BlackRock Buys $65M in Bitcoin as U.S. Crypto Bill Odds Passage Surge

Highlights

- BlackRock bought $64.5 million worth of Bitcoin, rebounding from outflows from its IBIT ETF.

- The purchase came after BlackRock transferred some BTC to Coinbase earlier in the day, fueling sell-off speculation.

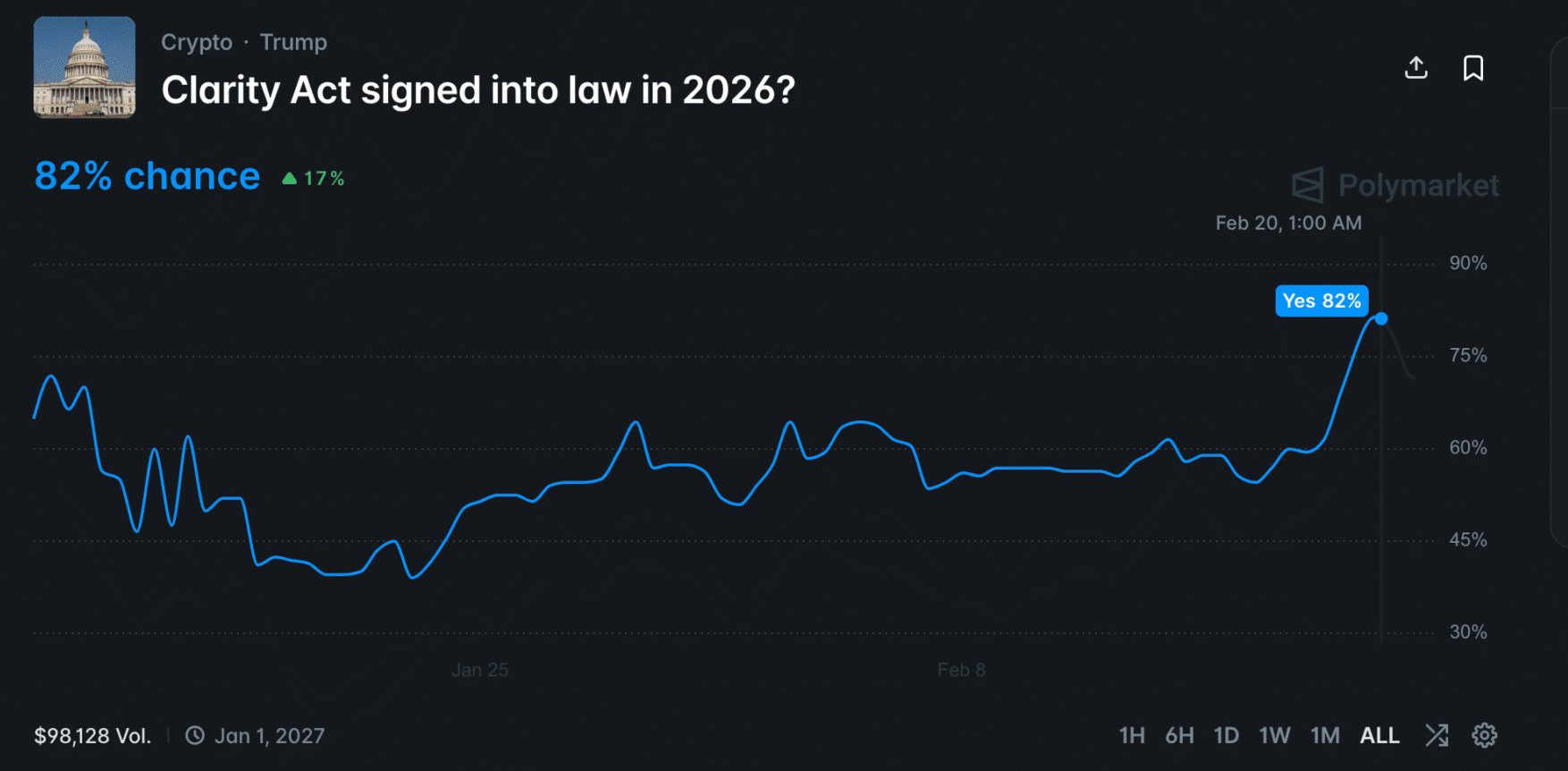

- Optimism around the CLARITY Act grew as Polymarket odds surged on signs of policy progress.

The world’s largest Asset manager, BlackRock, has increased its exposure in Bitcoin with a new purchase. This comes after the odds of the crypto bill’s passage began to spike.

BlackRock Purchases More Bitcoin Despite Market Downturn

Data from SoSovalue showed that the billion-dollar asset manager bought in $64.5 million worth of the BTC token. This especially comes after three days of consistent sell-off in its IBIT fund.

BREAKING:

🇺🇸 BlackRock has bought $64,500,000 worth of Bitcoin. pic.twitter.com/5Sdz3ryzOT

— Ash Crypto (@AshCrypto) February 21, 2026

The move comes hours after BlackRock deposited 2,563 BTC, valued at $173 million, and 49,852 ETH, valued at $97 million, into Coinbase. This was seen as the company possibly looking to sell these coins. It comes, especially given the trend of outflows from the previous days.

This purchase was made in the midst of a few macroeconomic events that saw the BTC price moving sideways. For instance, as reported by CoinGape yesterday, the U.S. PCE inflation numbers came out higher than expected, indicating that inflation could be on the rise again. Bitcoin, in particular, dropped in response to this piece of news as Blackrock and other asset managers started trading.

Then, the Supreme Court ruled that the Trump tariffs were illegal because the U.S. president did not have the authority to impose them using the IEEPA. The price of BTC then began to pump.

Trump then replied by imposing his tariffs, which caused the price to stabilize. This did not, however, stop BlackRock from expanding its holdings of the cryptocurrency.

Crypto Bill Nears Approval as Odds Spike

The CLARITY Act is set to become law as the signals from the policymakers are looking promising. The data from Polymarket has also reflected this change in sentiment as the odds continue to spike.

Eleanor Terrett reported that Trump’s crypto advisor Patrick Witt recommended a plan that was previously suggested and abandoned. This would enable third-party providers to reward customers with prizes of stablecoin based on transactions and activity, as opposed to balances. If this is approved, then the market could see more institutional money from the likes of BlackRock.

“Earning yield on idle balances, a key crypto industry goal, is effectively off the table,” she said. “The debate has narrowed to whether firms can offer rewards linked to certain activities.”

It was reported that the Banks are having meetings regarding their position on the new proposal of the White House. Coinbase CEO Brian Armstrong also recently shared in an interview that the Banks have been trying to sabotage the progress of the crypto bill because of selfish intentions.

- Tom Lee’s Bitmine Doubles Down on Ethereum With $34.7M Fresh Purchase

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?