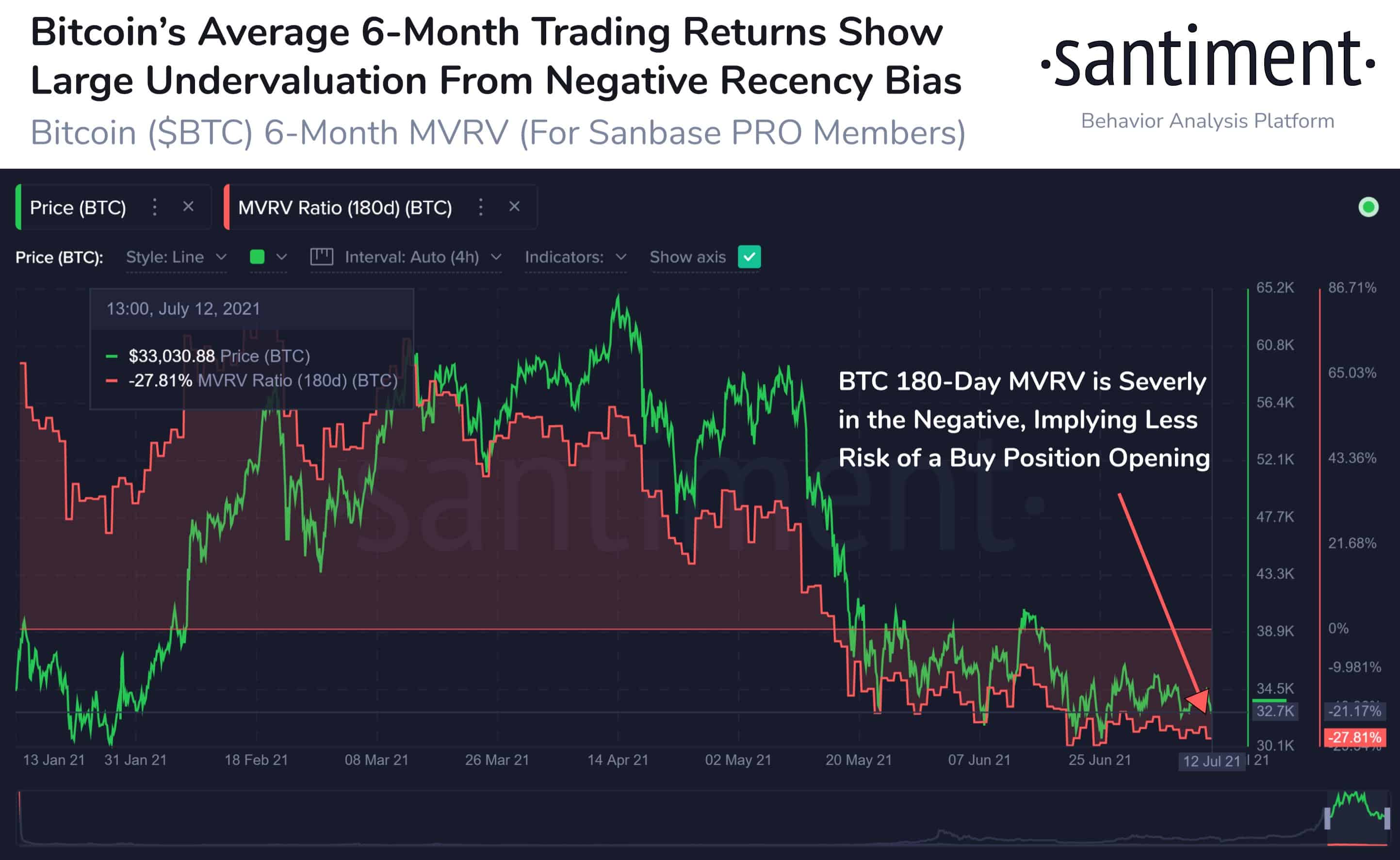

Bitcoin’s 6-Month Average Return Turns Negative

As per on-chain data provider Santiment, Bitcoin’s average 6-month trading returns have turned negative. With BTC repeatedly moving towards lower lows, the investor confidence is low and FUD is higher.

Santiment notes that based on historical trends, this is the right moment to make the move for long-term investors by keeping their negative bias aside. As per the on-chain data provider, Bitcoin looks undervalued at this price point.

On the other hand, Bitcoin’s mining hash rate has been showing strong bounceback moving back above 100 exahashes/second. This is a healthy sign and suggests that miners are getting back on track after a major crackdown by China last month.

Bitcoin (BTC) needs to convincingly break the $35,000 resistance and sustain there if it has to start the next leg of the bull run.

- CLARITY Act: Banks and Crypto Make Progress Following “Constructive” Dialogue at White House Meeting

- Expert Warns Bitcoin Bear Market Just In ‘Phase 1’ as Glassnode Flags BTC Demand Exhaustion

- SEC Chair Reveals Regulatory Roadmap for Crypto Securities Amid Wait for CLARITY Act

- ProShares Launches First GENIUS Act Focused Money Market ETF, Targeting Ripple, Tether, Circle

- BTC Price Falls as Initial Jobless Claims Come In Below Expectations

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?