Week in Crypto: BTC Price and Data Analysis, Crypto Coin of the Week & Top Performers

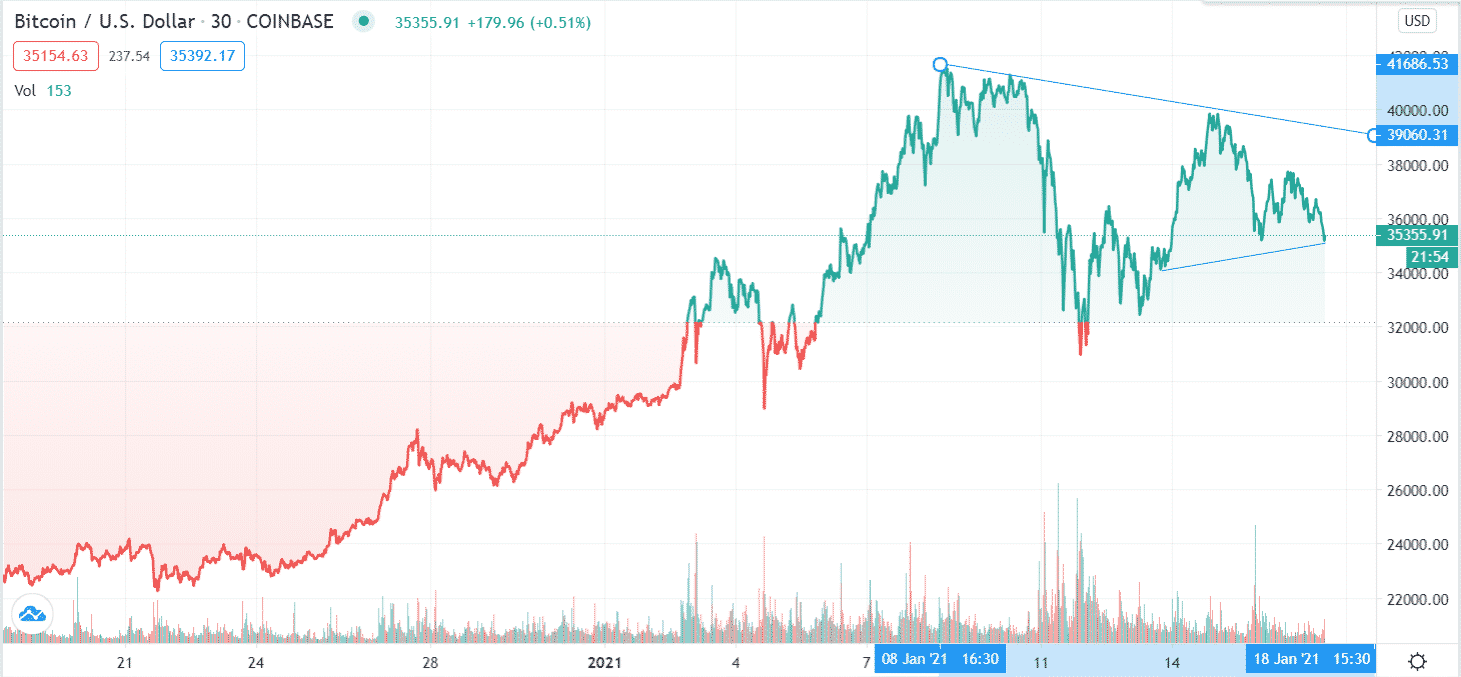

BTC price was down 2.03% at USD 35,218, and volume was down close to 20% over the past 24 hours at press time. Binance (5.15%), Huobi Global (2.25%), and Coinreal (1.89%) were the top volume contributors for BTC in the spot market.

As the market seems to be building a base for the next breakout, there are some interesting facts with respect to the on-chain data. According to the data put forward by intotheblock, 92% of holders of BTC are making money as their average cost of buying was less than the current price, with only 4% in at the money and other $5 out of the money because of the slide in price from USD 40000 levels to USD 35000 levels. The total transactions greater than USD 100 k over the past week have been close to USD 145.81 billion, with 15 % of the holders taking positions in BTC only in the last month

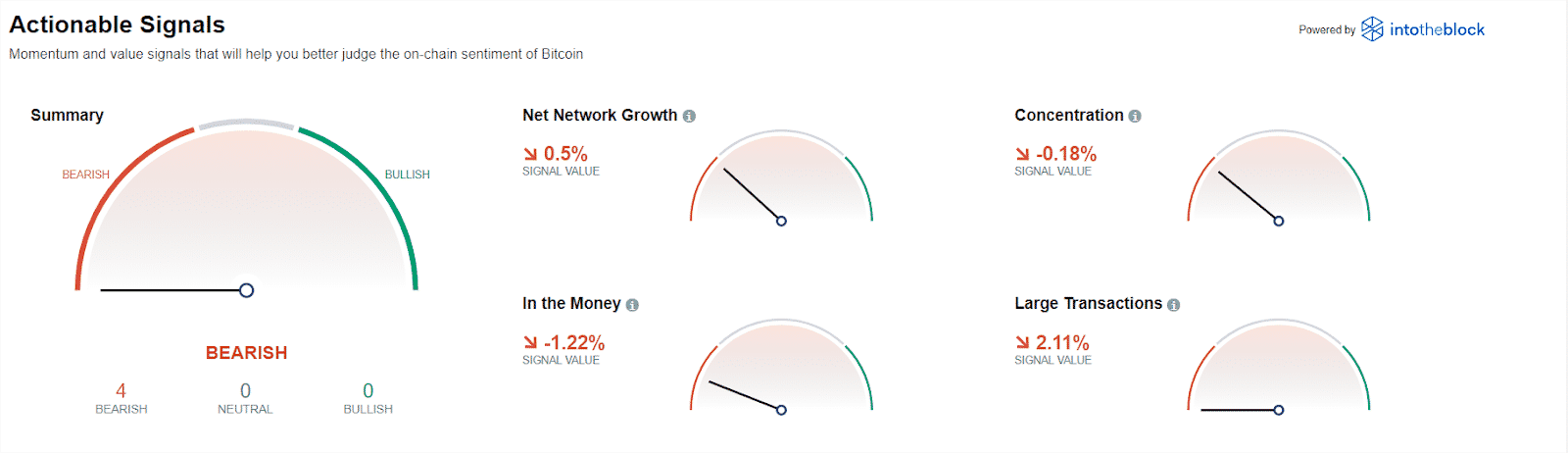

While the momentum and value signals are writing a bearish note, the net network growth has seen a dip of 0.5 %, with In The Money momentum signals and concentration signals are also showing a red.

Buzzing coin for the week: PolkaDot [DOT] Token

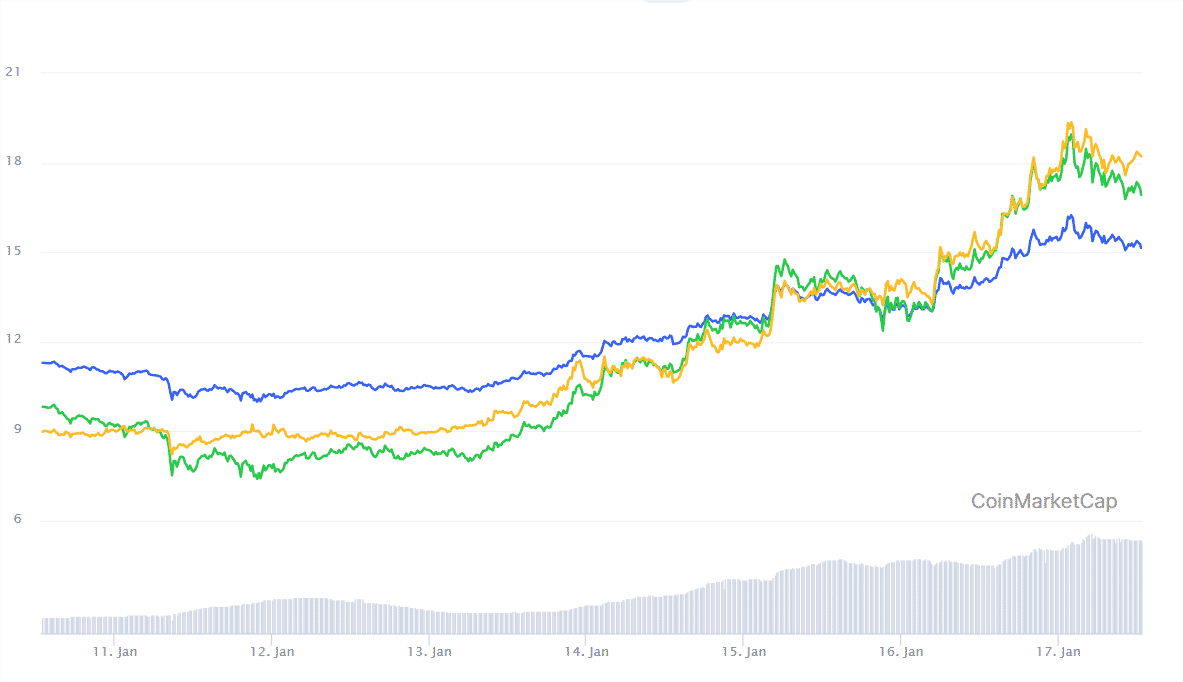

Polkadot ($DOT) has been an abuzz whole of this week. The coin has seen some significant gains with 15.29 % over the past 24 while going to press, which just added to the move of over 71% during the past week. In this pursuit of gains, the DOT token breached the ATH USD 19.32, becoming the fourth-largest coin in terms of market cap, surpassing the embattled XRP under a threat of litigation in the United States.

The leading exchanges that have contributed to the volume of this token have been Binance, with two DOT pairs of USDT and BTC contributing 15.77 % and 3.56 %, respectively.

Polkadot ($DOT) is an open-source multichain protocol that enables the cross-chain transfer of any data or asset types, cryptocurrencies, thereby expanding blockchains interoperable with each other. The protocol also connects private and public chains, oracles, future technologies, and permission-less networks, allowing such independent networks to share information and transactions through the Polkadot relay chain

Overall Crypto Market Mood and Sentiment

Overall the market has been pretty range-bound over the past week, with BTC and Altcoins continue to move forward only to his resistance when bears come charging in. It will require some efforts from the bulls to keep the momentum going and march beyond the resistance for a breakout. All eyes would be on Ethereum and PolkaDot to give altcoins a reason to rise.

- Over the last 24 hours, The global crypto market cap is $968.24B, a 4.09% decrease over the previous day and the volume in the previous 24 hours is $135.20B, which makes a 9.81% decrease.

- The total volume in DeFi is currently $15.20B, 11.24% of the entire crypto market’s 24-hour volume.

- The volume of all stable coins is now $107.42B, 79.45% of the total crypto market 24-hour volume.

- THE BTC dominance still stands at 66.4%

- The biggest gainers over the past 24 hours are

- WaykiChain Governance Coin: with a rise of 131.46 %

- Light Coin Exchange Token: with a rise of 120.19 %

- Daiquilibrium: with a rise of 112.24 %

- The biggest losers over the past 24 hours are

- VKF Platform: showing a drop of 55.56 %

- Metacoin: showing a drop of 50.42 %

- Gifto: showing a drop of 49.68 %

What do you think will happen in the markets in the coming week?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs