BTC Price Climbs To $28k On Grayscale ETF Victory, Bull Run In The Making?

BTC price reacted positively to the landmark victory of the largest digital assets investment manager, Grayscale Investments against the United States Securities and Exchange Commission (SEC).

The appeals court rejected the SEC’s decision to stop the conversion of the company’s Bitcoin Trust product into an exchange-traded fund (ETF), following a reevaluation of its initial proposal.

Will BTC Price Climb to $30k or Drop To $25k

Crypto participants in the US and the world at large continue to wait with bated breath for the SEC to approve the first spot Bitcoin ETF. ETFs carry a lot of weight when it comes to the mainstream adoption of cryptocurrencies. They are a conduit for conventional investors to dip their feet in the crypto verse, without the need to hold the underlying digital asset like BTC.

Despite Grayscale’s victory, the road to the first approval of a spot ETF is very uncertain and remains at the mercy of the SEC, which is expected to decide on seven more proposals whose deadlines come in a week.

99.99999% of the world doesn't know that the SEC has to decide on 7 BTC ETFs within the next 3 days:

-blackrock

-bitwise

-vaneck

-wisdomtree

-invesco

-fidelity

-valkyriethe suits at our doorstep

— odin free 🦇🔊 (@odin_free) August 29, 2023

On September 1, Bitwise, an investment company, will know the fate of its spot BTC ETF proposal. BlackRock, VanEck, Fidelity, Invesco, and WisdomTree are all waiting for the SEC’s verdict for their funds – anticipated by September 2, as indicated in numerous SEC filings.

Concurrently, Valkyrie is expecting a response from the SEC about its application by September 4.

Meanwhile, BTC price jumped in the direction of $30,000 following the appeals court ruling after consolidating its August losses around $26,000 and the major support at $25,000.

Some size context for why $GBTC is a big deal.

The Grayscale Bitcoin Trust controls more than 635k BTC.

That's like 4.5 times the size of MicroStrategy.

Simply put they dominate the ETF-like products holding spot BTC by a big margin. pic.twitter.com/5lhwJKhhKy

— ecoinometrics (@ecoinometrics) August 29, 2023

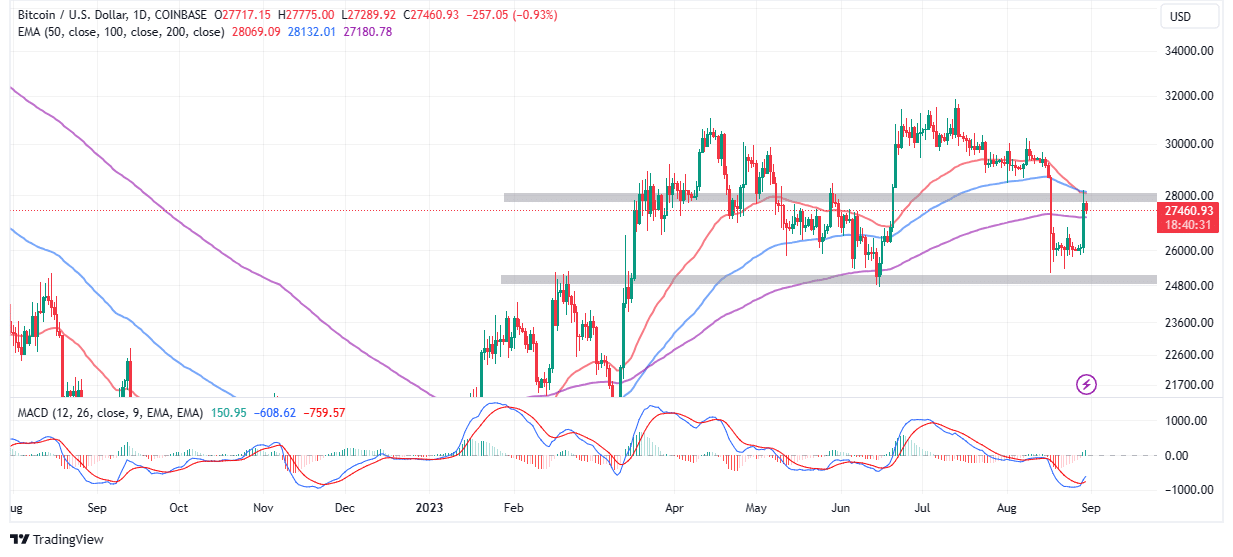

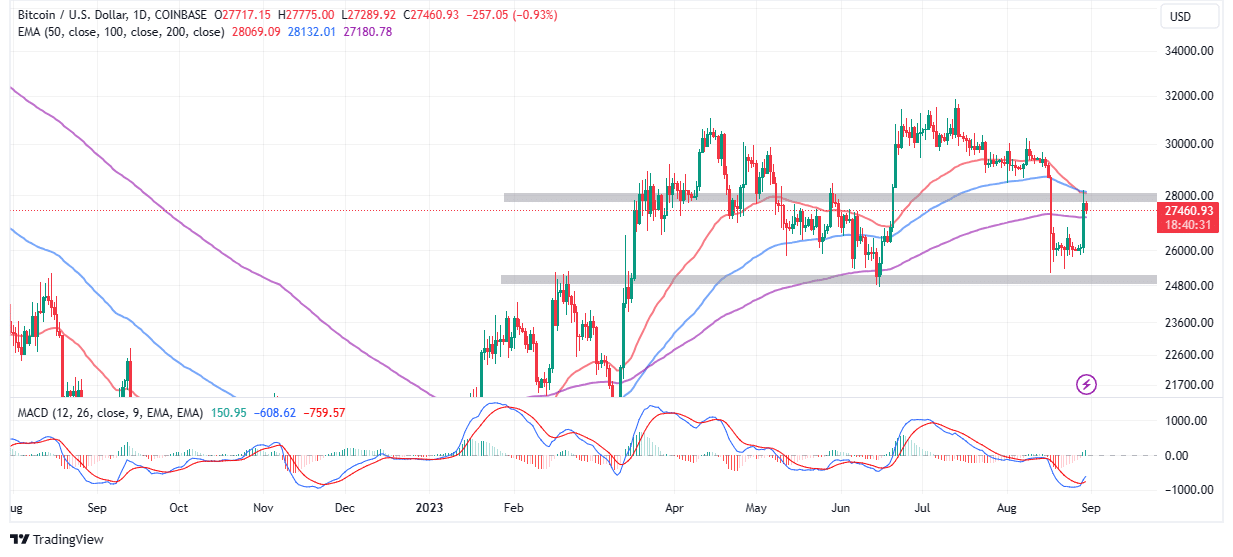

The largest crypto tested resistance at $28,000, reinforced by two indicators; the 50-day Exponential Moving Average (EMA) (red) and the 100-day EMA (blue). Although up 5.2% to $27,420, Bitcoin has corrected from the weekly high of $28,280.

If investors continue to heed the call to book fresh positions in BTC ahead of an expected climb above $30,000, the path with the least resistance would stick to the upside.

The Moving Average Convergence Divergence (MACD) indicator reinforced the bullish outlook with a buy signal. Traders consulting this momentum indicator buy when the MACD line in blue flips above the signal line in red.

If investors missed out on the sudden rally from $26,000 to $28,230, they may want to wait until BTC price confirms a breakout above the confluence resistance of around $28,000. Such a move would serve as an assurance of enough momentum to see Bitcoin through $30,000.

Considering the weak market structure, investors should also prepare for a plausible correction back to $26,000 and possibly $25,000. At the same time, September might not be an easy month for BTC price, especially if the Federal Reserve in the US hikes interest rates again as it tightens its grip around the stubborn inflation.

Additionally, there is a possibility of the SEC approving ETF proposals as a batch or postponing the decision to a later date. The former outcome would be extremely bullish for BTC price while the latter may keep the market depressed, possibly paving the way for losses to $20,000.

Related Articles

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs