Breaking: Bitwise Files S-1 For SUI ETF With U.S. SEC

Highlights

- Bitwise has filed a registration statement with the SEC to offer a SUI ETF.

- The crypto ETF issuer plans to offer staking for the fund.

- Coinbase is listed as the fund's custodian.

Crypto ETF issuer Bitwise is looking to add a SUI ETF to its growing list of crypto funds. The crypto asset manager has filed an S- 1 with the U.S. Securities and Exchange Commission (SEC) to offer this fund, which will provide 100% spot exposure to the altcoin.

Bitwise Files With SEC To Offer SUI ETF

A SEC filing shows that the crypto asset manager has filed a Form S-1 with the SEC to offer a fund that provides exposure to SUI, the native token of the Sui network. Bitwise becomes the fourth asset manager to file to offer this spot fund, joining Grayscale, 21Shares, and Canary Capital.

Grayscale filed the Form S-1 for its SUI ETF earlier this month, while 21Shares and Canary had filed to offer this fund earlier in the year. SUI could become the sixth crypto asset that Bitwise offers 100% exposure to, as the asset manager already offers spot BTC, ETH, SOL, XRP, and DOGE ETFs.

Meanwhile, it is worth mentioning that Bitwise’s crypto index fund already provides institutional investors with Sui exposure, although the fund also holds other crypto assets. According to the filing, the top crypto exchange, Coinbase, will be the fund’s custodian.

Furthermore, Bitwise plans to offer staking for the SUI ETF, generating additional tokens in the process. The asset manager will offer in-kind creations and redemptions for the fund, enabling the firm to directly transact with the token instead of using cash. Bitwise didn’t reveal the ticker for the fund or what exchange it will list on.

Notably, this filing comes just weeks after the SEC approved the 2x leveraged SUI ETF, offered by 21Shares. 21Shares could also be the first to launch the first spot SUI fund, as it has already amended its filing to include key details.

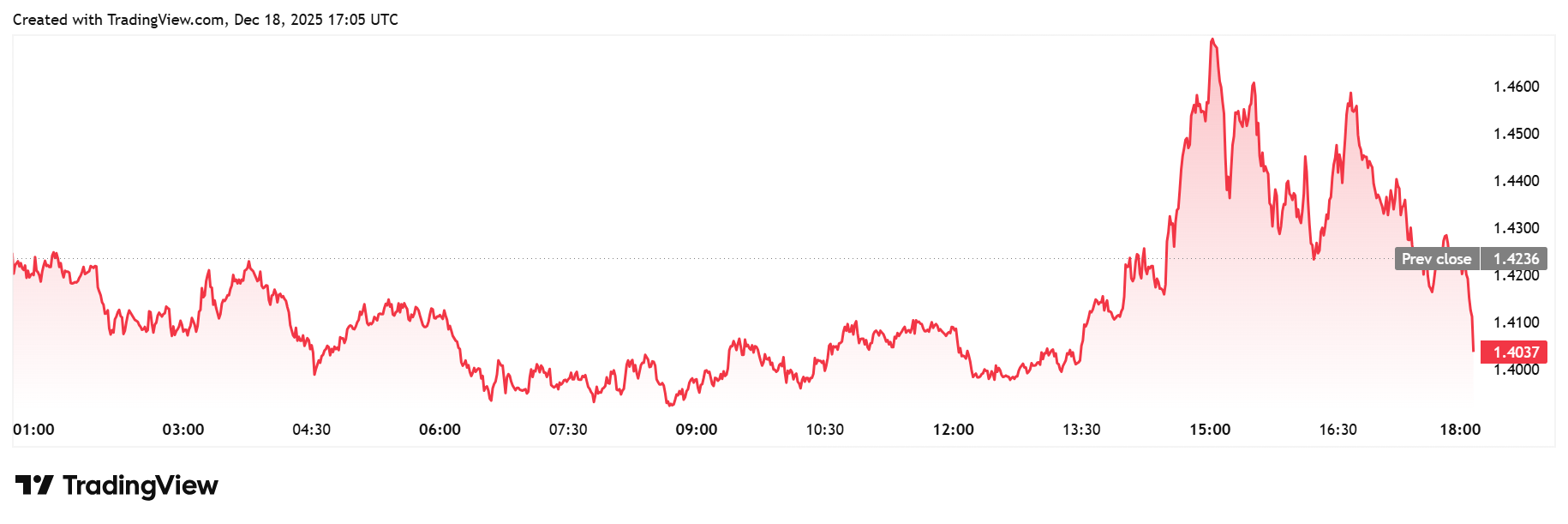

The SUI price remained largely unchanged amid the Bitwise filing. TradingView data shows that the altcoin is currently trading at around $1.4, down in the last 24 hours. SUI is also down over 12% in the last week.

- Breaking: U.S. PCE Inflation Rises To 2.9% YoY, Bitcoin Falls

- BlackRock Signals $270M Bitcoin, Ethereum Sell-Off as $2.4B in Crypto Options Expire

- XRP News: Dubai Tokenized Properties Trading Goes Live on XRPL as Ctrl Alt Advances Project

- Aave Crosses $1B in RWAs as Capital Rotates From DeFi to Tokenized Assets

- Will Bitcoin, ETH, XRP, Solana Rebound to Max Pain Price amid Short Liquidations Today?

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans