Bitcoin’s Lightning Network Is the Answer to DeFi’s Fragile Market Says Michael Saylor

The decentralized finance (DeFi) market has never been in a bad state than now with two big protocols – Terra and Celcius – facing major crises within a month’s time. Some analysts told Bloomberg that there are some major existential issues within the DeFi space.

Mahin Gupta, founder of Liminal, a digital-asset custody platform said: “What is happening with Celsius will have serious repercussions for the industry. It’s a not-insignificant player, and its apparent failure will have ripple effects.”

The recent fragility in the DeFi space is a reminder outsized yields could be sometime too good to be true. However, Bitcoin maximalist Michael Saylor believes that Bitcoin can come to the rescue of the DeFi market. Responding to the Bloomberg article on Tuesday, Saylor wrote:

“The sound ethical, economic & technical foundation for DeFi is Bitcoin. The next generation of DeFi will be built using the #Lightning protocol and the BTC token”.

As such, the MicroStrategy CEO has been quite bullish about Lightning Network, Bitcoin’s Layer 2 scalability solution. Saylor believes that Bitcoin is the future of money and the Lightning protocol will help to scale transactions more efficiently. He said:

“If you’re going to do payments and transactions high speed, you’re going to need a base layer that’s ethically sound, economically sound, and technically sound. That’s what Bitcoin is. But then billions and billions of transactions are going to go on a layer 2 like Lightning.”

Bitcoin Could Be Cheaper Than It Looks

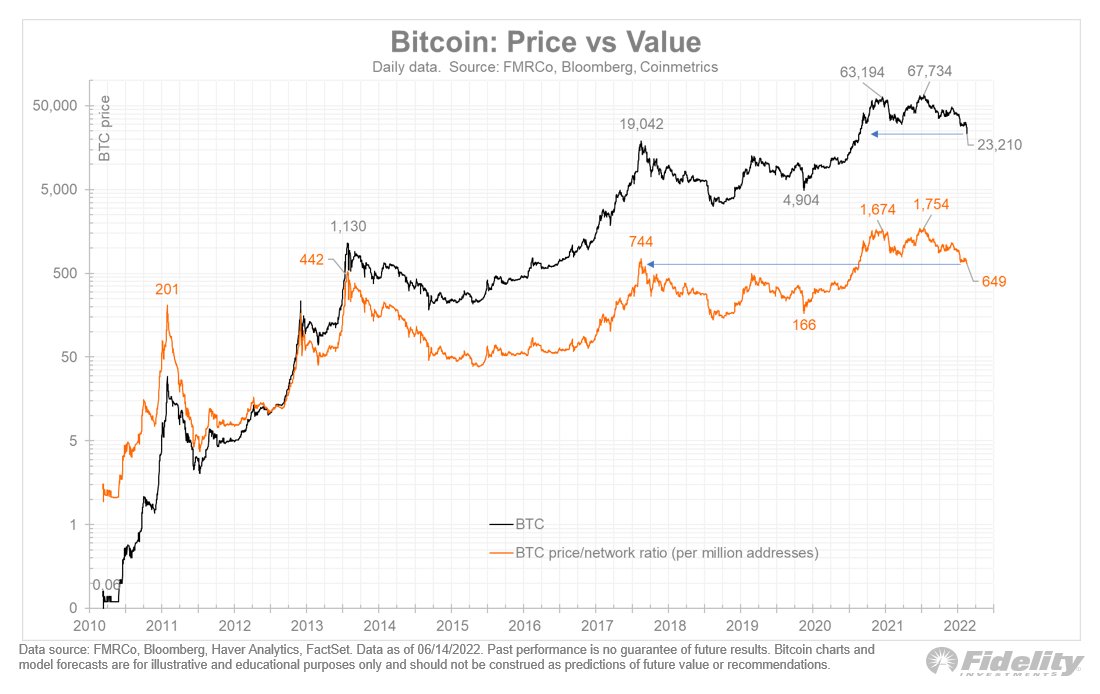

Jurrien Timmer, head of Global Macro at Fidelity wrote that Bitcoin could be cheaper than it looks. He adds:

If we consider a simple “P/E” metric for BTC to be the price/network ratio, then that ratio is back to 2017 and 2013 levels, even though BTC itself is only back to late 2020 levels. Valuation often is more important than price.

Just as CoinGape reported, Bitcoin’s retail accumulation has continued despite this price correction.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Gold ETF vs Tokenized Gold: Who Could Outperform in 2026?

- Crypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik’s ETH Selloffs, Regulatory Progress Feb 23-27

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Crypto Market Crashes as U.S.-Iran Tensions Escalate With Airstrikes

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs