BitGo To Follow Gemini’s Footsteps With US IPO After 4x Revenue Surge

Highlights

- Crypto custodian BitGo manages over $90.3 billion in assets across 1,400 digital assets for 4,600 clients.

- The IPO will be led by Goldman Sachs and Citigroup with the company yet to disclose total shares under offering.

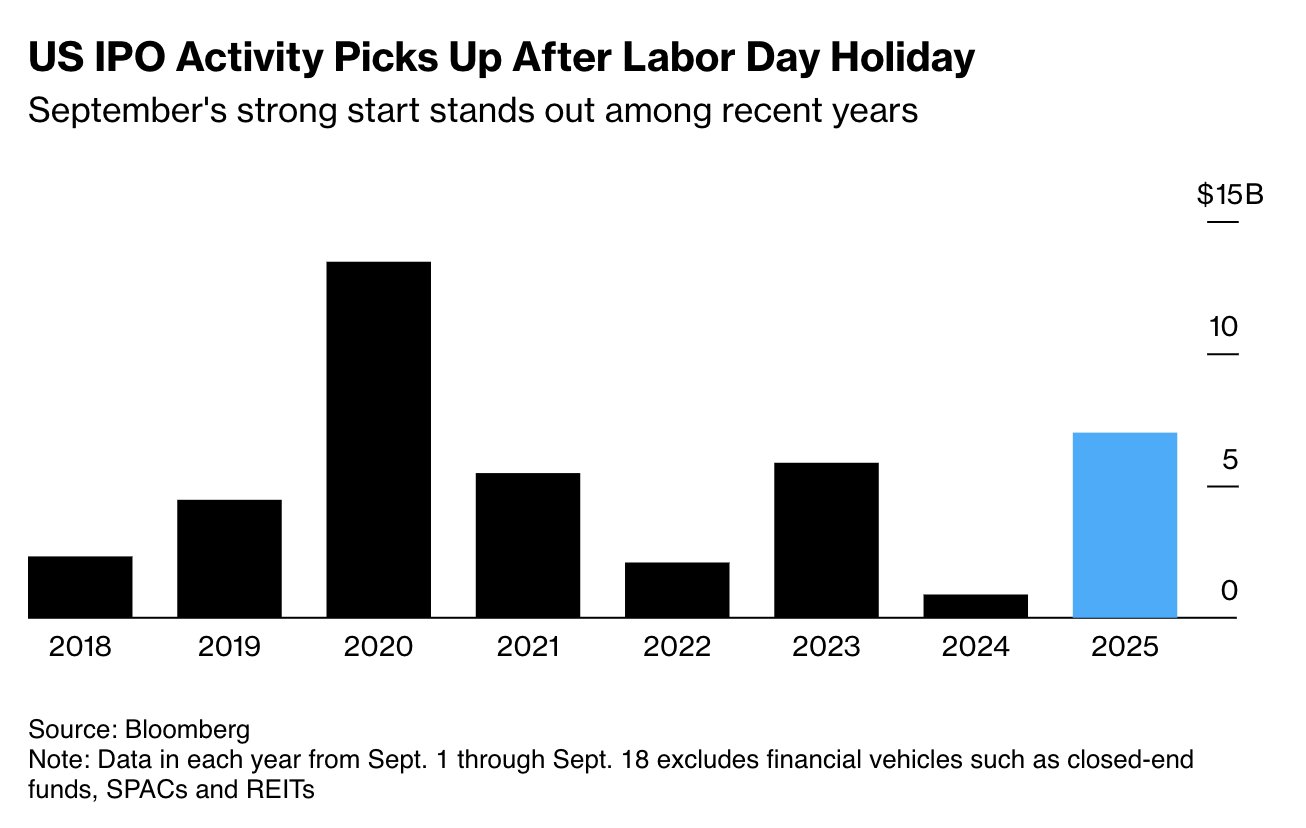

- The U.S. IPO market is seeing its strongest momentum since 2020, with 14 deals in September raising $7 billion.

Crypto custodian BitGo is now planning for a US IPO following the footsteps of crypto exchange Gemini, while reporting a 4x revenue growth in the first half of 2025. This comes as the US IPO market remains red hot for 2025, with Fed rate cuts likely to bring additional liquidity push. The crypto custodian submitted an S-1 registration to the U.S. Securities and Exchange Commission (SEC) on September 19, while reporting $3 billion in revenue for 2024.

BitGo Clocks 4X Revenue Growth in H1 2025

As per the filing shared with the U.S. Securities and Exchange Commission (SEC) on September 19, the crypto custody firm reported net income of $12.6 million on revenue of $4.19 billion for the first half of the year 2025. This compares with net income of $30.9 million on revenue of $1.12 billion during the same period last year in 2024.

The development comes following the successful debut of crypto exchange Gemini on Nasdaq, earlier this week. Besides, the latest filing shows that BitGo plans to list its Class A Common stock on the New York Stock Exchange (NYSE) under the ticker BTGO. Banking giants Goldman Sachs and Citigroup will lead the offering.

According to the filing, BitGo co-founder and CEO Michael Belshe will retain the authority to determine the outcome of matters requiring shareholder approval. The California-based crypto custodian firm disclosed in July that it had confidentially filed for a US IPO, along with digital asset manager Grayscale.

As of now, BitGo caters to more than 4,600 clients and over 1.1 million users, while supporting over 1,400 digital assets. By the end of June 2025, the custodian had over $90.3 billion in assets on the platform.

US IPO Market Is Red Hot

In their recent report, Bloomberg noted that the latest Fed rate cut this week is setting the stage for an active U.S. IPO calendar. Companies across technology and services, and even the crypto space, are now preparing for fall listings. October is expected to be particularly busy, as 14 offerings this month have already raised $7 billion, the highest monthly total since 2020.

Within the crypto space, the Circle Internet Group Inc. (NASDAQ: CRCL) stood out as the most successful IPO, soaring 365% above its IPO price after a $1.2 billion offering in June. More recent debuts have been less stable, with Gemini Space Station Inc., led by the Winklevoss twins, falling 14% since raising $446 million in its IPO.

Just two days before, BitGo Europe secured regulatory approval from Germany’s financial authority, BaFin, to expand into regulated cryptocurrency trading. The move allows institutional clients across the European Union to access both over-the-counter (OTC) and electronic crypto trading services through the platform.

- Robert Kiyosaki Reveals Why He Bought Bitcoin at $67K?

- XRP News: Ripple Partner SBI Reveals On-Chain Bonds That Pay Investors in XRP

- BitMine Ethereum Purchase: Tom Lee Doubles Down on ETH With $34.7M Fresh Buy

- BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?