BlackRock Makes Multiple BTC Withdrawals as Bitcoin Price Slips to $95K, Is a Sell-Off Coming?

Highlights

- BlackRock has reportedly move multiple BTC tranches from Coinbase Prime.

- This has led to speculation of a sell-off amid the recent pull back of the Bitcoin price.

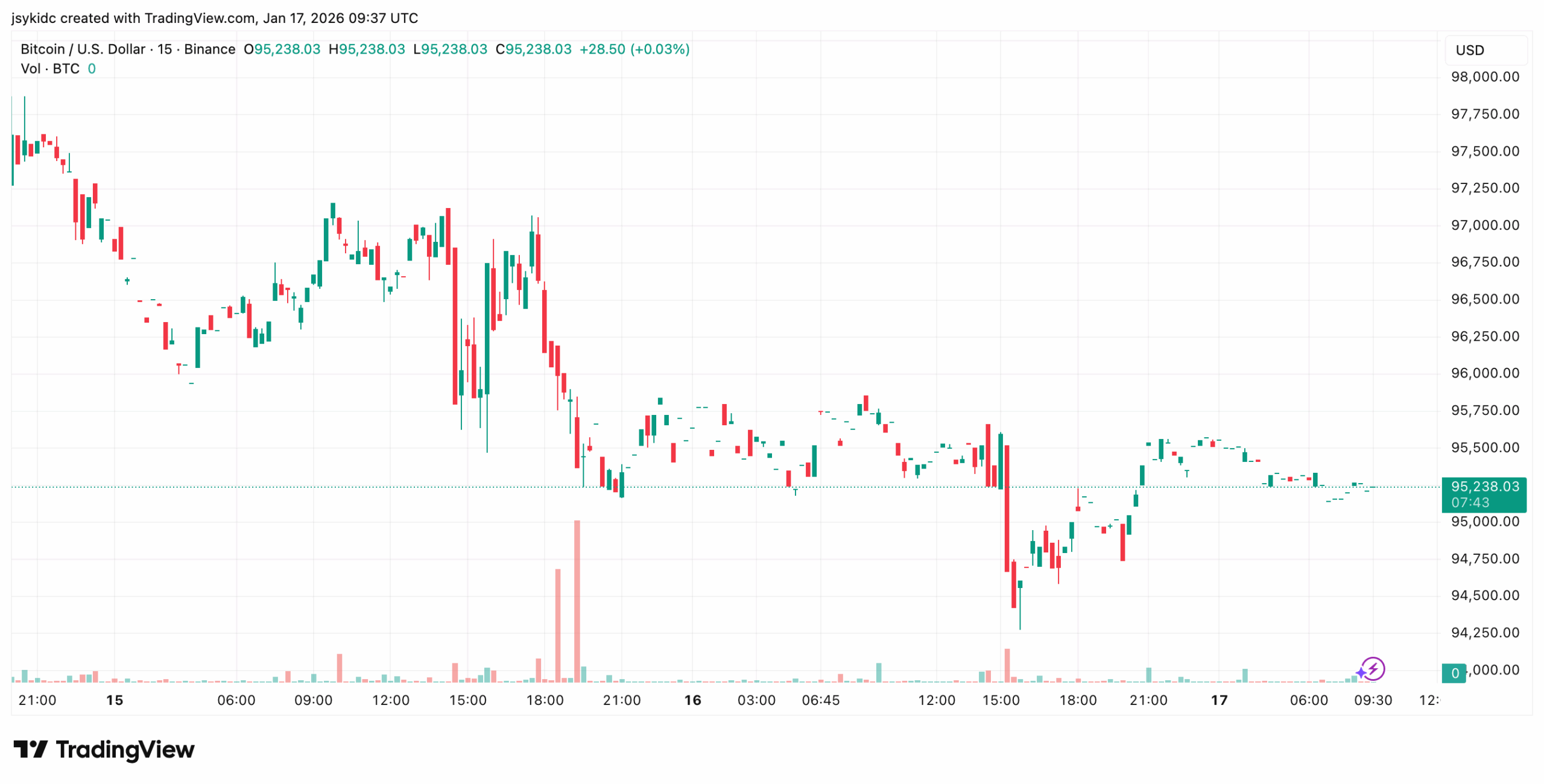

- Bitcoin is now back trading at the $95,000 level after its earlier attempt to break $98,000.

BlackRock has reportedly pulled out some of its BTC from its Coinbase account. This comes just as they have been boosting their portfolio with more purchases. To add, the Bitcoin price has seen a pullback from its recent highs raising speculation that the move might be to sell.

BlackRock Moves BTC as Bitcoin Price Dips

According to data highlighted by an expert, the asset manager has made multiple withdrawals of BTC from Coinbase Prime. While many experts speculate that these are just custody transfers from the exchange’s hot wallet to the IBIT ETF, many think they might be gearing up to sell some tokens.

BlackRock has been withdrawing a ton of BTC from Coinbase pic.twitter.com/c3u2ymRzTO

— 0xMarioNawfal (@RoundtableSpace) January 17, 2026

These transfers raised investors’ eyebrows, especially as it comes when the token pulled back from its recent highs of above $97,000. The coin is down about 1% in the past 24 hours.

This is not the first time BlackRock has made significant withdrawals. Around the same time last week, the asset manager moved abour $294 million in BTC and ETH to Coinbase. The transfer was ahead of the crypto options expiry and was also tied to a potential sell-off.

A day before then, they made a similar transfer to the exchange, raising a pattern. However, SoSoValue data on ETF inflows and outflows tell a different story. At the close of trading on Friday, Bitcoin ETFs saw an outflow of $394 million. Other funds by other asset managers saw outflows, but only IBIT saw an inflow of about $15 million.

Meanwhile, it was reported that BlackRock purchased about 6,647 tokens in one trading session yesterday. Its total Bitcoin holdings are now at 781,000 BTC, closing in on 4% of the tokens in circulation currently.

Why is Bitcoin Falling in Value?

The Bitcoin price, which looked to be gaining ground after trading in the range of $90,000, has retreated in performance. The coin broke close to $98,000 earlier this week as experts projected its return to $100,000.

However, the token could not sustain its upward momentum especially after the setback the crypto market bill encourntered during the week. Sentiment shifted badly among traders as Coinbase publicly called the crypto bill a “bad” legislation.

Joining the decline, crypto stocks also recorded massive losses mirroring the Bitcoin price decline. Gold and silver, which also had a great start to the week, saw losses of about 1% and 5% respectively.

Adding to the BlackRock BTC transfers, there was a shift in sentiment after the Supreme Court delayed its ruling on the Trump Tariffs. Markets had expected a decision on clarity this week but were met with disappointment as no decision was made. This has kept the fears of a potential market crash if a negative verdict is decided.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin Price Rebounds as Jane Street “10 am Dump” Pattern Stops Amid Lawsuit

- US OCC Proposes Rule to Implement GENIUS Act & Prohibits Stablecoin Yield

- ETHZilla Abandons Ethereum, Rebrands as Forum to Focus on RWA Tokenization

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale