Breaking: Bitwise Solana Staking ETF (BSOL) Records First Outflow as Institutions Panic

Highlights

- Bitwise Solana Staking ETF saw first outflow of $4.6 million since its debut.

- Investors panic amid the crypto market crash ahead of BOJ rate hike.

- SOL price tumbles more than 6% to $124 lows on Tuesday.

Bitwise Solana Staking ETF records its first outflow since its launch amid extreme fear sentiment in the broader crypto market. Daily trading volume on BSOL hits a new low as institutions panic over potential crash. SOL price tumbles more than 6% to $124 lows on Tuesday.

Bitwise Solana Staking ETF (BSOL) Breaks Inflow Streak

Bitwise Solana Staking ETF saw $4.6 million in outflow, according to Farside Investors data on December 16. This marks the first-ever outflow from the leading fund offering 100% direct exposure to SOL with built-in staking rewards.

BSOL sold almost 36.86k SOL, recording its lowest daily trading volume. It indicates negative sentiment among investors, marking a notable shift amid the latest crypto market crash.

Bitwise Solana ETF, offering 100% direct exposure to SOL with built-in staking rewards, has maintained strong institutional interest since its launch in late October despite extreme fear sentiment in the crypto market.

However, the latest outflow signals panic among institutional investors ahead of a potential rate hike by the Bank of Japan (BOJ) later this week. Also, experts believe there will be a potential decline in trading volumes in the coming days due to the holiday season.

Meanwhile, net inflows into spot Solana ETFs were $35.20 million. Fidelity Solana ETF (FSOL) saw $38.7 million in inflows on Monday. This was the largest inflow to date in the FSOL. Other SOL ETFs saw minimal inflows.

SOL Price Tanks amid Bearish Sentiment

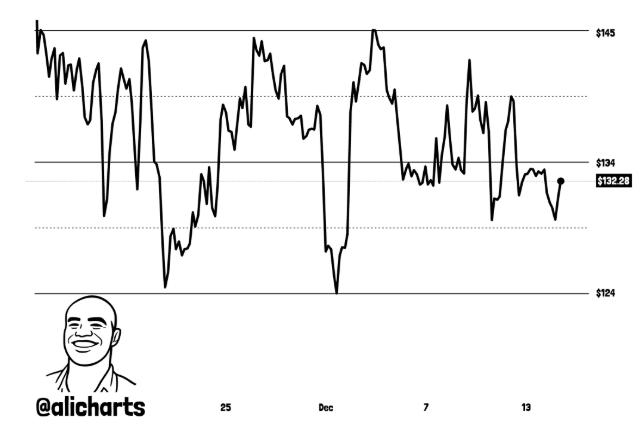

SOL price fell by more than 6% over the past 24 hours, currently trading around $126. The 24-hour low and high are $124 and $134.72, respectively.

Furthermore, trading volume has increased by 73% over the last 24 hours. The rise comes as traders buy the dip amid news that CME’s spot-quoted Solana futures launch.

Moreover, Ondo Finance announces expansion to the Solana network in early 2026, bringing tokenized stocks, bonds, and ETFs to the blockchain.

CoinGlass data also shows massive selling in the derivatives market amid outflow from Bitwise Solana ETF. At the time of writing, the total SOL futures open interest dropped almost 2% to $7.09 billion in the last 4 hours.

Crypto analyst Ali Martinez pointed out that Solana is stuck between $145 and $124. Further pullback could trigger massive liquidations.

The 24-hour futures open interest dropped by more than 4%, with declines of 4% and 0.90% on CME and Binance, respectively. This signals negative sentiment among derivatives traders amid a broader pullback in the crypto market.

- Crypto Attack of the Century? Solana Network Resists Historic DDoS With Zero Downtime

- Shiba Inu News: SHIB Scores Major Win With U.S. Regulated Derivatives Launch

- Strategy’s mNAV Slips to Lowest Ever as MSTR Stock Falls 8%, Will Michael Saylor Sell Bitcoin?

- U.S. Senate Hits the Pause Button on Crypto Market Structure Bill, Why the Delay Again?

- Why is the Crypto Market Down Today? BTC, ETH, XRP Lead Drop

- Here’s How Dogecoin Price Could Rise After Crossing $0.20

- Is XRP Price Headed for $1.5 as Whales Dump 1.18B XRP in Just Four Weeks?

- Bitcoin Price Weekly Forecast as Gold’s Surge Revives Inverse Correlation — Is $85K Next?

- Ethereum Price Risks $2,600 Drop Despite JPMorgan’s New Fund on its Network

- Analyst Confirm Pi Network Price Could Still Reach $1, Here’s When?

- Is Ethereum Price Set for a Rebound as a Prominent Whale Accumulates $119M After the Dip?