BNB Hits New ATH As Binance Partners With $1.6T Franklin Templeton

Highlights

- Institutional adoption and partnerships push BNB price to a new record high.

- Binance partners with Franklin Templeton on securities tokenization programs that comply with appropriate regulations.

- CEA Industries raises BNB treasury to $368 million, targets 1% circulating supply.

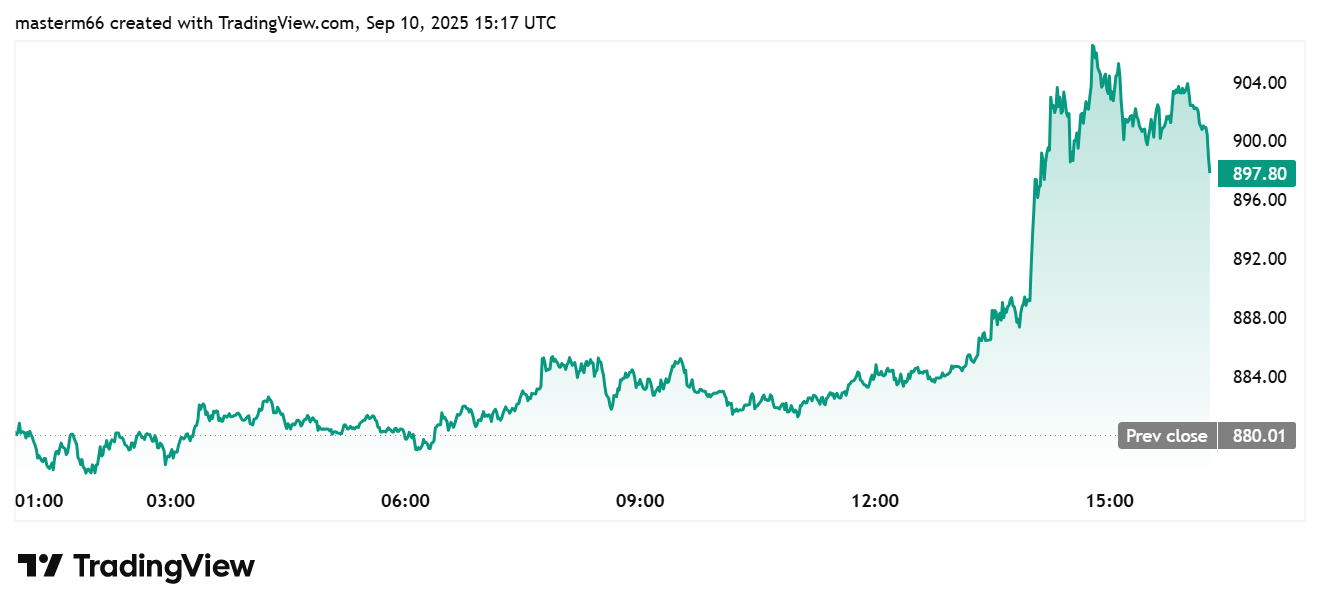

BNB hit a new all-time high above $904 today. The price boom was driven by the deal between Binance and Franklin Templeton deal as well as the BNB treasury accumulation by CEA industries.

Binance-Franklin Templeton Alliance Boosts Blockchain Adoption and BNB Price Gains

BNB price could be set for a rally to $1,400 after hitting a new all-time high of over $904. It even increased by almost 3% in a single session. The rally has boosted the token to over 28% in its year-to-date returns backing the claim that it is among the largest performers in 2025. The increased institutional demand, stronger corporate treasury participation and mainstream alliances are reflected in the price surge.

The most recent cause of the BNB price increase occurred after a recent Binance announcement. The crypto firm revealed that it has formed a strategic alliance with Franklin Templeton, a multinational investment powerhouse with $1.6 trillion in assets under management. Both companies will collaborate to establish digital asset programs to bring together traditional finance and blockchain based applications.

This collaboration will integrate Franklin Templeton experience of compliant securities tokenization with the Binance trading platform that is trusted globally. Collectively, they have set the objectives of creating efficient and scalable products that suits a wide audience and that includes investors.

Roger Bayston, Head of Digital Assets at Franklin Templeton, said the focus was on moving tokenization from “concept to practice.” Bayston further said it enhances settlement, collateral management, and portfolio construction. Sandy Kaul, Head of Innovation, added that blockchain should be seen as an opportunity to reimagine financial systems rather than a threat to legacy models.

A Binance executive, Catherine Chen, stated that the firm has a history of pioneering crypto solutions and stressed that the partnership would accelerate the integration of capital markets with BNB and other digital assets.

Corporate Treasuries Boost BNB Record Price Rally

One more reason for the strong BNB price uptrend is accumulation by corporate treasuries. Recently, CEA Industries (traded under Nasdaq with the symbol BNC) reported the purchase of 30, 000 BNB. According to the press release, this purchase cost the company about $26 million.

This puts its aggregate holdings of 418,888 tokens at a value of $368 million. The latest purchase follows a recent BNB treasury expansion worth $33 million. It also reinforced its position as one of the largest BNB treasuries in the world. Also, BNC has declared a goal to own one percent of the BNB circulating supply by the end of 2025.

If fully executed, including warrants that could add $750 million, its treasury could exceed $1.25 billion. CEO David Namdar described the effort as part of a larger $100–200 billion shift into digital asset treasuries.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs