How to Buy Bitcoin Anonymously? – A Detailed Guide

If you’re reading this, chances are you care about privacy, especially when money is involved. And that’s completely fair. Personal data is more valuable than ever in 2025, regulations are tighter, and violations of data feel like a weekly headline.

Therefore, it’s not surprising that many individuals would like to anonymously buy Bitcoin without presenting passports, selfies, and proof-of-address documents just to make a simple purchase.

Buying Bitcoin without Know Your Customer (KYC) checks isn’t about doing anything shady. For most people, it’s about reducing exposure. Uploading sensitive documents to centralized platforms creates permanent records that can be hacked, leaked, or misused years down the line.

Others simply prefer to keep their financial activity private, the same way you might prefer to pay cash instead of swiping a card. Therefore, let’s be clear upfront. Full anonymity doesn’t truly exist. Privacy comes in layers, and each layer usually involves trade-offs, higher fees, lower limits, or more effort.

In this guide, I’ll walk you through the realistic ways people are buying Bitcoin anonymously in 2025, what actually works, and what to watch out for.

Why Does Privacy Still Matter with Bitcoin?

Well, Bitcoin is often described as anonymous, but is that really true? BTC is pseudonymous. All your crypto wallet addresses don’t contain your name, but every transaction is permanently visible on the blockchain. Once an address is linked to your identity, usually through a KYC exchange, that is it. Your privacy is gone for good.

Most large crypto exchanges may want to go fully no-KYC, but they require full identity verification to comply with anti-money laundering laws. This means your name, documents, transaction history, and wallet addresses are all tied together. With stricter reporting rules in the U.S., Europe, and other regions in 2025, that data trail is only getting longer.

Those advocating for privacy claim that this undermines financial freedom, especially in countries with poor data protection laws, unstable banking systems, or restrictive governments.

Even in relatively stable regions, many people simply don’t want their entire financial history to be stored on centralized servers.

In that matter, does privacy mean immunity? Of course not. IP addresses, transaction timing, and payment methods can still leave fingerprints. And yes, buying Bitcoin anonymously is legal in many countries for personal use, but it isn’t when using it for illegal activity.

Laws around the world differ, so it’s always up to you to understand local regulations before moving large amounts.

Ways To Buy Bitcoin Anonymously

Let’s look at ways in which you can buy Bitcoin anonymously in 2025.

1. Peer-to-Peer Platforms: The Most Practical Starting Point

For most people, peer-to-peer (P2P) platforms are the easiest and most flexible way to buy Bitcoin without KYC. These platforms connect buyers and sellers directly, cutting out centralized intermediaries.

Think of it like a marketplace rather than an exchange. You browse offers, choose a seller, agree on payment terms, and complete the trade using escrow to protect both sides.

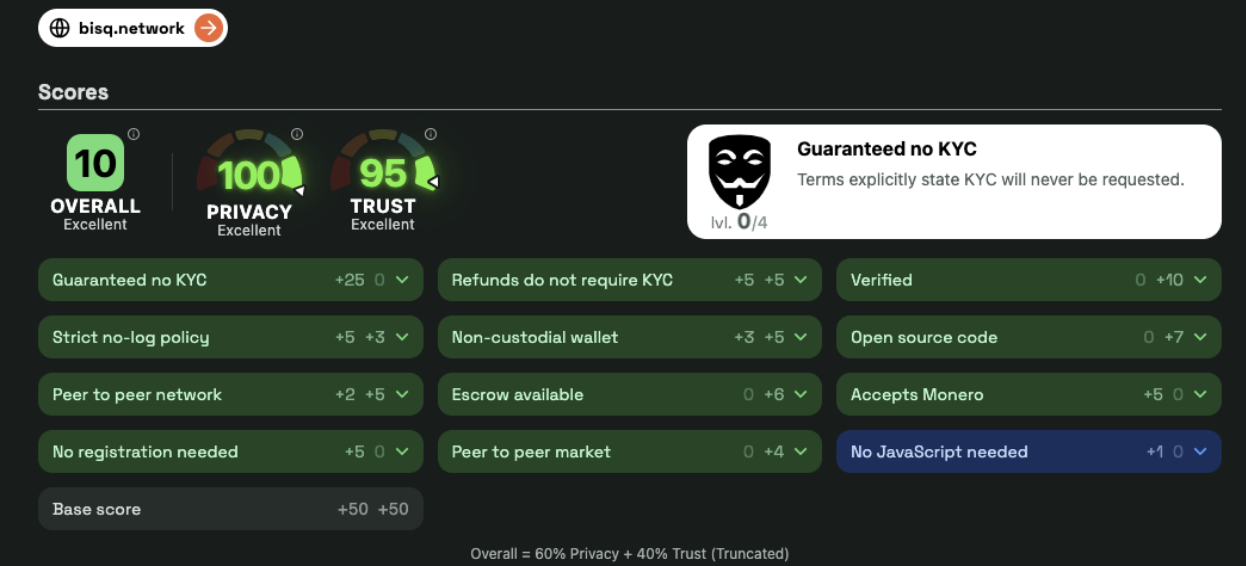

Platforms like Bisq remain a favorite for privacy-focused users, earning a rating of 4.7 on KYCNOT.ME. It runs as a desktop application, routes traffic through Tor, and never collects personal information. Trades are decentralized, and no central authority holds your funds or data.

Hodl Hodl is another popular option, especially if you want Lightning Network support and lower fees. It also operates without KYC and uses multisig escrow to secure trades. You can also buy Bitcoin anonymously using apps like Peach, Vexl, and Robosats, which make it easy to find nearby sellers or complete trades via chat-based systems.

If you’re new to P2P trading, start small. Build a reputation, stick to sellers with strong feedback, and follow basic safety rules. Consider meeting in public places, double-check wallet addresses, and never rush a trade.

These platforms have improved a lot over the years, and dispute systems are far better than they used to be, but caution still matters.

2. Bitcoin ATMs: Fast, Physical, and Private (Within Limits)

If P2P platforms do not appeal to you, then Bitcoin ATMs, often called BTM is another popular option for anonymous purchases. You can use these machines to insert cash and receive Bitcoin directly to your wallet. No need to handover your ID, especially for smaller transactions.

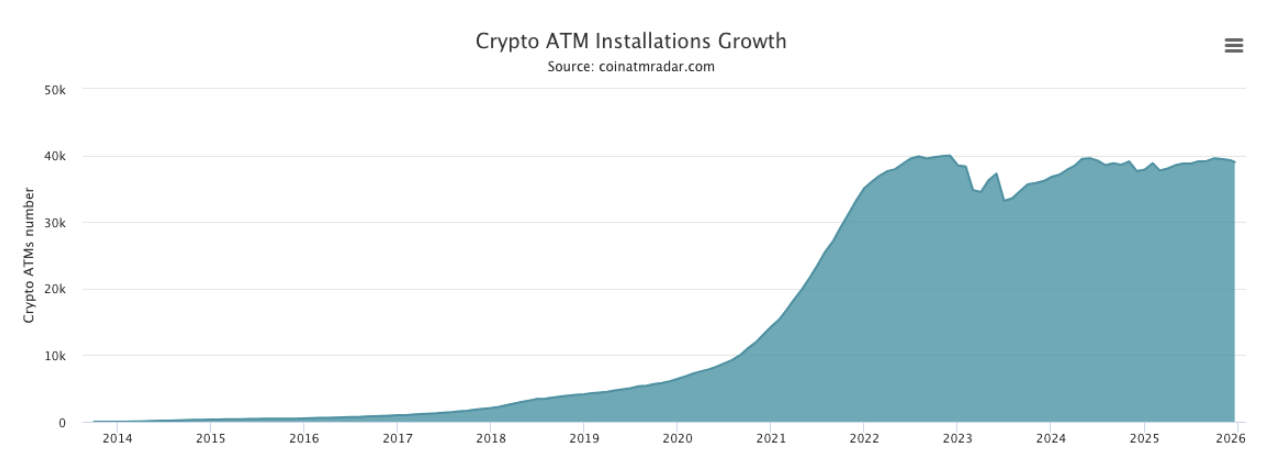

According to Coin ATM Radar, there are currently approximately 39,000 to 40,000 Bitcoin (and crypto) ATMs worldwide.

Bitcoin ATM Installations Growth (Source: Coin ATM Radar)

Many crypto ATM operators allow no-KYC purchases under specific limits. The range is from a few hundred to around $1,000 per transaction. Requirements vary by country, region, and operator, so it’s worth checking beforehand.

Using a BTM is straightforward. You scan your wallet’s QR code, insert cash, confirm the transaction, and the Bitcoin is sent to your address. The biggest downside is fees, which can range from 5% to over 10%. You’re paying for convenience and privacy.

If you are looking for something simple and hands-on, then these BTMs would be a better option. However, remember that physical locations still create metadata, so it’s wise to use crypto wallets focused on privacy and avoid reusing addresses.

3. No-KYC Exchanges: More Features, Fewer Questions

If you want a more flexible option than P2P platforms but still maintain anonymity, no-KYC crypto exchanges sit somewhere in between.

These exchanges don’t require identity documents, though they usually enforce withdrawal limits to stay compliant with minimal regulations. Like many users, you may find those limits to be more than enough.

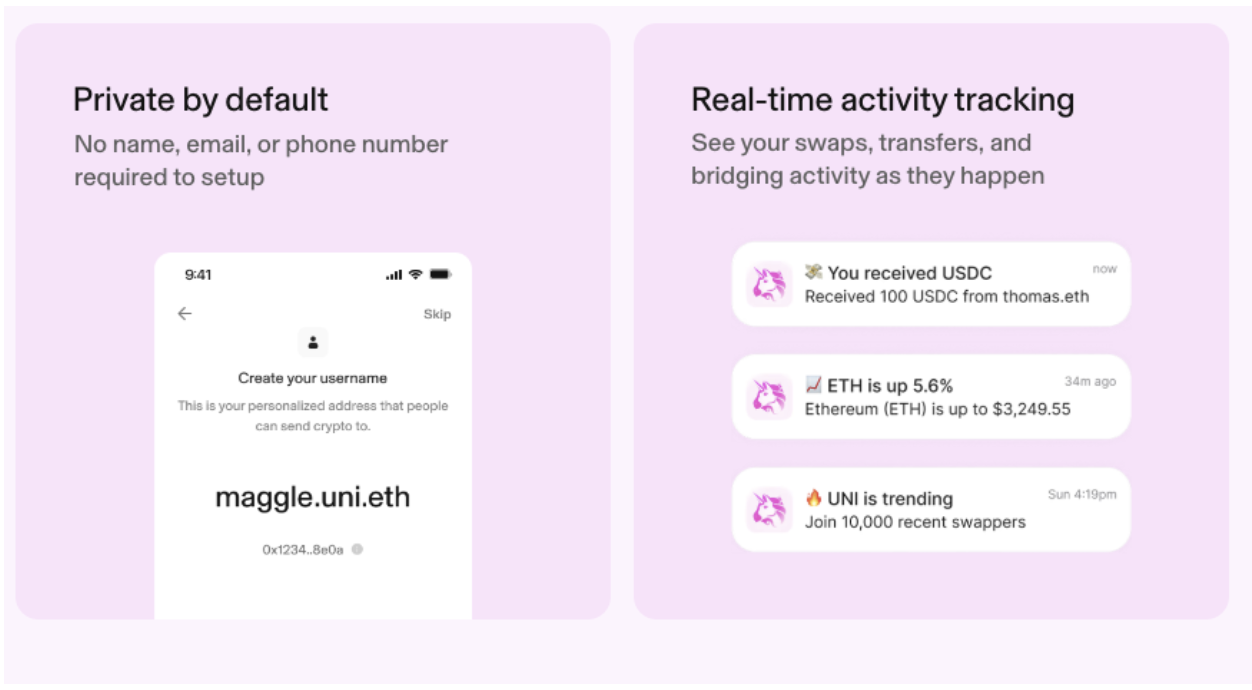

Some centralized cryptocurrency exchanges still allow trading without KYC up to certain thresholds. They offer spot trading, derivatives, and access to a wide range of assets. On the decentralized side, DEX platforms like Uniswap or dYdX require nothing more than a wallet connection.

The usual workflow is simple. First, fund a wallet (often using Bitcoin or stablecoins acquired via P2P or ATMs), connect it to the platform, and then trade. No accounts, no uploads, no personal data. It’s that simple.

Source (Uniswap)

Note that blockchain activity can still be analyzed, especially if funds move between known addresses. Privacy here comes from reducing identity exposure, not invisibility.

4. Advanced Options: Swaps, DEXs, and Mining

If you are a more experienced users, decentralized swaps offer you another privacy-friendly route. On-chain swap services allow you to exchange one cryptocurrency for another without accounts or verification. You send funds in, receive Bitcoin out, and that’s it, just like in the case of Ghostswap.

Besides the swaps, we have mining as another option to buy Bitcoin without KYC. However, this approach is not beginner-friendly. Mined Bitcoin is newly issued and doesn’t come from an exchange, making it one of the cleanest sources from a privacy standpoint. However, mining requires upfront investment, technical knowledge, and patience. Although it’s not a shortcut, but it’s worth it for some

Security Still Comes First

No matter which method you use to buy Bitcoin, security should always come before convenience. Privacy doesn’t mean much if your funds aren’t safe in the first place.

A few basic habits go a long way:

- Use non-custodial wallets preferable hardware wallets like the Ledger Nano. Avoid reusing wallet addresses

- Add extra security layers

- Stay off public Wi-Fi

Ledger Nano hardware wallet

Final Thoughts

Buying Bitcoin anonymously without KYC is still possible, but it’s no longer effortless. Each method comes with compromises, whether that’s higher fees, lower limits, or extra steps. For many users, that’s a fair trade for keeping personal data off centralized servers.

If privacy is your top priority, P2P platforms and Bitcoin ATMs remain the most accessible options. For more experienced users, no-KYC exchanges and decentralized tools offer flexibility without full exposure.

At the end of the day, it’s about balance. Total anonymity is a myth, but smart choices can dramatically reduce risk.