Bitcoin’s (BTC) Massive Ascending Channel Signals A Break to the Upside

Over the last week, the world’s largest cryptocurrency has been consolidating under $50,000 levels. On a weekly chart, BTC has lost 4.67%. As per data on CoinMarketCap, BTC is currently trading 0.5% down at $48,003 and a market cap of $901 billion.

However, if we look at the one-decade long-term chart of Bitcoin, the world’s largest cryptocurrency has formed an ascending channel and is poised to give a break to the upside, notes popular crypto analyst Will Clemente.

Friendly reminder that Bitcoin is in one massive ascending channel that will likely break to the upside. pic.twitter.com/P9kcwKW1Aw

— Will Clemente (@WClementeIII) August 29, 2021

Bitcoin has continued to remain volatile over the last few months. As Bitcoin continues to show sideways movement in the last 10 days, it is trading in an interesting range of $46K to $50K.

The $46,000 level remains a strong 200 DMA for the crypto. On the other hand, there’s stiff resistance at $50,000. It will be interesting to see where does BTC gives its breakout first.

#bitcoin is in a very interesting place right now sandwiched between resistance at 50K and the 200 day MA at 46K.

Squeezy squeezy pic.twitter.com/VyYrchN2IJ

— Lark Davis (@TheCryptoLark) August 30, 2021

Is Bitcoin Preparing for September Correction?

Crypto analyst Lark Davis shares some interesting insights for the month coming ahead. Historically, September has been a month of corrections and consolidation for Bitcoin and the overall crypto market.

As mentioned in his above tweet, Bitcoin is facing strong resistance at $50,000. Thus, closing above it consistently for a few days can get it prepared for its run-up to $100,000 and more. Any strong breakout above $50,000 will set Bitcoin for a mega bull trend.

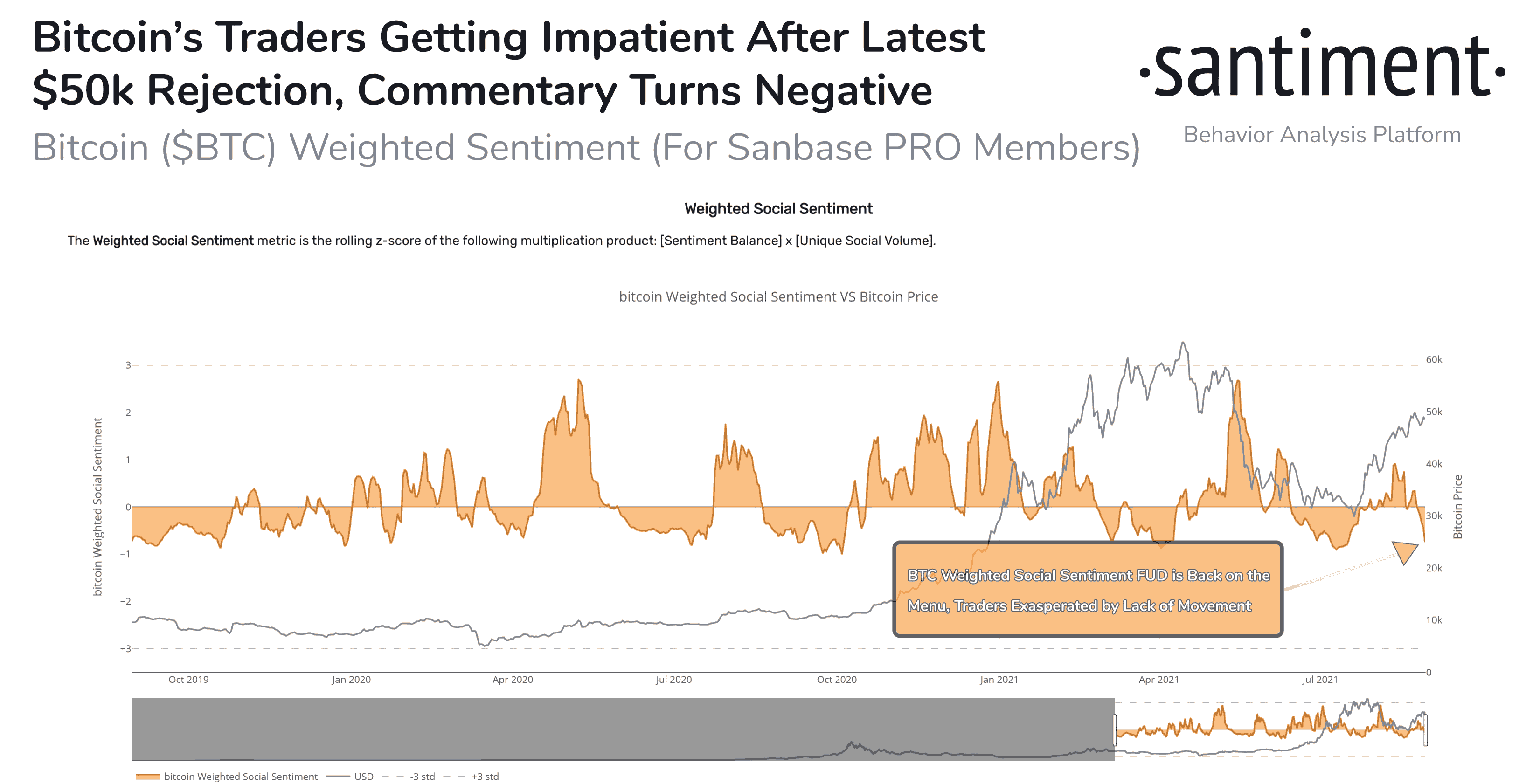

On this flip side, any breakdown under the 200 DMA will signal further pressure and downside in the price. With the recent rejections to $50K, Bitcoin traders have turned impatient, reports on-chain data provider Santiment.

“Now six days since Bitcoin crossing over (and then crossing back) $50k, traders appear to have gotten restless with the lack of return back to this coveted psychological price. Commentary has turned negative again, which is a solid recipe for a bounce,” reports Santiment.

Bitcoin is trading at an exact equal distance between its support and resistance. It will be interesting to see in which direction Bitcoin moves first.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs