Breaking: Coinbase Registers 114.9 Million Shares For Direct Listing on Nasdaq

Coinbase has registered 114.9 million of its shares for a direct listing on Nasdaq as per a report from Reuters. The cryptocurrency exchange announced its plans of making a public debut towards the end of last year and filed the S1 Form with the SEC in the last week of February revealing its plans of direct public listing on Nasdaq.

Earlier reports suggested that the firm was targeting a share price of $200 apiece, however, post its S1 filing, its pre-market valuation has exceeded $100 billion as many believe the actual valuation might exceed further. Accounting for the current 115 million shares listing and a pre-market valuation of $100 billion-plus suggest that the share price will be much higher than the early price target of $200.

Coinbase is one of the most successful and regulatory compliant crypto exchanges primarily serving US customers. The firm has gained over 40 million customers since its opening and accounts for billions worth of spot cryptocurrency trading volume on a daily basis.

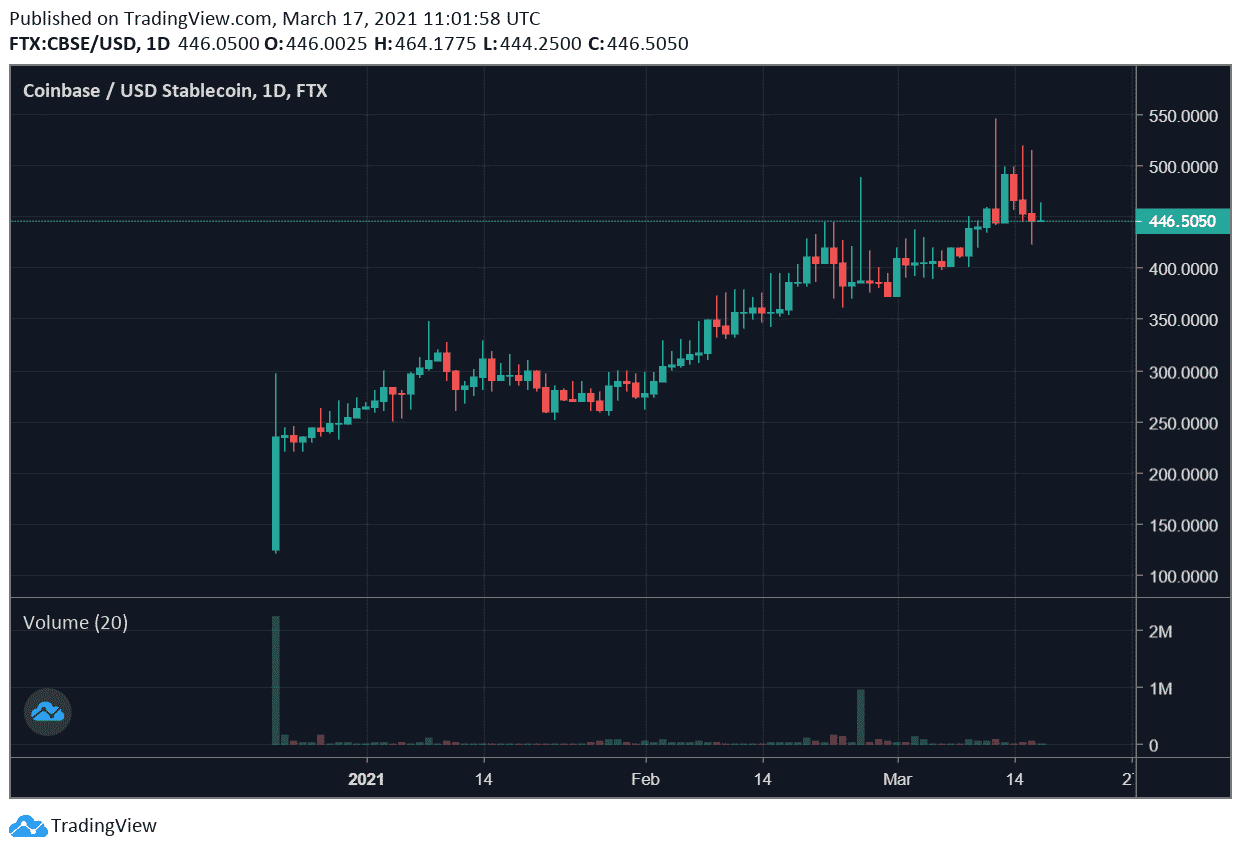

Coinbase Pre-Market Shares Trading Near $450 on FTX

The pre-market shares of Coinbase listed on FTX are currently trading near the $450 mark having reached as high as $550 only a couple of weeks ago. FTX, a decentralized exchange notorious for adding pre-IPO shares at discounted rates, has earlier listed the Airbnb pre-IPO shares as well.

Coinbase was among the first crypto companies to announce its public debut plans towards the end of last year which saw many other crypto entities such as Bakkt, Kraken, BlocFi, and a few other mining firms also announcing their public debut.

Coinbase however has chosen to go public via a direct listing on Nasdaq rather than through a SPAC merger, which is currently the rage for companies looking to go public. A number of crypto companies including Bakkt and several other firms have chosen the SPAC merger over the direct listing. The growing popularity of SPAC has made SEC Corporate Director call for better regulations around SPACs.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin Treasury Firm MARA Considers Selling BTC Reserves After Policy Update

- Cardano Founder Warns Over CLARITY Act, Cites Lack of Protection for DeFi, Stablecoins, Prediction Markets

- Core Scientific Sells 1,900 BTC as Bitcoin Miner Pivots to AI, CORZ Stock Dips

- Bitcoin News: VanEck CEO Projects Gradual BTC Rally in 2026 as ETFs Sees $458M Inflows

- Bitcoin, Gold Slip as Donald Trump Says “Unlimited Munition Stockpiles” for US-Iran War

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

Buy $GGs

Buy $GGs