Breaking: Metaplanet Expands Treasury With 5,268 BTC Purchase, Climbs to 4th Largest Holder

Highlights

- Metaplanet aquires 5,268 BTC at an average price of $116,870 per coin, spending $615M.

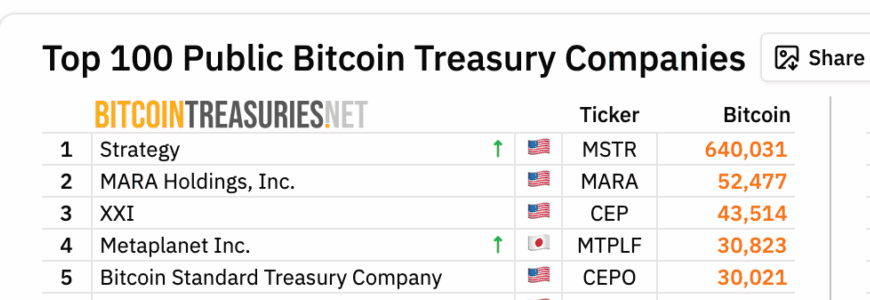

- Total holdings surge to 30,823 BTC, pushing it to the 4th-largest corporate Bitcoin holder.

- Revenue growth strongly driven by Bitcoin, with Q3 revenue up 115.7% to $16.75M.

Metaplanet has expanded its Bitcoin portfolio with another purchase. The Tokyo-listed firm is now the fourth-largest BTC holding firm in the crypto space.

Metaplanet Adds 5,268 BTC

In a recent release, Metaplanet disclosed the acquisition of 5,268 BTC at an average price of around $116,870 per coin, totaling roughly $615 million. With this addition, the company’s overall Bitcoin stash has grown to 30,823 BTC. This brought its total holdings valued at approximately $3.33 billion. The firm’s year-to-date BTC yield now stands at a staggering 497.1%.

The company outlined the details of its purchase in a filing, explaining that its key metrics are central to evaluating how its treasury approach delivers shareholder value. These indicators help strip away the effects of share dilution to measure the real growth of the token holdings and their impact in yen terms.

The purchase has pushed the firm past Bitcoin Standard Treasury Company in corporate rankings, making it the fourth-largest holder of the token worldwide.

This brings the firm closer to Michael Saylor’s Strategy, which continues its relentless weekly acquisitions. Most recently, the firm announced a BTC purchase of $22.1 million, bringing its total haul to 640,031 tokens.

Notably, Metaplanet had just secured the 5th spot, overtaking Bullish, which had been relatively quiet with its token purchases.

The firm is quickly rising in the rankings, showing its strong desire to become Asia’s top treasury company. Executives have stated that they aim to capture a 1% share of the global BTC market by 2027. They believe they can reach this goal by growing operations and using preferred share financing, all while not affecting common shareholders.

Revenue Growth Driven by Bitcoin

Beyond its purchases, the company’s Bitcoin Income Generation division has fueled major financial gains. In Q3 2025, the unit reported revenue of $16.75 million. This represented a quarterly growth of 115.7%. On this basis, the company doubled its full-year revenue forecast to $46 million and raised its operating profit guidance to $31 million.

These figures highlight the scalability of Metaplanet’s business model. The firm also plans to use its preferred share issuance program to continue funding token purchases.

Furthermore, the Japanese firm launched three new subsidiaries, Metaplanet Income Corp. in the United States, along with Bitcoin Japan Inc. and Bitcoin Japan Co., Ltd. This is to broaden its reach in the digital asset sector. This expansion follows the completion of a $1.4 billion fundraising effort aimed at powering its global growth strategy.

The Japanese company has persisted in aggressively accumulating Bitcoin despite recent price volatility. In essence, this shows a sustained dedication to its future.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Gold ETF vs Tokenized Gold: Who Could Outperform in 2026?

- Crypto Weekly Wrap: Jane Street Targeted After Terra Suit, Vitalik’s ETH Selloffs, Regulatory Progress Feb 23-27

- Meme Coin Market Dead? Top 5 Reasons Dogecoin, Shiba Inu, and Pepe Are Crashing

- Crypto Market Crashes as U.S.-Iran Tensions Escalate With Airstrikes

- Breaking: Ethereum Price Drops Amid Israel-Iran Tensions; Machi Big Brother Liquidated Again

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs