Breaking: BTC Price Hits $60K As BlackRock Bitcoin ETF Saw Massive $520M Inflow

Highlights

- BlackRock iShares Bitcoin ETF witnessing an inflow of $520 million

- Spot Bitcoin exchange-traded funds (ETF) witnessed $577 million net inflow

- BTC price breaks over $60,000 on the back of massive Bitcoin ETF demand

The week is turning out to be great for spot Bitcoin ETFs as they started the week with a $520 million inflow on Monday and recorded another strong inflow of $577 million on Tuesday. The massive inflow came on the back of BlackRock iShares Bitcoin ETF witnessing an inflow of $520 million alone, triggering a BTC price rally to $60,000.

BlackRock Leads Spot Bitcoin ETF Inflow

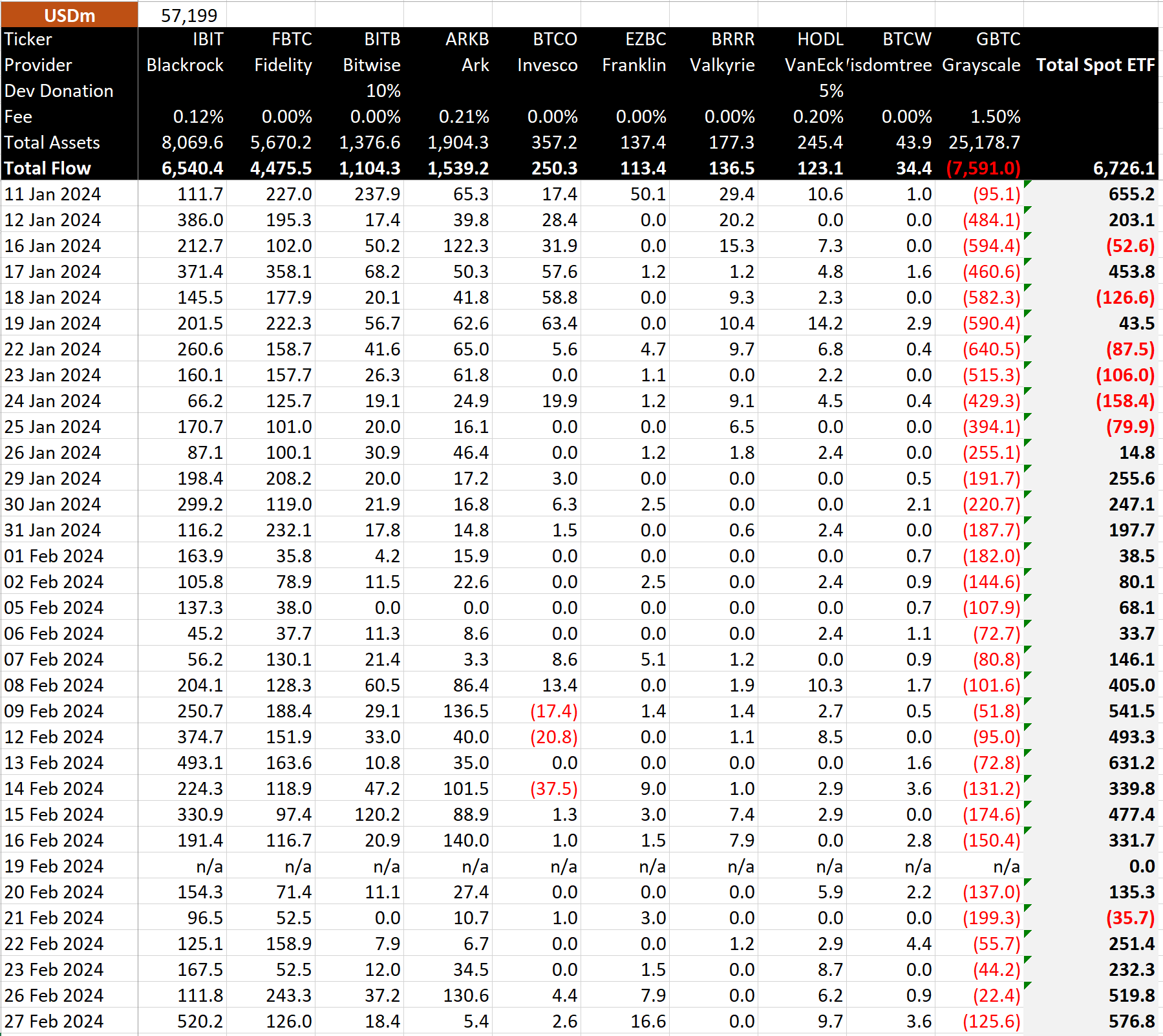

Spot Bitcoin exchange-traded funds (ETF) witnessed $577 million net inflow (or 10,167.5 BTC net inflow) on February 27, according to data by BitMEX Research. This was the third-largest inflow until launch, as all nine spot Bitcoin ETFs recorded massive trading volumes. However, Grayscale’s GBTC outflow increased again on Tuesday after dropping to $22.4 million a day before.

BlackRock iShares Bitcoin ETF (IBIT) saw over $520 million, breaking its largest inflow to date record. IBIT also saw a record $1.3 billion trading volume, exceeding the daily trade volume of most large-cap US stocks. Following the latest inflow, BlackRock’s net inflow hit over $6.5 billion and asset holdings jumped over 141,000 BTC.

Fidelity Bitcoin ETF (FBTC) and Ark 21Shares (ARKB) Bitcoin ETF saw $126 million and $5.4 million, respectively. Bitwise (BITB), VanEck (HODL), and others spot Bitcoin also saw substantial inflows, indicating strong bullish sentiment among retail and institutional investors.

Notably, GBTC saw a $125.6 million outflow, an increase from Monday’s $22.4 million outflow, setting aside hopes of a paradigm shift. Bloomberg senior ETF analyst Eric Balchunas said the daily trading volume of nine new spot Bitcoin ETFs except GBTC exceeded $2 billion for the second consecutive day as BTC price holds strongly above $57K.

Also Read: Sam Bankman-Fried’s Defense Counsel Proposes 6 Year Sentence or Less

BTC Price Breaks Above $60,000

Crypto Fear & Greed Index has reached a 4-year high value of 82 today, with the market sentiment currently in the ‘Extreme Greed’ zone. The FOMO reaches into Wall Street as traders’ interest in BTC is extremely high. Experts predicted BTC price to hit $60,000 before bitcoin halving.

BTC price skyrocketed to $60,000, less than a few percentage away from the $68.6K high established 27 months ago. The 24-hour low and high are $56,329 and $60,450, respectively. Furthermore, the trading volume has increased slightly in the last 24 hours, indicating interest among traders.

Good morning,#Bitcoin is above $58K, where funding rates are going through the roof.

Astonishing strength, definitely areas to start looking for profits. pic.twitter.com/WXRzkEkaBA

— Michaël van de Poppe (@CryptoMichNL) February 28, 2024

Also Read: US SEC Request Judge Torres to Extend Remedies Briefing Deadlines in Ripple Case

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs