Breaking: Spot Ethereum ETF S-1 Amendments In from 8 Firms, What’s Next?

Highlights

- All 8 issuers (BlackRock, Fidelity, 21Shares, Grayscale, Franklin Templeton, VanEck, iShares, Invesco) filed Spot Ethereum ETF S-1 amendments.

- Franklin Templeton & VanEck disclosed ETF fees of 0.19% and 0.20%, pressuring BlackRock to keep fees below 30bps.

- BlackRock leads with a $10M seed investment; 21Shares, Franklin Templeton, and Invesco also disclosed significant seed investments.

All eight applicants of Spot Ethereum ETFs have submitted their S-1 amendments, adding more information about fees and seed investments, and are waiting for the SEC’s nod.

Some of the notable filings include those from BlackRock, Fidelity, 21Shares, Grayscale, Franklin Templeton, VanEck, iShares, and Invesco.

Spot Ethereum ETF S1 Amendments and Fees

BlackRock, Invesco Galaxy, VanEck, Franklin Templeton, Grayscale Investments, and 21Shares have submitted the new round of amended S-1 filings for Spot Ethereum ETFs to the SEC on Friday. Both Bitwise and Fidelity had submitted their amendments earlier.

Currently, only Franklin Templeton and VanEck have revealed their fees, which stand at 0.19% and 0.20%, respectively.

All spot eth ETF S-1 amendments are now IN…

Bitwise, Fidelity, 21Shares, Grayscale, Franklin, VanEck, iShares, & Invesco.

Known fees so far are Franklin (0.19%) & VanEck (0.20%).

Now we wait for SEC. https://t.co/7Uo4kIOQg8

— Nate Geraci (@NateGeraci) June 21, 2024

Eric Balchunas, a senior ETF analyst at Bloomberg, said, “VanEck’s fee of 0.20% is quite low, putting pressure on BlackRock to keep their fee under 30bps.” The SEC approved the 19b-4 forms for these ETFs last month, but the registration statements need to become effective before the trading can begin.

Seed Investments Disclosed

Some firms also revealed the seed capital that they have invested in such disclosures. 21Shares US LLC, the sponsor for the 21Shares Core Ethereum ETF, acquired 20,000 shares, which made a seed investment of $340,739.

Franklin Templeton disclosed a $100,000 initial capital for its Ethereum ETF while Invesco Ltd. put in $100,000 for the Invesco Galaxy Ethereum ETF.

BlackRock is in.. no fee posted but they did report seeding with $10m (altho I think that may have been known already in prev filing). Anyway that's basically a wrap. Ball in SEC's court now. pic.twitter.com/nbYoJo8Xj4

— Eric Balchunas (@EricBalchunas) June 21, 2024

BlackRock disclosed a relatively large seeding payment of $10 million, despite this information being public prior to the announcement. These investments are important because they show that the issuers are committed to the funds and offer the initial capital for the ETFs to trade.

Read Also: Ethereum ETF Approval Process Labeled Political By Nate Geraci, Here’s All

Anticipation for SEC Approval

The updated filings are submitted as the market eagerly awaits the final decision from the SEC. The SEC has a strict review process that guarantees that all the disclosure and other regulatory procedures are done before ETFs begin trading. With the launch date rumored to be on July 2, investors are now waiting for the ruling of the SEC.

Subsequently, this year in January, the SEC allowed a number of Spot Bitcoin ETFs with fees between 0.21% and 0.39% which paved way for Ethereum ETFs. The rates that have been proposed by Franklin Templeton and VanEck are relatively competitive meaning there is a price war going on to provide cheaper investment options to the investors.

The enthusiasm around Ethereum ETFs is wider than just the US. In Europe, Standard Chartered has announced the launch of a Spot Bitcoin and Ethereum trading desk, indicating a growing global interest in cryptocurrency investment products.

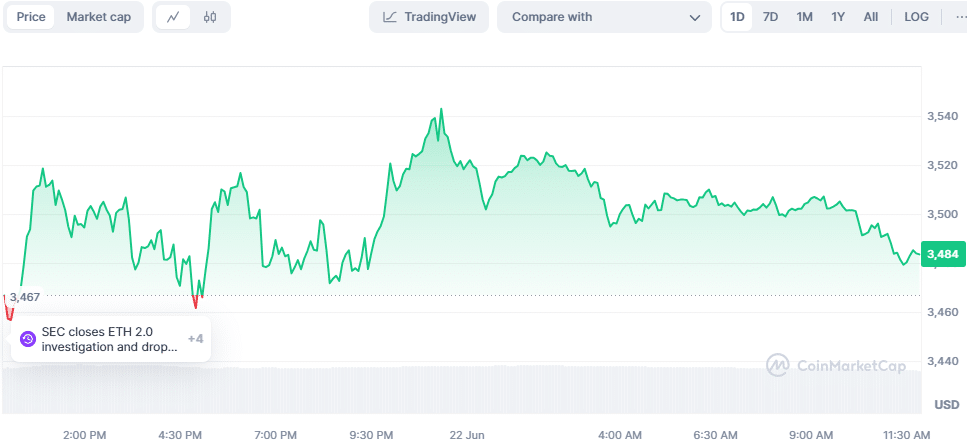

Meanwhile, post the submission of the S1 Amendments, Ethereum (ETH) price has recovered touching an intra-day high of $3,543 before facing resistance.

Source: CoinMarketCap

At press time, ETH was trading at $3, 484 a 0.60% surge from the intra-day low of $3,447. However, despite the recovery and rise in market cap by 0.52% to $426,056,756,138, the trading volume decline by 7.11% to $14,179,349,970.

Read Also: Ethereum Price Drops Below $3,500 as Whales Transfer $79M to Coinbase

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs