BTC Surges Above $53K as Funding Rates Cool Down; Can 77K Bitcoin Option Expiry Bring Back Price Volatility

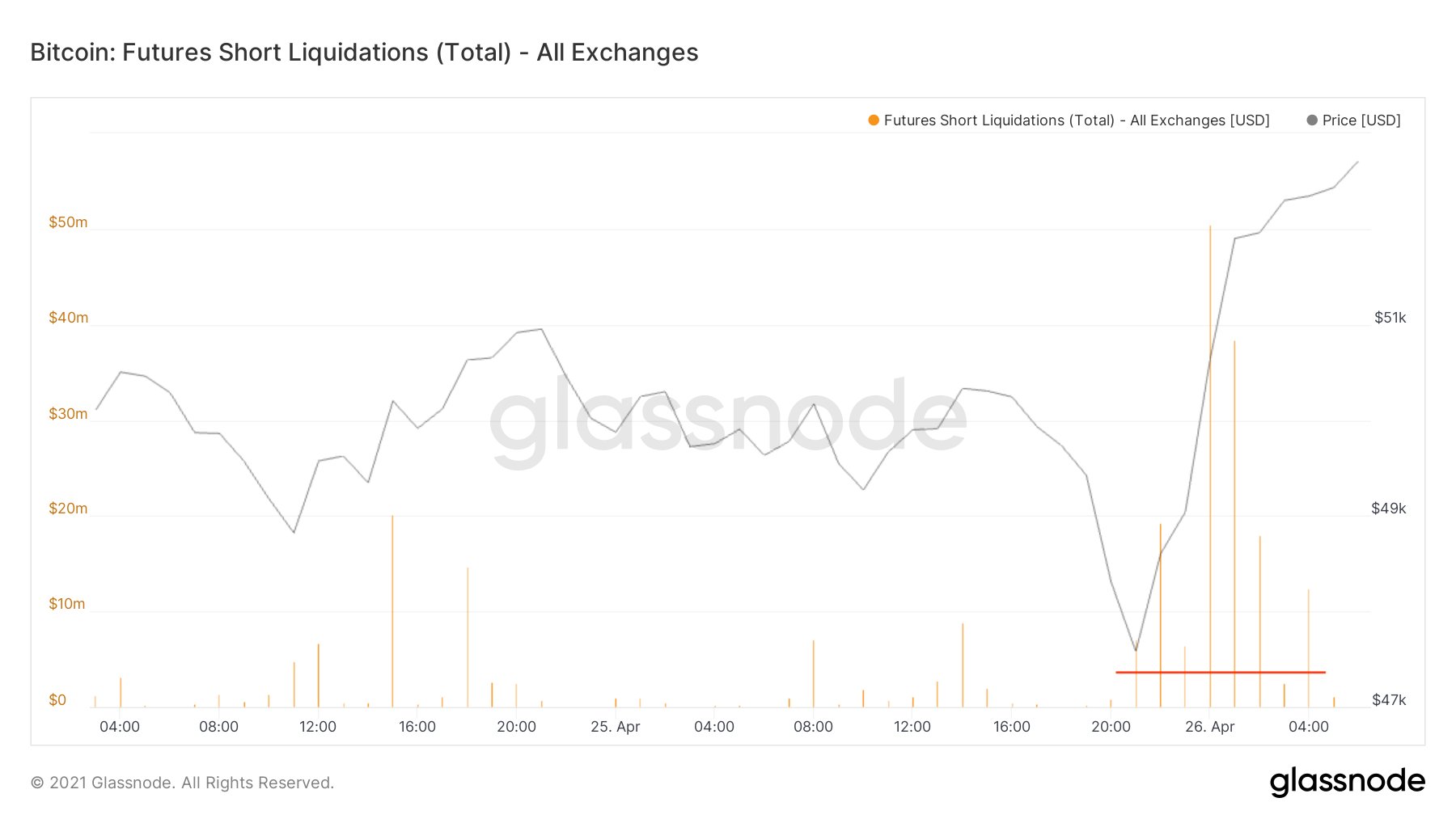

Bitcoin price finally broke past the week-long correction phase to rise above $53,000, registering an 8% rise for the day. Bitcoin price registered over a 20% correction falling to $47,159. The last price correction was attributed to the highly leveraged futures market as funding rates skyrocketed leading to the liquidation of over $4 billion in long positions. Many even called it a shake-off from the weak hands which was evident as many new entrants sold their holding as the price crashed, while long-term hodlers refused to sell.

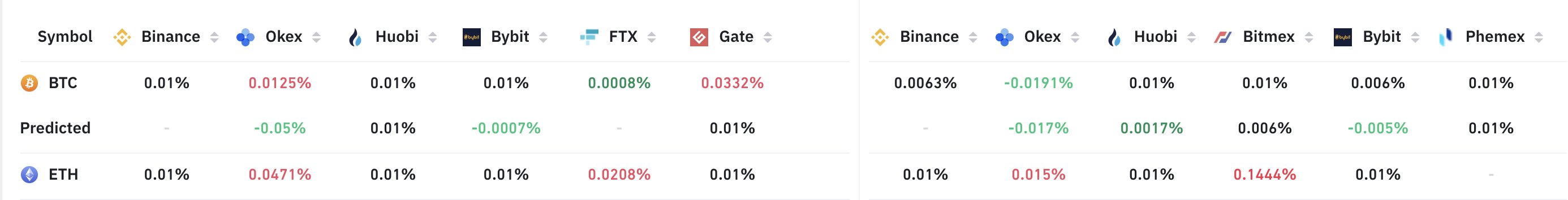

The funding rates have cooled down significantly since then and the open interest in the futures market has also come down to March levels.

The on-chain support for Bitcoin remained formidable at $47K despite bearish sentiment prevailing throughout last week. The network hashrate that dropped significantly post the second week of April due to a power outage in China is also returning to normal levels as the top cryptocurrency breaks out of the consolidation phase to regain last week’s loss. Today’s bullish surge above $50,000 also saw nearly $150 million worth of short positions getting liquidated today.

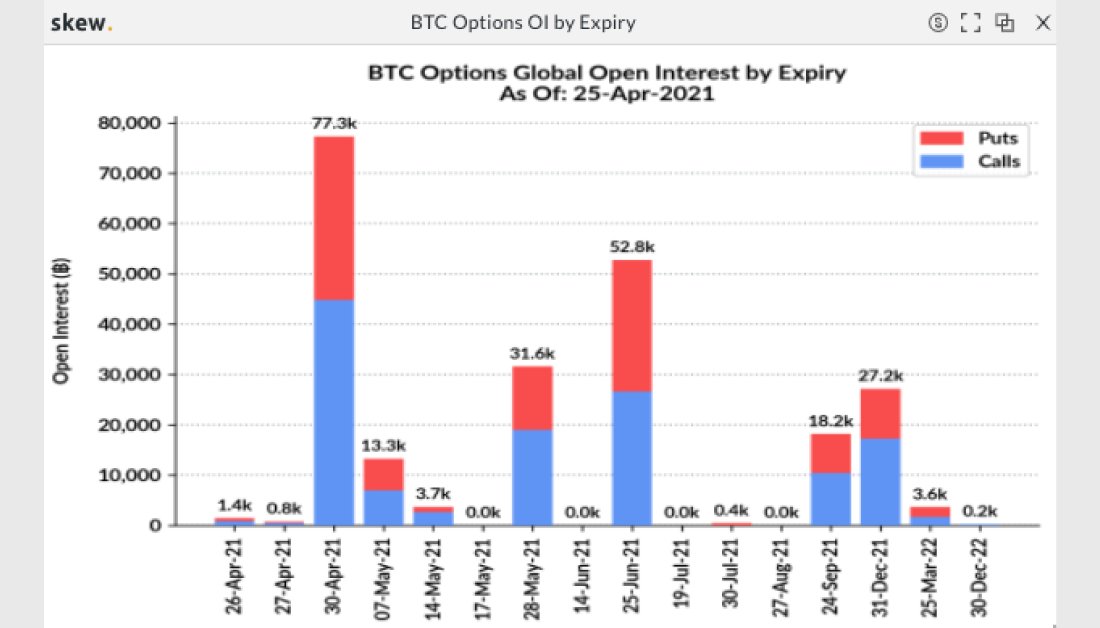

77K Bitcoin Options Set For Expiry, Would Price Volatility Make a Comeback?

The expiry of the Bitcoin Options contract at the end of each month is often associated with increased price volatility in the Bitcoin market and as we near the end of April, another 77K worth of Bitcoin Options market is set to expire.

The mainstream media has predicted doom for Bitcoin with every price correction only to be proven wrong every time this bull season. The on-chain metrics for the top cryptocurrency still flash bullish signals, especially when compared to the bull season of 2017. When compared to the short-lived bull run of 2017, bitcoin has managed to overcome nearly three corrections over 20% with ease.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BlackRock Adds $289M in BTC as Bitcoin ETFs Log 2-Week High Inflows Of $500M

- Glassnode Signals Bitcoin Still Faces Downside Risk Amid Massive Sell Pressure at $70K

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- ZachXBT Names Axiom Exchange in Alleged Employee Crypto Insider Trading Investigation

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs