BTC Price Falls as Initial Jobless Claims Come In Below Expectations

Highlights

- BTC Price drops sharply as Jobless claims fall to 206,000, well below forecasts.

- Strong labor data dampens rate-cut hopes, pushing yields higher and pressuring crypto.

- Continuing claims rise to 1.869M, hinting at slower rehiring despite low layoffs.

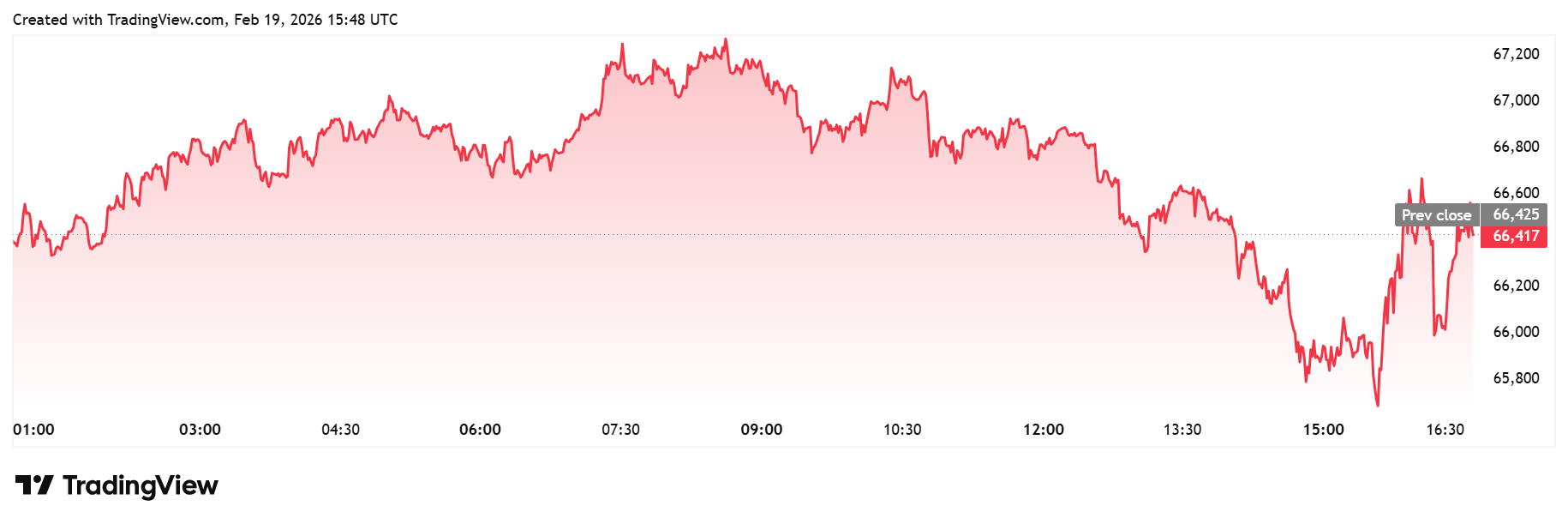

BTC price slipped today after fresh U.S. labor data showed fewer layoffs than expected, shaking rate-cut hopes. Initial jobless claims fell to 206,000 for the week ending February 14, the lowest level this year and far below forecasts of 223,000.

BTC Price Drops After Jobless Claims Drop

BTC price dipped lower soon after the jobless claims release. At the time of writing, Bitcoin was trading at $66,160, down by 1.80% in the past 24 hours. The decline followed a broader pullback already underway from Wednesday’s Federal Reserve meeting minutes.

Bitcoin had fallen below the psychological $66,000 level after the FOMC minutes yesterday, with the Fed raising the possibility of a rate hike. That earlier drop set a weaker tone going into Thursday’s session, leaving BTC price vulnerable to another negative catalyst.

Notably, the labor data added to concerns that inflation risks could keep rates higher for longer. As a result, Bitcoin extended its decline instead of stabilizing. Initial jobless claims fell from last week’s 227,000 reading, a 23,000 drop.

This comes well below another estimate that placed expectations at 225,000. However, continuing claims rose slightly to 1.869 million, suggesting some workers still faced longer job searches.

What Does Lower Claims Mean for the Crypto Market

Lower-than-expected initial jobless claims often point to a labor market with fewer layoffs and stronger employer demand. In this case, the data indicated that the U.S. economy remains resilient.

As a result, the numbers reduced expectations that the Federal Reserve needs to cut rates quickly, which is bearish for the BTC price. That matters for crypto markets because rate cuts typically support risk assets through cheaper borrowing and stronger liquidity.

However, a stronger labor report can push bond yields higher and lift the U.S. dollar. Those moves can increase the opportunity cost of holding assets like Bitcoin, which do not generate yield.

Notably, traders often interpret “good” economic news as negative for crypto when it delays easing policy. The jobless claims surprise added to that dynamic, especially as markets were still taking in the FOMC minutes. In addition to these macro data, Bitcoin’s price is also facing downward pressure due to the rising U.S. Iran tensions, with a potential military action on the cards.

Expert Views and Saylor’s Bitcoin Conviction

Following the report, analyst Lark Davis pointed to the split between initial and continuing claims. He noted that initial jobless claims came in below expectations. Davis argued that rising continuing claims could indicate workers are struggling to find new jobs.

He added that weaker labor conditions could eventually push the Fed toward rate cuts, which often support risk assets. However, he also raised questions about whether the Fed would move fast enough if conditions deteriorate.

Just minutes after the jobless claims release, MicroStrategy co-founder Michael Saylor continued his Bitcoin support. He wrote, “Never Been More ₿ullish,” despite the market reaction and BTC price weakness.

- SEC Chair Reveals Regulatory Roadmap for Crypto Securities Amid Wait for CLARITY Act

- ProShares Launches First GENIUS Act Focused Money Market ETF, Targeting Ripple, Tether, Circle

- Breaking: CME Group To Launch 24/7 BTC, ETH, XRP, SOL Futures Trading On May 29

- White House to Hold CLARITY Act Meeting With Ripple, Coinbase, Banks Today

- Senator Warren Warns Fed Against Bitcoin Crash Rescue Amid Liquidity Pump Claims

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?