BlackRock Moves Another $465M in Bitcoin and Ethereum Amid Crypto Market Sell-Off

Highlights

- Arkham data shows that BlackRock deposited 4,198 BTC to Coinbase.

- The asset manager also sent 43,237 ETH to the crypto exchange, likely in a move to sell.

- The Bitcoin ETFs as a group saw outflows of $903 million on November 20.

The world’s largest asset manager has again deposited a significant amount of Bitcoin and Ethereum into Coinbase, likely in a bid to offload these coins. These coins, as the crypto market faces a massive sell-off, including from the crypto ETFs, which are currently recording huge daily net outflows.

BlackRock Deposits BTC And ETH Into Coinbase As Crypto Market Crashes

Arkham data shows that the asset manager deposited 4,198 BTC and 43,237 ETH into Coinbase. This follows the daily net outflows of $903 million and $261 million that the Bitcoin and Ethereum ETFs recorded yesterday.

Notably, BlackRock’s BTC ETF saw net outflows of $355.50 million, while its ETH ETF recorded net outflows of $122.60 million. These crypto ETFs continue to face significant outflows as the crypto market crashes.

CoinGape reported earlier this week that BlackRock deposited 6,735 BTC into Coinbase after it recorded a net outflow of $523 million on November 18, its largest daily outflow since launch. It also deposited 64,706 ETH on the same day as its ETH ETF recorded a daily bet outflow the previous day.

The crypto market sell-off continues to intensify with BTC facing selling pressure from institutional investors and whales. This has caused the flagship crypto to crash to as low as $81,000 today, marking a new six-month low.

Veteran trader Peter Brandt recently suggested this may be the start of a prolonged bear market, predicting BTC could drop to as low as $58,000. However, he still expects that the flagship crypto will rally to as high as $200,000 in the next bull market.

Meanwhile, Bitcoin critic Peter Schiff predicted that BTC would drop to $10,000 amid the crypto market crash. This came as he claimed that the crypto industry duped the financial media into believing that a digital pyramid scheme is a legitimate asset class that investors, corporations, and governments should own.

And I will be saying it again when its back at $10K.

— Peter Schiff (@PeterSchiff) November 21, 2025

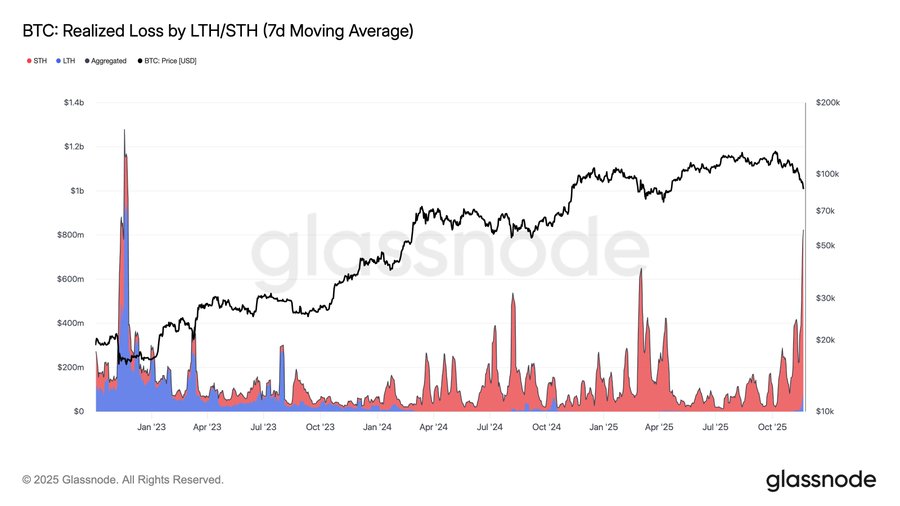

BTC Realized Losses Reach FTX Collapse Levels

In an X post, on-chain analytics platform Glassnode revealed that BTC realized losses have surged to levels last seen during the FTX collapse, with short-term holders driving most of the capitulation. The platform added that the scale and speed of these losses reflect a meaningful washout of marginal demand as recent buyers unwind into the drawdown.

Glassnode also recently stated that Bitcoin’s Mayer Multiple has retraced toward the lower bound of its long-term range, signaling a slowdown in momentum amid the crypto market sell-off. The platform explained that historically, such compressions have aligned with a value-driven phase where price consolidates and demand begins to step in.

Also Read: Top Crypto Offers In November 2025

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs