BlackRock Dumps Ethereum, Buys $366M in Bitcoin

Highlights

- BlackRock sells Ethereum, reallocates $366M into Bitcoin.

- Data from Arkham and SoSoValue confirm institutional shift from Ethereum exposure to Bitcoin.

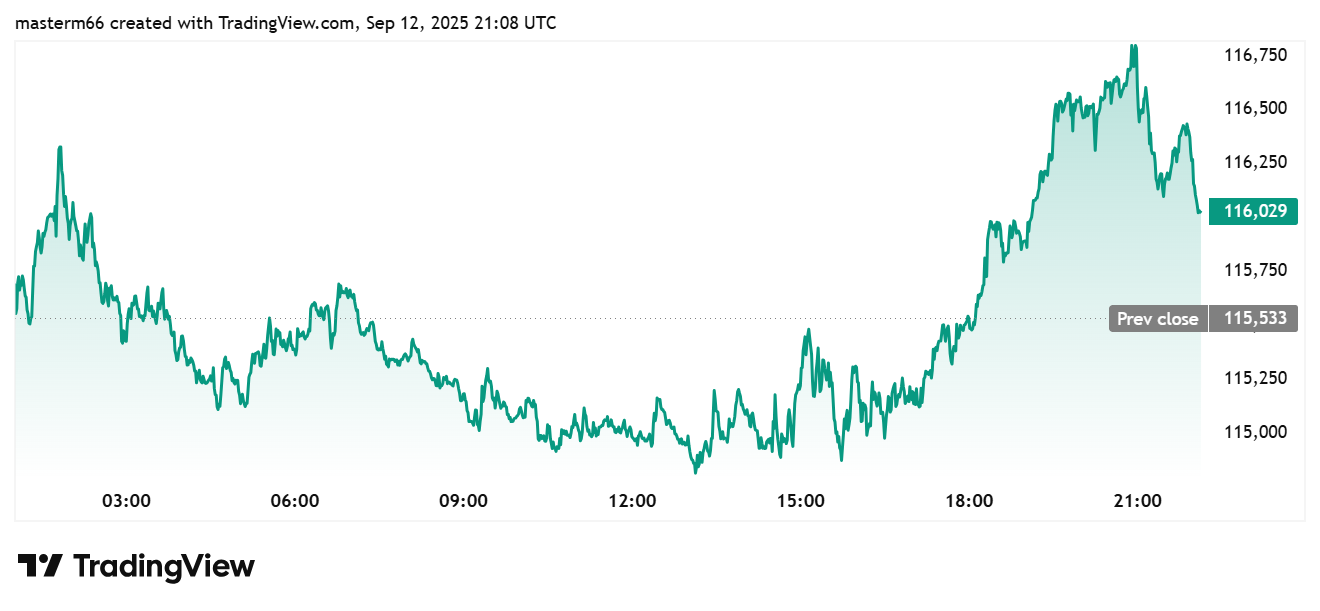

- Bitcoin rises 0.54% to $116,162 as Ethereum shows stronger short-term gains.

BlackRock is moving capital between top digital assets, selling Ethereum while purchasing a significant amount of Bitcoin. The scale of the Bitcoin purchase stood out across the ETF landscape.

BlackRock’s ETF Flows Signal Clear Institutional Rotation From Ethereum to Bitcoin

Arkham Intelligence data and SoSoValue statistics flows revealed that BlackRock’s iShares Bitcoin Trust (IBIT) recorded net inflows of $366.2 million. At the same time, its iShares Ethereum Trust (ETHA) posted net outflows of $17.39 million.

BLACKROCK IS SELLING $ETH

BUT THEY JUST BOUGHT $366M OF $BTC pic.twitter.com/1taEJ7qGOU

— Arkham (@arkham) September 12, 2025

Fidelity’s FBTC followed with $134.71 million in inflows, while Bitwise’s BITB attracted $40.43 million. Other funds recorded modest additions. By comparison, BlackRock’s Ethereum vehicle was the only major product posting heavy withdrawals. This move is similar to a previous transaction where BlackRock sold ETH and bought BTC. This indicates a shift in institutional exposure from ETH to BTC.

It is also worth mentioning that BlackRock is reportedly preparing to tokenize ETFs on blockchain. The firm is building on the success of its Bitcoin ETF and expanding its presence in the crypto space.

The flows were confirmed by the on-chain mapping tool of Arkham, which revealed how BlackRock wallets scaling down ETH positions and scaling up in Bitcoin holdings. This demonstrates that Bitcoin remains the most desired reserve asset amongst institutions.

The flow highlights the changes in exposure by asset managers to the leading cryptocurrency. The IBIT net inflows chart indexed everyday showed a consistent interest in Bitcoin.

Institutional Flows Cause Diverging Patterns in Bitcoin and Ethereum Prices

This development also shows BlackRock as a major market mover. The largest investment manager has had a consistent impact on the institutional sentiment with its allocations. BlackRock continues to show a cautious but clear preference for the leading cryptocurrency by cutting Ethereum exposure and scaling Bitcoin purchases.

The flows from BlackRock BTC and ETH ETFs also match broader crypto market dynamics. Market performance on September 12 reflected these ETF flows. Bitcoin price traded at $116,162, up 0.54% in 24 hours. The weekly price performance shows gains of up to 4.95% and its year-to-date figure has been up at 24.41%. In the last one year, Bitcoin has risen by over 102%, which strengthens the effectiveness of this asset as an inflation hedge.

Ethereum price, on the other hand, showed better returns in the short term. Its price increased by 4.01% to trade at $4,639.5 over the last day. The best growth was 8.05% weekly, and the six-month performance was 139.71%.

Ethereum gained almost 98.5% over the last 12 months yet it remains below Bitcoin in the institutional flows. According to Coinglass data, ETH futures volume is up 13.67% to $93.88 billion. Also, open interest is now at $65.10 billion after an increase of 5.17%.

These positives are a reflection of growing leveraged activity and broader engagement in addition to spot trading. The growing open positions suggests that traders are positioning themselves for continued price swings which would likely be towards an upside.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs