Breaking: CME Group to Launch Solana and XRP Futures Options as Institutional Demand Grows

Highlights

- Beginning from October 2025, CME Group will begin to offer contracts to sell options on Solana and XRP futures.

- These new contracts will have trade options of one day, month, or quarterly expiries.

- Institutions and individual investors are especially interested in these options separate from Bitcoin or Ethereum.

An announcement was made by CME Group, the largest derivatives exchanger worldwide, revealed that it would introduce options for Solana and XRP futures. It is the latest addition to CME crypto derivatives as institutions and retail investors increase their demand for Solana and XRP.

CME Expands Crypto Offerings With Solana and XRP Options Launch

According to a press release, the launch is scheduled for October 13, 2025, pending regulatory approval. The new products will allow traders to access options on Solana, Micro Solana, XRP, and Micro XRP futures.

Expiries will be offered on business days on a monthly, and quarterly basis to provide more flexibility to market players. CME Group said the contracts are designed to meet demand from institutions, hedge funds, and active retail traders.

According to Giovanni Vicioso, the launch reflects high liquidity in Solana and XRP futures. Vicioso is the Global Head of Cryptocurrency Products for the CME Group. He noted that the new contracts will provide additional tools for risk management and exposure strategies. Recently, CME XRP futures registered record open interest amid ETF approval optimism, reinforcing confidence in contract demand.

Cumberland, one of the leading liquidity providers, welcomed the development and said it highlights the shift beyond Bitcoin and Ethereum. FalconX, another trading firm, added that rising digital asset treasuries are increasing the need for hedging tools on alternative tokens like Solana and XRP.

High Record Trading Volumes Demand Solana and XRP Futures

Solana futures and XRP continue to gain popularity since their launch earlier this year. According to CME official records, many have bought and sold more than 540,000 Solana futures contracts since March. A value that amounts to over $22 billion. Solana contracts hit a record 9,000 contracts in August, worth $437 million. Open interest also set a record at 12,500 contracts.

XRP futures have seen similar momentum since their debut in May. More than 370,000 contracts, representing $16.2 billion in notional value, have been traded. CME’s XRP futures surged to a high in July before setting a new peak record in August. Last month, it recorded an average daily volume of 6,600 contracts worth $385 million. Open interest also climbed to 9,300 contracts, valued at $942 million.

CME Group said the contracts will be available through the CME Globex platform and cleared by CME Clearing. This allows participants to benefit from a system that is safe and has strong risk management. The CME Group believes that the introduction of options would further ease trading and introduce new participants into crypto markets.

Meanwhile, the announcement hasn’t had a significant effect on the prices of Solana and XRP. SOL price traded at $234.80, down 0.93% on the day, after closing the previous session at $237.01. Despite the daily dip, Solana has gained 8.14% over the past week and 22.91% in the past month.

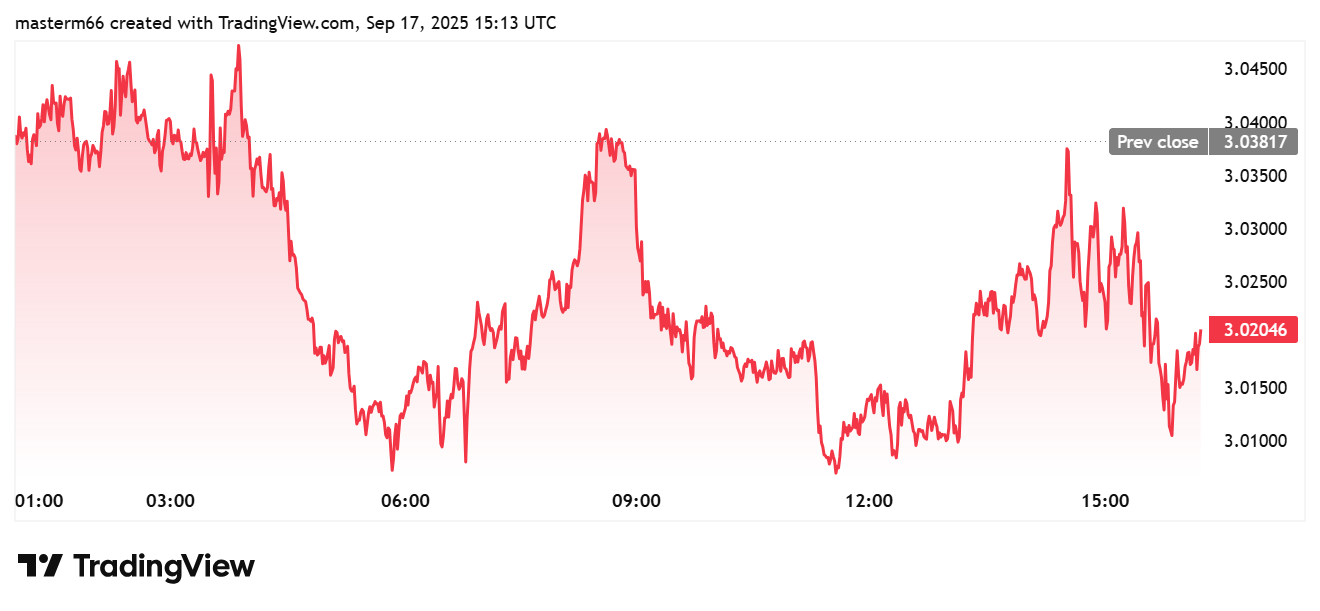

XRP price has also held firm momentum in recent trading sessions. The token traded at $3.02, slipping 0.58% on the day. Over the past week, XRP is up 2.37%, though it remains slightly down 2.31% in the past month.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs