Breaking: MicroStrategy’s Michael Saylor Might Be Selling Bitcoins At Your Back

All that we have been hearing over the last two years is that MicroStrategy CEO Michael Saylor has been aggressively buying Bitcoins. However, a contrary report suggests that Mr. Saylor might be dumping his thousands of Bitcoins at your back.

Bitcoin critic Mr. Whale published a detailed report saying Saylor has been selling his BTC for months while urging others to “take out double mortgages and go all-in”.

Mr. Whale digs into the past of Michael Saylor wherein he compares his investment failures of the dot-com bubble of the late 90s. Citing an article from the Fortune Magazine, Mr. Whale says that Saylor lost a whopping $13.5 billion back then, the most by any individual. Mr. whale writes:

His investment failures came from years of negligent accounting practices, fraud, and overall terrible leadership. It’s clear his companies valuation is solely based on his ability to attract hype by engaging in popular “trends”, which we saw with their eagerness to be at the center of the dot-com bubble, and now with the Bitcoin bubble.

Later in 2000, the U.S. SEC also accused him of fraud. As a result, Saylor had to pay $350,000 as a penalty to the SEC and $8.3 million to shareholders.

MicroStrategy Doesn’t Like Bitcoins, Insiders Selling BTC

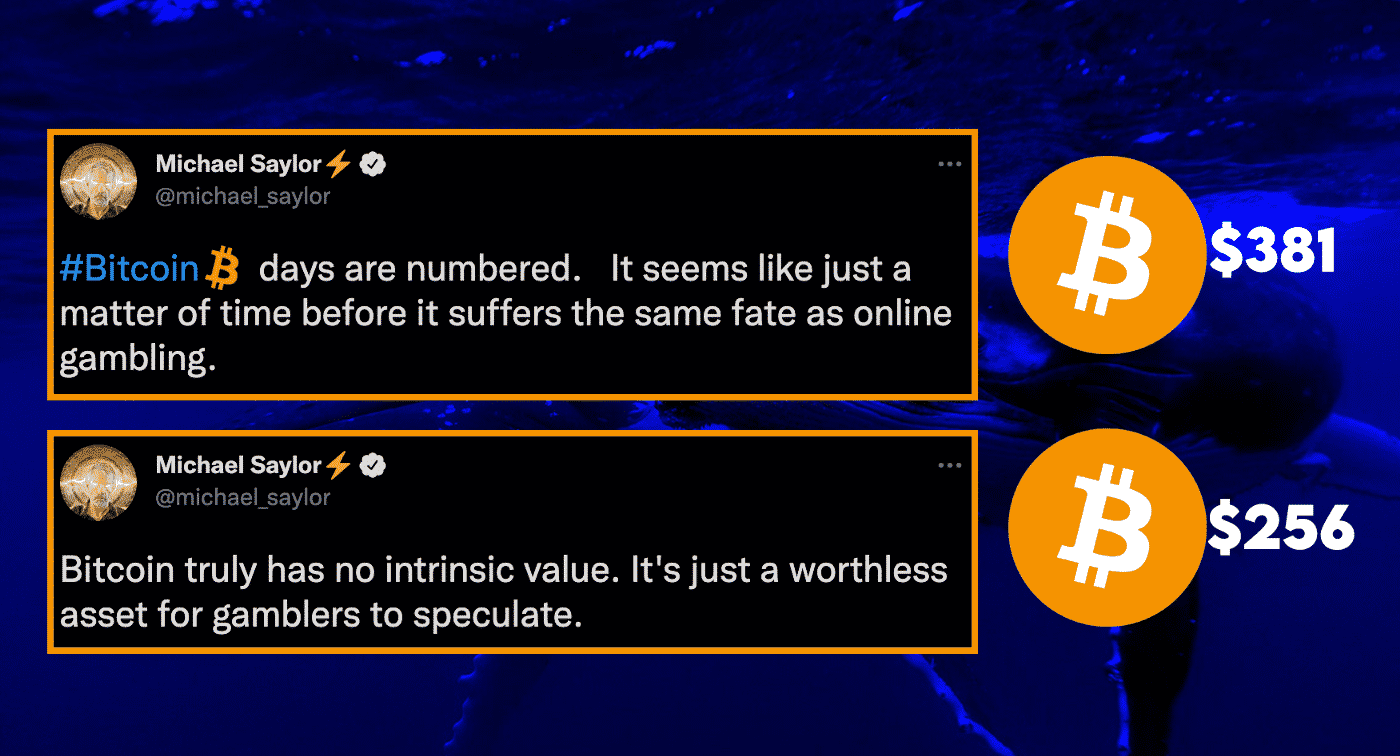

Mr. Whale digs into some of the old tweets by Michael Saylor wherein he has criticized Bitcoin. In some of his very old tweets, Saylor wrote that “Bitcoin’s days are numbered” and that it doesn’t hold any intrinsic value.

Mr. Whale accuses Saylor of creating the Bitcoin hype and attracting investors into buying BTC and his company’s stock. He further adds that Michael Saylor and his company’s insiders could dump the stock at extremely overvalued prices.

Mr. whale says that Saylor is playing theatrics with his assuring words that he has “no plans to sell Bitcoin in the next 100 years”. Instead, the Microstrategy CEO has an exit plan in place. Furthermore, the whistleblower also accused Saylor of swaying people to buy BTC in September 2021. Mr. Whale said that it was an attempt from Saylor to gather enough liquidity to dump their own holdings. The whistleblower writes:

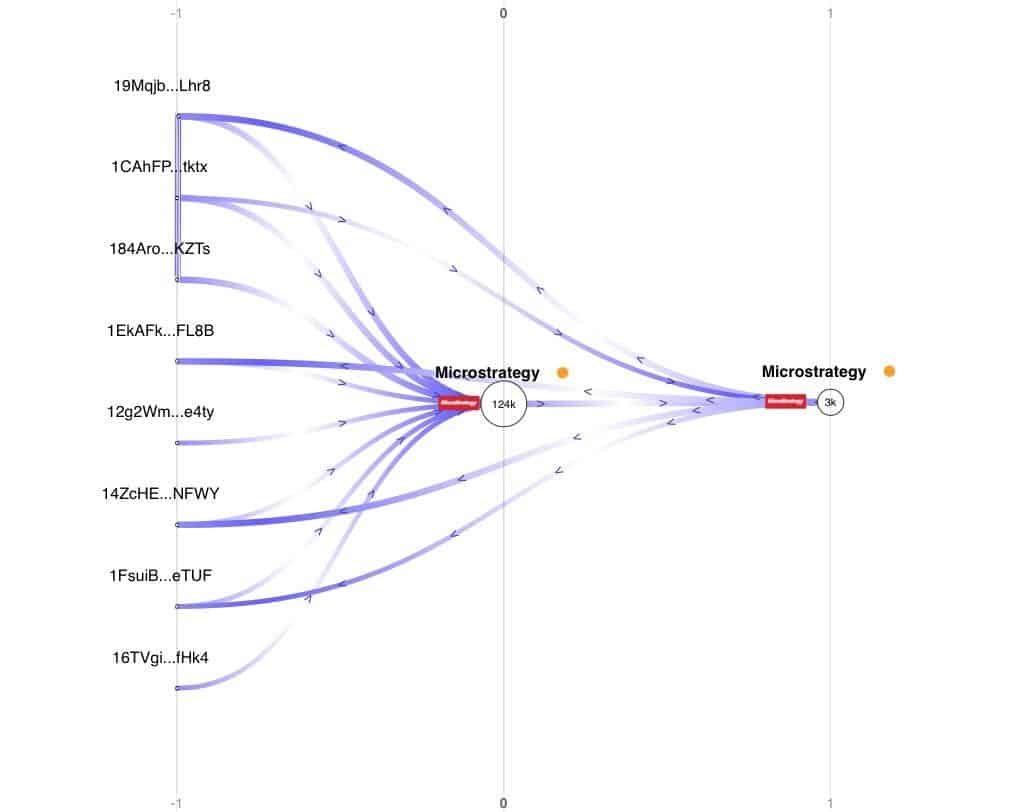

Back in September 2021, I warned investors that Michael Saylor was secretly dumping his shares. This week, it was confirmed to be true. Michael Saylor has transferred his BTC to a secondary address that has been using Coinbase and Okex to sell bitcoins.

He says that Saylor’s company MicroStrategy sold $63 million worth of BTC while announcing its purchase. “Microstrategy has dumped over 8000+ Bitcoin. I expect them to dump more in the coming months. Be careful out there bulls,” he writes.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin News: CitiBank to Launch BTC Services in 2026

- Deutsche Bank-Backed AllUnity Launches First MiCA-Compliant Swiss Franc Stablecoin

- Crypto Market on Edge as US-Iran Hold Talks Ahead of Trump’s War Deadline

- XRP Prepares for Phase 4 Lift-Off, $21.5 Level in Focus

- Vitalik Buterin Exceeds Planned Ethereum Sales as Total Liquidations Hit $35M

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

Buy $GGs

Buy $GGs