BTC Price Dips Target $20k, Last Opportunity Before the Bull Run?

BTC price is under pressure to sweep through lower levels in search of liquidity and an

opportunity to launch the next bull market.

Key market-moving events last week such as the release of the Federal Open Markets Committee (FOMC) meeting minutes implied that further rate increases were necessary to control inflation in the US.

On top of this came news that Elon Musk’s SpaceX had written down $377 million in Bitcoin, which caught the market by surprise, and triggered a sell-off following a period of record low volatility.

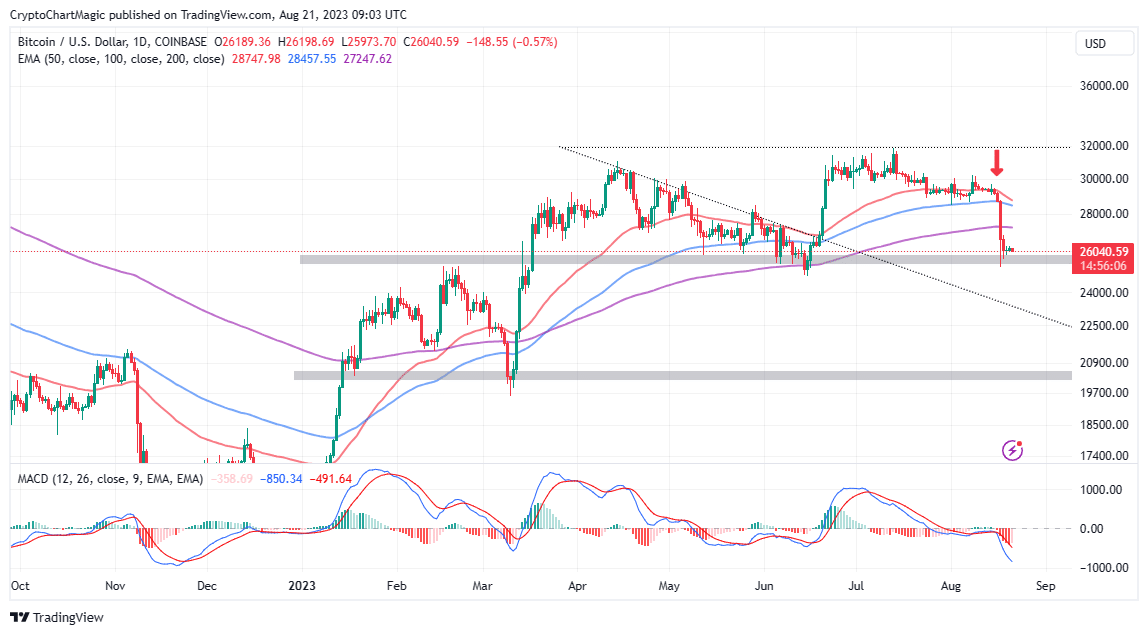

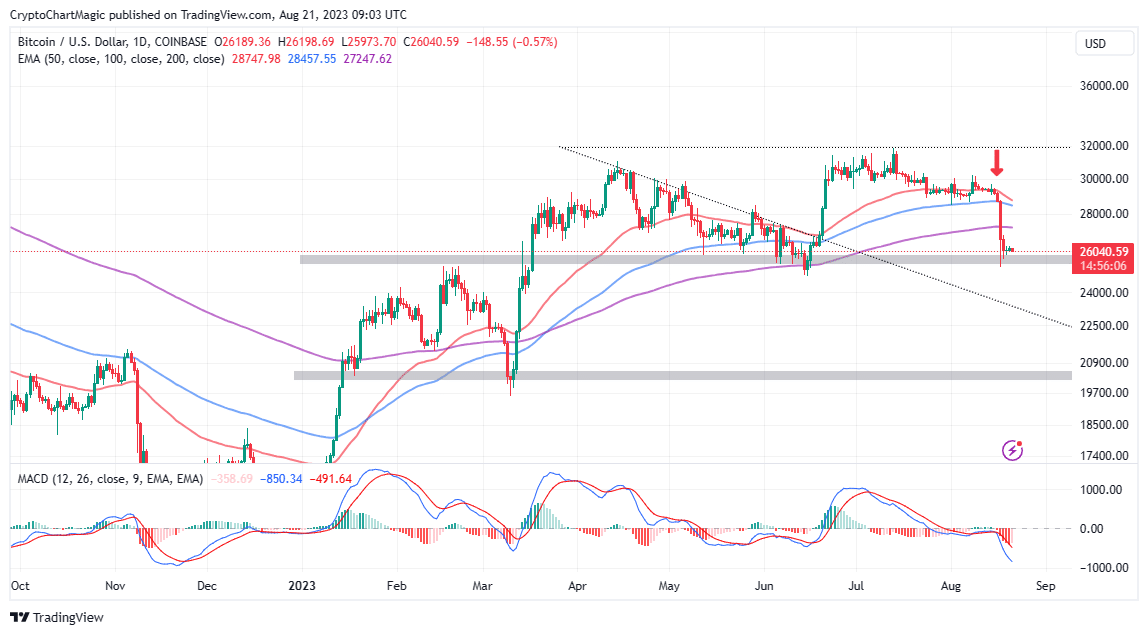

BTC Price Sinks Below Bull Market Moving Averages

Bitcoin is trading below all the moving averages, considered to be necessary for the bull market by analysts like Rekt Capital. The indicators in question are the 21-week Exponential Moving Average (EMA), the 50-week EMA, and the 200-week EMA.

With the largest crypto trading below all those moving averages, declines are bound to take precedence. Likely to suffer the most are retail investors who may have purchased BTC as the price jolted to $32,000 in early July with the hope of a breakout to $40,000.

#BTC has officially Weekly Closed below all three of these Bull Market moving averages$BTC #Crypto #Bitcoin https://t.co/NpEOGhqeaF

— Rekt Capital (@rektcapital) August 21, 2023

Based on the daily chart, after failing to make a successful rebound above $27,000 over the weekend, BTC is hovering around $26,000 in search of sturdy support. However, the path with the least resistance appears stuck to the downside.

The Moving Average Convergence Divergence (MACD) adds credence to the bearish outlook following the confirmation of a buy signal in early July.

Traders trading this indicator carefully timed the MACD line in blue crossing below the signal line in red, which later dropped beneath the mean line (0.00).

Like the moving averages in the weekly time, Bitcoin still holds below the 50-day EMA (red), the 100-day EMA (blue), and the 200-day EMA (purple) on the daily chart.

For now, $26,0000 is the most important support, because it could determine where BTC price heads to over the next few weeks.

A sustained break below this price level could trigger another sell-off as fear grips the market. Retail investors would be in a rush to protect their capital – in the process, selling pressure would explode sending Bitcoin on a final descent before the 2024 – 2025 bull market.

It would also be premature to rule out a possible rebound from the same $26,000 support. However, with the current dilapidated market structure, it would take bulls a force equal to move Mt. Everest to send Bitcoin on a rally beyond $30k.

That said, investors must tread carefully and be ready for all possible outcomes. Notably, continued losses below $26,000 may not necessarily mean doom for Bitcoin. On the contrary, the dips might be a blessing in disguise, as investors are presented with an opportunity to stack up on Bitcoin before the final ascent into the bull market, expected after the halving in April 2024.

Related Articles

- Empowered Funds Files For Bitcoin Futures ETFs

- Terra Luna Classic Proposal To Directly Burn 800 Mln USTC Officially Passed, LUNC Jumps

- ETH Price Heading to $1,000 If It Drops Under This Level, Will Ethereum ETF Save?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs