Breaking: Bitcoin Miner MARA Acquires 11,774 BTC For $1.1 Billion

Highlights

- Bitcoin miner MARA bought 11,774 BTC For $1.1 Billion and at average price of $96,000 per bitcoin.

- The Bitcoin miner now holds 40,435 BTC, worth around $3.9 billion.

- Crypto analyst Ali Martinez warned that Bitcoin is still at risk of dropping to as low as $85,000.

Bitcoin miner MARA has announced the purchase of 11,774 BTC for $1.1 billion, bringing its total Bitcoin holdings to 40,435 BTC. The Bitcoin miner is the public company with the second largest Bitcoin holdings, and this announcement comes just a day after MicroStrategy, the public company with the largest BTC holding, announced another purchase.

MARA Acquires 11,774 BTC For $1.1 Billion

MARA revealed in a recent filing with the SEC that it had purchased 11,774 BTC for $1.1 billion. Meanwhile, the Bitcoin miner also confirmed this purchase in an X post, stating that it used the proceeds from its zero-coupon convertible notes offerings to make this purchase.

The company acquired these bitcoins at an average price of $96,000 per BTC and has achieved a BTC yield of 12.3% quarter-to-date (QTD) and 47.6% year-to-date (YTD). Following this recent purchase, the Bitcoin miner now holds 40,435 BTC, worth around $3.9 billion based on the current Bitcoin price.

MicroStrategy co-founder Michael Saylor also commented on MARA’s announcement, touching on the fact that the company has achieved a BTC yield of 47.6% YTD, which seemed to have impressed the tech entrepreneur and Bitcoin advocate.

Interestingly, MARA Holding’s announcement comes just a day after Saylor’s company announced that it purchased 21,550 BTC for $2.1 billion. MicroStrategy and Marathon Digital are the public companies with the largest Bitcoin holdings. However, the software company is well ahead, with 423,650 BTC compared to the Bitcoin miner’s 40,435 BTC.

Other companies are already looking to emulate this Bitcoin strategy, and Microsoft could soon be one of them. The company’s shareholders will vote today on a Bitcoin adoption proposal, which, if passed, would see the tech company adopt the flagship crypto on its balance sheet.

What Next For Bitcoin As Institutional FOMO Continues

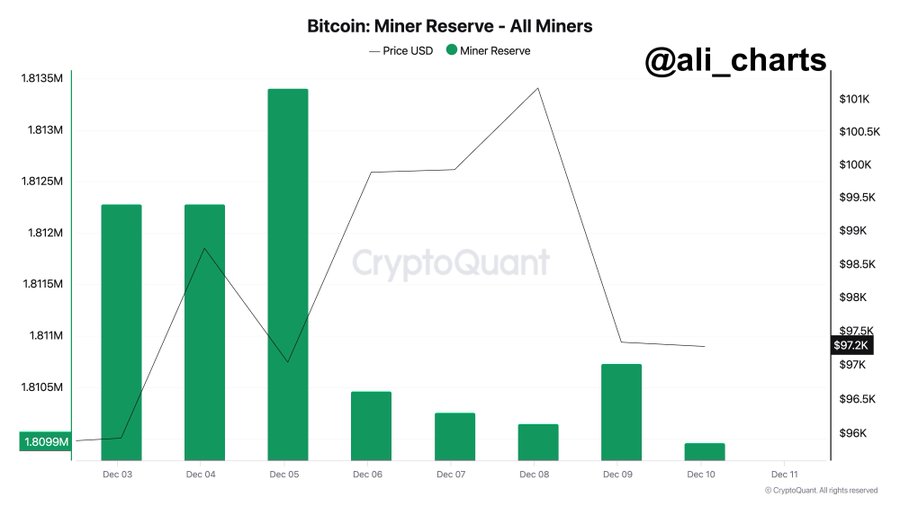

Amid MARA and MicroStrategy’s Bitcoin purchases, the BTC price remains tepid, consolidating within this $97,000 region. Crypto analyst Ali Martinez warned that the flagship crypto needs to hold above $96,000 to maintain its bullish outlook.

According to the analyst, the Bitcoin price could drop to as low as $85,000 in a repeat of last year’s pattern. Meanwhile, while whales like MARA and MicroStrategy are adding to their positions, some are offloading their coins, which looks to be putting significant selling pressure on the flagship crypto.

Martinez revealed that Bitcoin miners have sold 771 BTC in the last 24 hours. CoinGape also recently reported that the Bhutan government sold $40 million Bitcoin, although they still have 1,791 BTC left.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs