Bloomberg Analyst Predicts Blackrock’s IBIT To Surpass Satoshi Nakamoto Bitcoin Holdings By 2026

Highlights

- IBIT holds 660,842 BTC, second only to Satoshi’s 1.12M, and may surpass it by 2026.

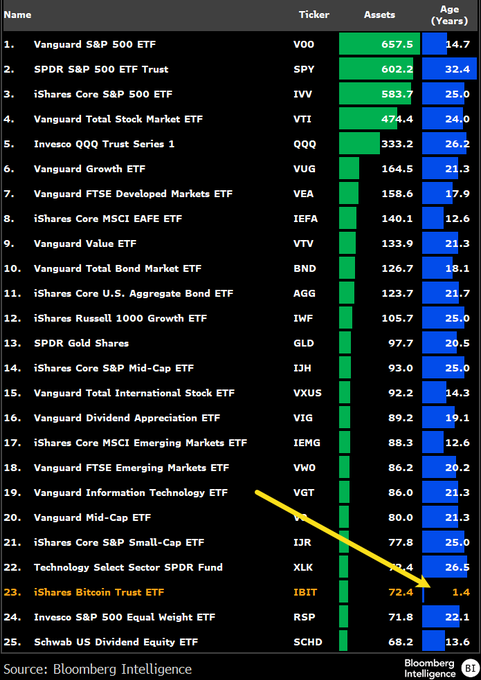

- BlackRock’s IBIT is now a Top 25 ETF globally after just 1.4 years on the market.

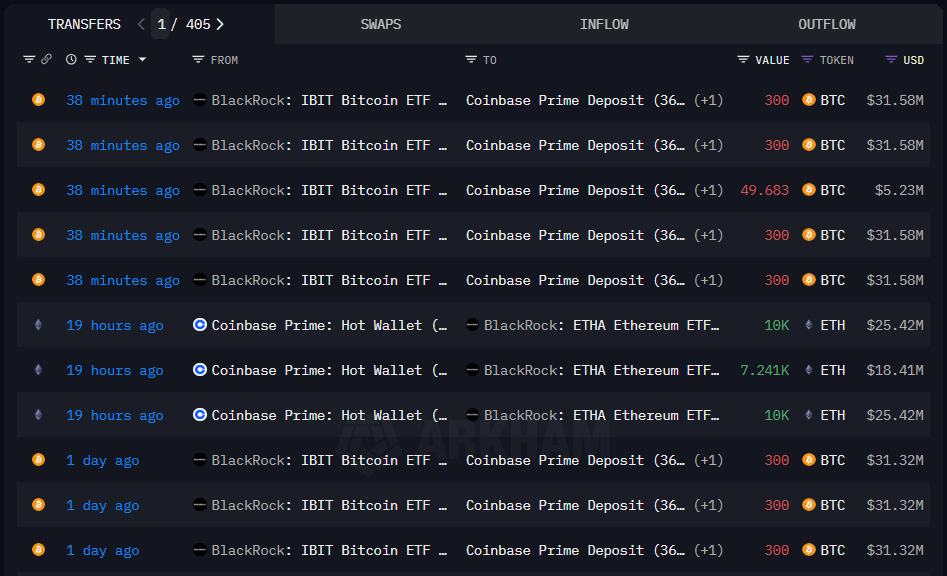

- BlackRock moved 5,362 BTC to Coinbase Prime as Bitcoin fell from $112K to $105K.

BlackRock’s iShares Bitcoin Trust (IBIT) may become the world’s largest Bitcoin holder by the end of 2026, according to Bloomberg Intelligence analyst Eric Balchunas. The ETF, which launched just 16 months ago, has rapidly accumulated Bitcoin and now holds over 660,000 BTC.

This growth places IBIT as the second-largest Bitcoin holder globally, behind only the anonymous Bitcoin creator Satoshi Nakamoto. If the current pace continues, IBIT could hold more than 1 million Bitcoin within 18 months.

Blackrock IBIT Bitcoin Holdings To Flip Satoshi Nakamoto

According to Bloomberg analyst Eric Balchunas X post, IBIT’s Bitcoin reserves now total approximately 660,842 BTC. This puts the ETF behind only Satoshi Nakamoto, whose estimated holdings stand at around 1,123,500 BTC. Per the analyst, the gap is narrowing as IBIT continues accumulating more assets.

MicroStrategy, now branded as Strategy, remains one of the largest corporate holders of Bitcoin. The firm currently holds around 580,955 BTC led by executive chairman Michael Saylor. Alongside Strategy, Binance holds approximately 622,546 BTC, coming fourth according to Eric.

The accuracy of Satoshi’s holdings has been questioned by some industry observers. Farside Investors, also posting on X, noted, “The dominant miner in 2009 may have mined 500k coins or 1 million coins, we just don’t know.” However, Eric Balchunas maintained that even using the higher estimate, IBIT is on track to hit 1M plus reiterating his earlier prediction last week.

IBIT Joins Global Top 25 ETFs by Size

Concurrently, BlackRock’s IBIT has entered the list of the 25 largest ETFs globally, reaching this status faster than any fund before it. According to data shared by Balchunas on X (formerly Twitter), IBIT is the youngest ETF on the list by a factor of nine, with only 1.4 years of history.

He described IBIT’s rise as unprecedented, noting that its asset growth has outpaced many long-established funds. Balchunas explained that IBIT’s success is due to the ETF format, which offers liquidity, trust, and ease of access for investors looking for Bitcoin exposure.

“IBIT is like an infant hanging out with teenagers and twenty-somethings,” Balchunas said in his post. The ETF currently manages nearly $70 billion in assets, reflecting growing demand from institutional and retail investors.

Recent Bitcoin Movements Raise Market Questions

On-chain data showed that BlackRock transferred 5,362 BTC worth over $560 million to Coinbase Prime accounts within two days. These transfers often occur before trades or rebalancing activities. Coinbase Prime is used mostly by institutional clients for custody and trading.

The timing coincided with a pullback in Bitcoin price from above $112,000 to around $105,000. On May 30 and June 2, more than $550 million exited BlackRock’s IBIT and other spot Bitcoin ETFs. Despite these changes, there is no official indication that BlackRock is reducing its Bitcoin exposure overall.

In addition to Bitcoin, BlackRock also withdrew 27,241 ETH (approximately $69 million) from Coinbase and redirected the funds to addresses linked to its Ethereum ETF structure.

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Will Bitcoin Crash To $58k or Rally to $75k After Hot PCE Inflation Data?

- Ripple’s RLUSD Gets Institutional Boost as SEC Eases Stablecoin Rules for Broker-Dealers

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise