BTC Price Needs to Hold In This Range to Confirm Bitcoin Recovery

After Tuesday’s victory of Grayscale over the US SEC, the Bitcoin price made a quick recovery surging past $27,500 levels. However, from there, the BTC price has undergone a partial retracement and is currently down 0.79% and is trading at $27,240.

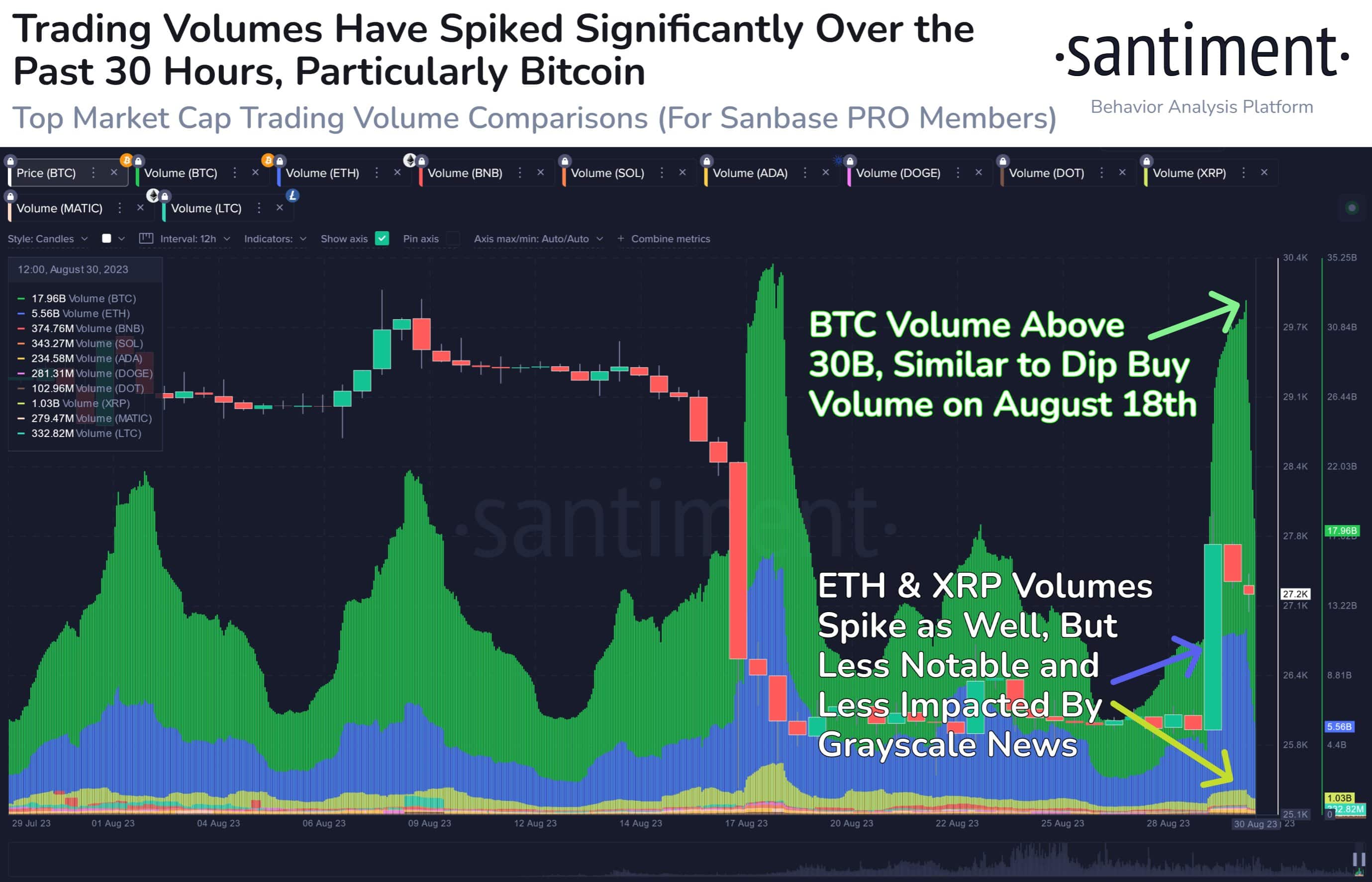

As per on-chain data, the trading volumes have sustained, even a day after Tuesday’s pump. On-chain data provider Santiment explains that trading activity remains substantial following the recent price increases across the cryptocurrency market.

Notably, there is a significant resurgence of trader attention on Bitcoin. If Bitcoin maintains its current range between $27,000 and $28,000, the situation should stabilize. However, if the price deviates beyond this range, increased volatility is probable.

Large holders in the cryptocurrency space, often referred to as whales and sharks, might have had insights about the Grayscale and SEC legal case’s result. On the day prior to the news, wallets holding 10,000 to 10,000 Bitcoin (BTC) collectively acquired around $388.3 million worth of BTC.

Watch Out for Bitcoin Technical Indicators

Over the last few weeks, Bitcoin has been showing weakness on the technical charts. The BTC price dropped under the 200-day moving average earlier this month and is failing to recover above these levels.

On the downside, if the BTC price fails to sustain under $25,000, it risks falling further all the way to $20,000. Other developments to watch ahead are the possible Fed tightening amid the stick inflation.

Bloomberg’s senior commodity strategist Mike McGlone explains: “Bitcoin $30,000 May Be New $12,000, With Fed-Tightening Overhang – The inevitable approval of Bitcoin ETFs in the US is moving closer, but the elephant in the room for all risk assets remains — the Fed is still tightening despite the tilt toward economic contraction”.

It will be interesting to see whether Bitcoin continues to sustain about the $27,000 going ahead, or that the current recovery would be just another dead cat bounce.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Bill Hits New Deadlock as Banks Reject White House Deal

- Why Experts Are Warning Bitcoin Rally Could Be A “Dead Cat Bounce”

- BTC and Gold Price Bounce as Trump Admin Brokers US-Venezuela 1000 Kg Gold Deal

- SEC Advances Major Crypto Securities Plan to White House for Approval

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

Buy $GGs

Buy $GGs