Breaking: BlackRock Spot Bitcoin ETF (IBIT) Soars 25% In Pre-Market Hours

After the U.S. Securities and Exchange Commission (SEC) greenlights spot Bitcoin ETF listing and trading, the largest asset manager BlackRock’s iShares Bitcoin Trust ETF (IBIT) debuts with a bang by skyrocketing nearly 25% in pre-market hours on Nasdaq. Experts anticipate a massive inflow in the Bitcoin ETFs from the first day itself.

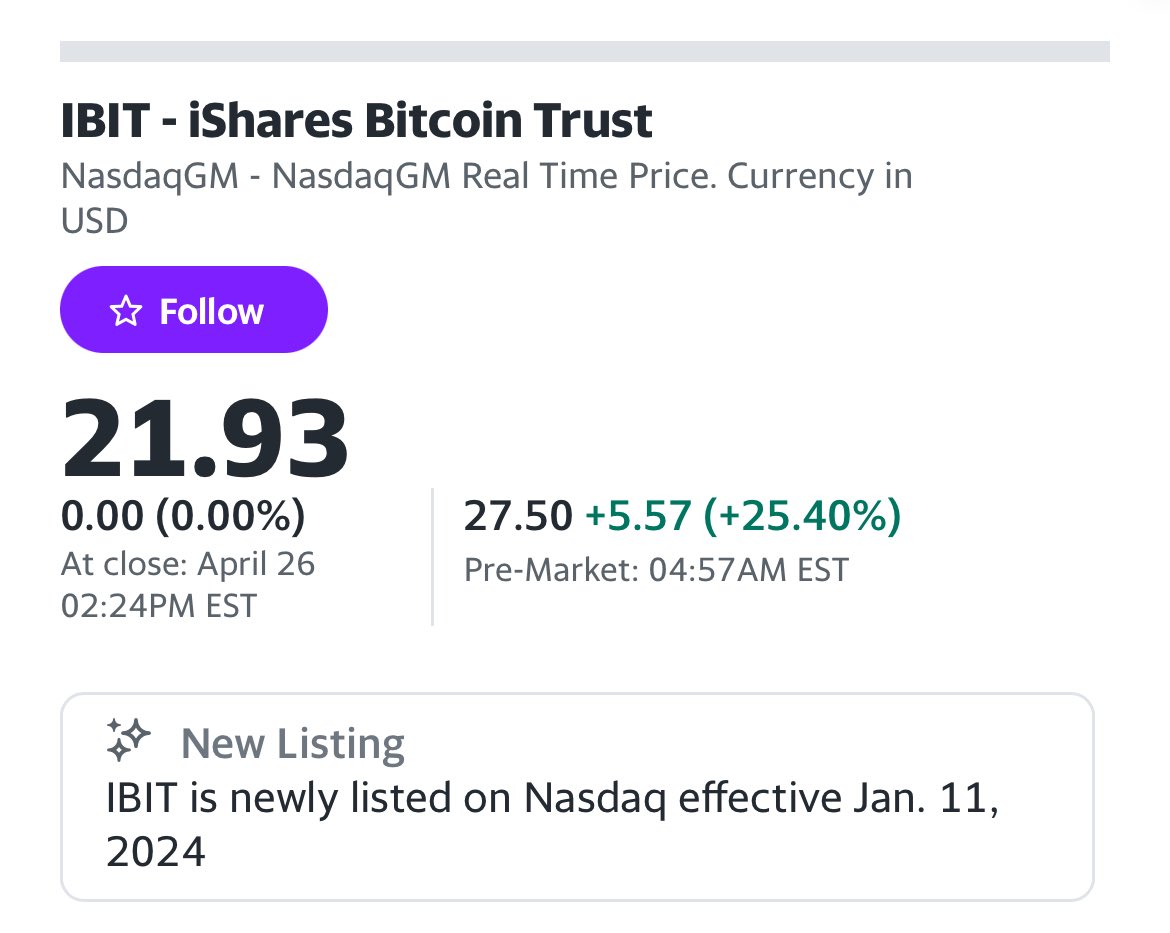

BlackRock Spot Bitcoin ETF Up 25%

BlackRock’s iShares Bitcoin Trust (IBIT) exchange-traded fund is trading at $27.50, up over 25% in pre-market hours on January 11. The BlackRock spot Bitcoin ETF net asset value (NAV) was at $26.12 on the approval date.

Bloomberg predicts $4 billion could flow into spot Bitcoin ETFs on the first day, with BlackRock grabbing nearly $2 billion inflow directly.

BlackRock spot Bitcoin ETF is live on their iShares website, Nasdaq, and across 175000 Aladdin investor platforms after the listing. BlackRock announced to reduce the fee to 0.25% and waive a part of the fee for the first 12 months. Thus, the fee will be 0.12% of the net asset value (NAV) of the first $5 billion of the Trust’s assets.

“Through IBIT, investors can access bitcoin in a cost-effective and convenient way,” said Dominik Rohe, head of Americas iShares ETF and Index Investing business at BlackRock.

BlackRock spot Bitcoin ETF will help remove some obstacles and operational burdens that prevent investors, from asset managers to financial advisors, from directly investing in Bitcoin.

Also Read: Bitcoin ETF Live Updates – US SEC Approves All 11 Spot Bitcoin ETFs, What’s Next?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs