BTC Price Soars Ahead Of 18,000 Bitcoin Options Expiry Today, What’s Next?

Highlights

- Bitcoin price rises by nearly 3%, signaling a bullish sentiment ahead of significant options expiry.

- The rally comes ahead of the 18,000 BTC options expiry set for today.

- Market analysts analyze Bitcoin and Ethereum options data to anticipate post-expiry price movements.

The Bitcoin (BTC) price has witnessed a notable advancement, marking a nearly 3% surge today following a period of sluggish trading. Meanwhile, the recent rally, after a prolonged volatile market sentiment, precedes a major event: the expiry of 18,000 Bitcoin options. With the options expiry in focus, the market participants are closely watching the implications of this on BTC’s price trajectory and the broader cryptocurrency market.

Market Analysis Ahead of Options Expiry

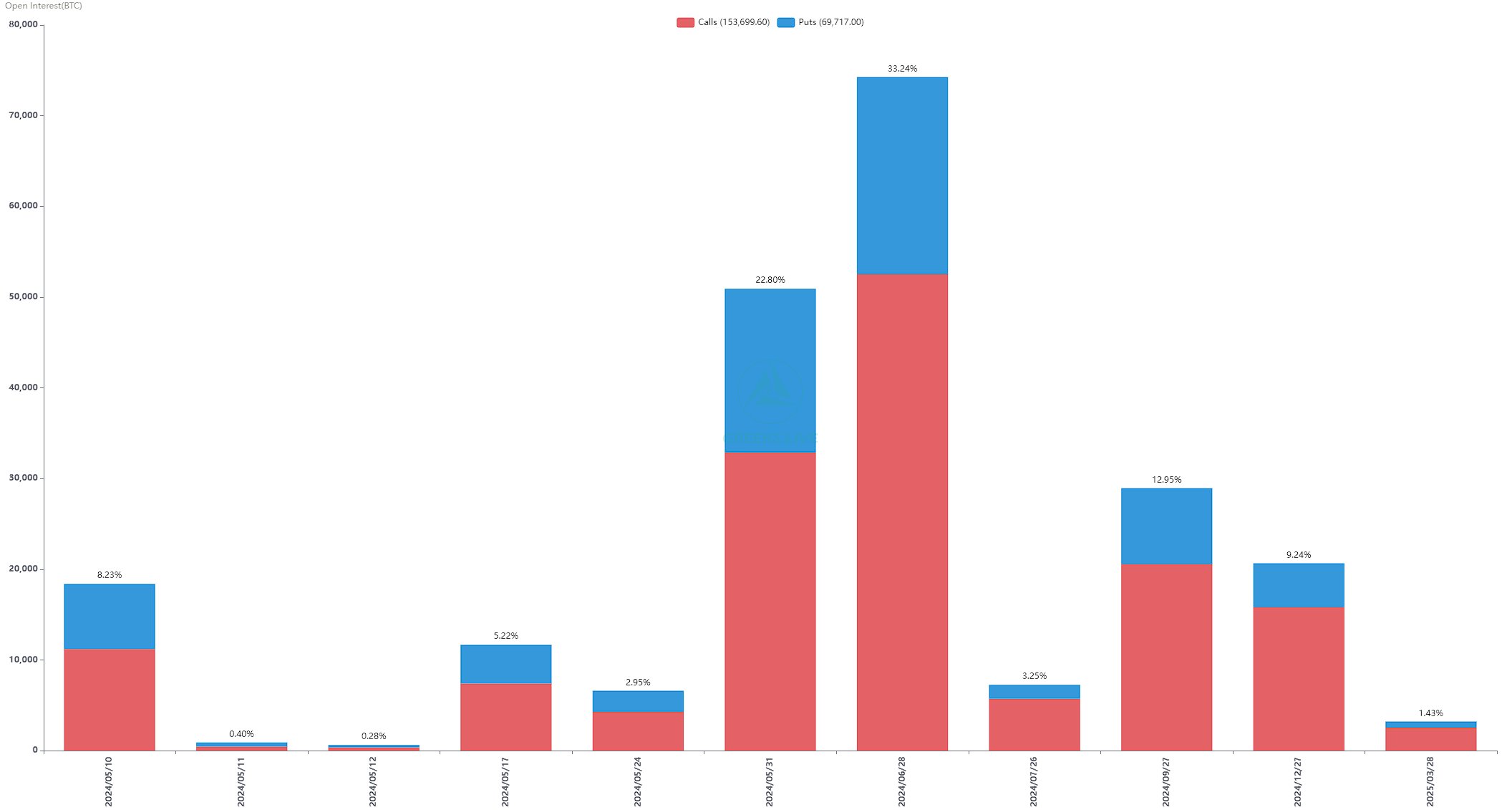

The recent surge in Bitcoin prices has investors’ attention, following volatile trading and ahead of today’s options expiry. Notably, As the market braces for the expiry of 18,000 Bitcoin options, analysts at Greeks. live to provide insights into the current options data. With a Put Call Ratio of 0.64, a Maxpain point at $62,000, and a notional value of $1.2 billion, anticipation is high regarding potential market movements post-expiry.

Meanwhile, the recent weakness in crypto markets, compounded by falling volumes and outflows from US BTC ETFs, has raised concerns. Despite a slight recovery in investor confidence due to decreasing implied volatility (IV), uncertainties linger, particularly considering historical market trends in May.

While Bitcoin garners attention, Ethereum (ETH) is also in focus as 280,000 ETH options are set to expire today. With a Put Call Ratio of 0.74, a Maxpain point of $3,050, and a notional value of $800 million, market participants are closely monitoring ETH’s price dynamics alongside BTC.

Also Read: Dogwifhat (WIF) Price Shoots 13% Amid Whale Accumulation, More Steam Left?

Implications Amid Fund Outflows

Despite the impending options expiry, both Bitcoin and Ethereum prices have rallied. In addition, this surge in the Bitcoin price comes despite reports of an $11.3 million outflow from US Spot Bitcoin ETFs on May 9. Notably, Grayscale’s ongoing exodus continues to weigh on the Bitcoin ETF flows.

However, as market participants navigate these developments, the coming hours post-options expiry will likely provide clarity on BTC and ETH’s short-term price trajectory. Traders remain vigilant, and prepared to react to any significant market movements resulting from this event.

According to CoinGlass data, the Bitcoin Futures Open Interest (OI) soared 1.84% to 480.25K BTC or $30.28 billion today. Simultaneously, the Ethereum OI noted an advancement of 0.58% to $10.76 billion at the same time.

Meanwhile, the Bitcoin price soared 2.74% and traded at $62,946.19, while its trading volume from yesterday rose 8.08% to $26.04 billion. On the other hand, the Ethereum price rose 1.80% to $3,034.26 ahead of the options expiry.

Also Read: Kraken Fires Back At SEC Over Unregistered Securities Trading Claims

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs