BTC Price Today: Bitcoin Nears $86K Amid Waning Trump’s Tariff Woes

Highlights

- Bitcoin surges nearly 2% amid potential tariff relief and renewed market confidence.

- Trump's administration is considering using tariff revenues to purchase Bitcoin.

- A top analyst predicts BTC price to hit $94K if the momentum holds.

BTC price today: Bitcoin has recorded a surge of nearly 2%, indicating a renewed market confidence towards the flagship crypto. Notably, the crypto market has recorded volatile trading lately, especially as President Donald Trump’s Tariff policy has dampened market sentiment, triggering a massive selloff in the broader financial market. However, with recent indications of further tariff relief, the investors seem to be entering the digital assets space again today.

BTC Price Today Soars Amid Trump’s Tariff Relief

Bitcoin price surged nearly 2% today as global financial markets reacted to recent comments from Donald Trump. The US President hinted at easing certain trade barriers, sparking renewed interest in digital assets. Investors, previously spooked by tariff escalations, appear to be shifting focus back to crypto.

Bitcoin traded at $85,896k, after touching a high of $85,926 in the last 24 hours. However, its one-day volume fell nearly 6% to $28.58 billion while CoinGlass data showed that BTC Futures Open Interest rose around 1%, reflecting renewed market confidence.

Meanwhile, this rebound in the financial market comes as Trump suggested possible exemptions from the steep 25% tariffs on imported vehicles. This potential relief for key partners like Mexico and Canada has calmed nerves in a market rattled by protectionist policies.

According to reports, Trump’s administration has also walked back some earlier tariffs. Notably, gadgets like smartphones, laptops, and other tech products from China are now off the hook.

However, despite the softer rhetoric, uncertainty looms. Reports suggest the administration may target new areas, such as pharmaceuticals and semiconductors. These sectors are critical to global trade and could face steep duties. Tensions with China remain high, with certain goods still facing tariffs up to 145%, while China maintains retaliatory measures of 125%.

Crypto Market In Focus

Amid the looming market uncertainty, investors are once again shifting their focus towards the digital assets space, especially Bitcoin. Besides, the Trump administration is reportedly considering using tariff revenues to purchase BTC, which has further fueled market sentiment.

Besides, the recent meeting between Donald Trump and BTC president Nayib Bukele has further bolstered market sentiment. On the other hand, the US government is exploring ways to accumulate more BTC, according to Bo Hines, Executive Director of the Presidential Digital Asset Advisory Committee.

This move is part of President Trump’s commitment to make the US a global crypto leader. The government is considering using tariff revenues to fund a national Bitcoin reserve, signaling a potential shift in economic strategy.

With BTC currently trading near $86K, the administration’s plan could redefine digital assets’ role in the US economy. Besides, it could also help continue its run towards the run ahead.

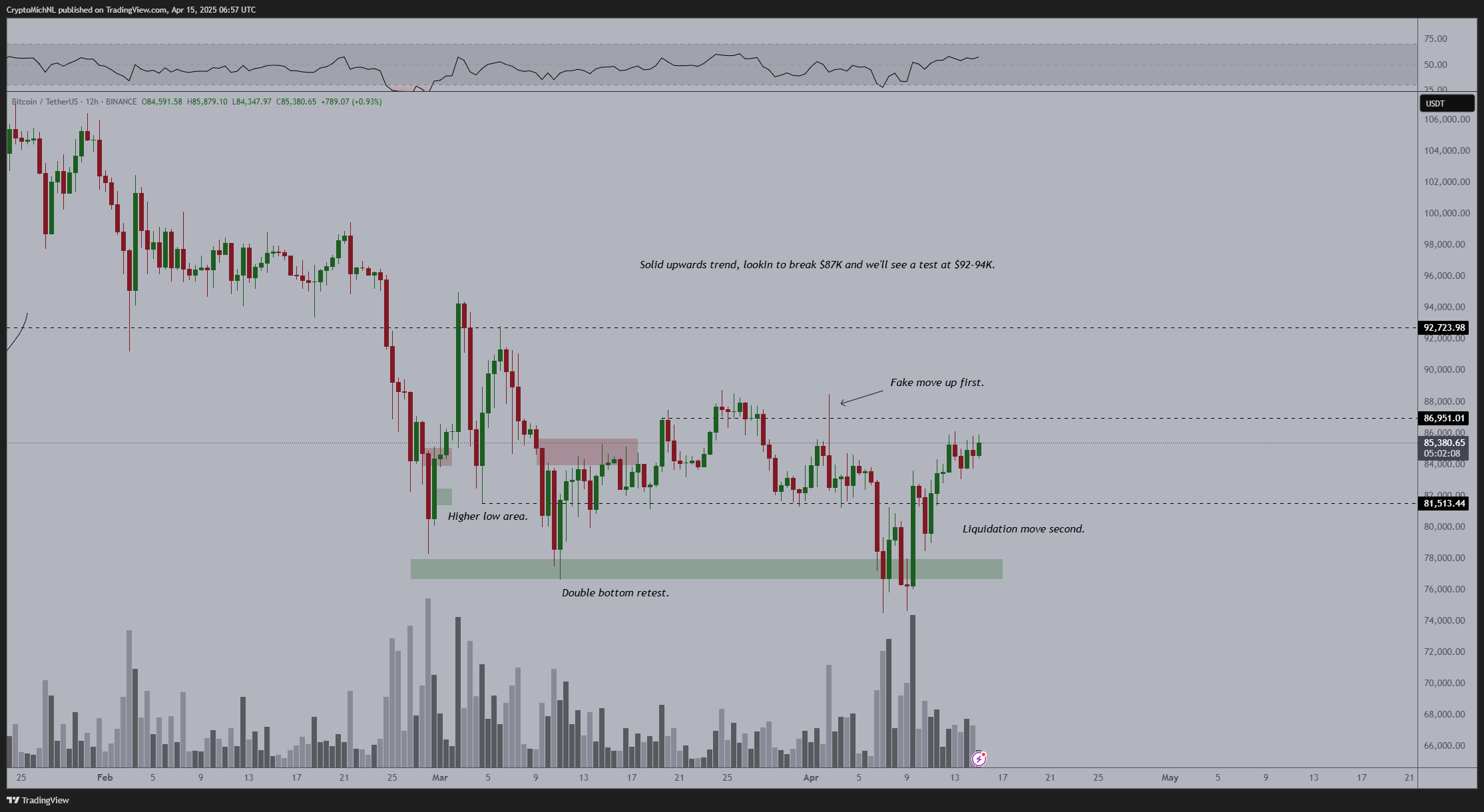

Meanwhile, as BTC price today recorded a robust surge, analyst Michael van de Poppe has shared key insights on the potential future trajectory of the coin. In a recent X post, Poppe said that if BTC breaks through $87K, it could potentially target $92K to $94K in the coming days.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- USDT And USAT Get Adoption Boost as Tether Invests in Whop for Faster Settlements

- BTC Price Rises as U.S. Plans to Hold Trump Tariffs on China Steady

- Crypto Market Soars on Rumors of Trump’s 0% Tax Policy for Digital Assets

- Hong Kong Set to Launch Tokenized Bond Platform and Issue First Stablecoin Licenses

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

Buy Presale

Buy Presale